PLEASE REFER TO SENIORSAVIOR.COM REGARDING UBS FLORIDA COURT DOCUMENTED UBS COLLABORATORS AND MORE UBS CLIENT VICTIMS.

A Government that does not care for it’s elderly is a Government in silent decline.

UBS ELDERLY PALM BEACH, FLORIDA CLIENT VICTIMS

It is said one can judge a country by the way the government treats their vulnerable elderly citizens. Do they defend them from predators like UBS AG of Switzerland? Under the quid pro quo Clinton, Bush II & Obama UBS deferred payment scheme the answer has been no. UBS and their collaborators wholesale looting UBS elderly Florida Client victims are noted within issues 4 & 5. We expose but a few examples of UBS continuing crimes against Florida elderly Clients. This will give the World an inkling of what transpires in other noted areas of the USA and the World. It should have been more disconcerting when we found UBS Presidential Team UBS (Clinton, Bush II, Obama) triplets accepting deferred and other payments from UBS to allow these and other crimes against vulnerable USA elderly.

________________________________

UBS ELDERLY CLIENTS BEWARE

Associated Press reports: “Older Americans lose $2.9 billion a year to fraud, according to a study last year by the National Committee for the Prevention of Elder Abuse and the Center for Gerontology at Virginia Tech. Most victims are between 80 and 89, and most are women. … A slowing down of brain function comes with normal aging, they noted. The elderly are susceptible to errors in judgment, particularly in situations where a snap decision is required. The Mayo Clinic defines ‘mild cognitive impairment’ as an ‘intermediate stage between the expected cognitive decline of normal aging and the more pronounced decline of dementia.’ ” VD-1 (see internalrevenue.com, issue 1, A11) UBS is on record particularly targeting Miami Dade to Palm Beach Counties, Los Angeles, New York elderly. It is known UBS has successfully hidden these painful newsworthy incidences within Florida by purchasing advertising in local papers and allegedly making campaign payments to judges and other politicians.

_____________________________________________

Honorable Palm Beach County, Florida Judge Martin Colin presiding.

HOW DO CERTAIN FLORIDA JUDGES AID & ABET UBS AG (SWISS) COLLABORATORS LOOTING ELDERLY ESTATES?

Palm Beach Post reports: “The savings of incapacitated seniors flow into the household of Palm Beach County Circuit Judge Martin Colin. This occurs courtesy of Colin’s wife – Elizabeth “Betsy” Savitt. She serves as a professional guardian, appointed by judges to make decisions for adults who no longer can take care of themselves. Savitt makes her money off the nest eggs of the elderly, many suffering from dementia and put in guardianships in the same Probate & Guardianship Division where Judge Colin wields considerable influence (see VD-17, VD-18). His fellow judges approve Savitt’s fees. Savitt has taken money from the elderly people whose lives she controls without first getting a judge’s approval as well as double-billed their accounts, a Palm Beach Post investigation has uncovered in court records. Families of some of the seniors say the judge’s wife and her attorneys drum up unnecessary litigation that runs up fees, benefiting herself, the judge and her lawyers. Savitt doesn’t appear before her husband, but Judge Colin does oversee other guardianship cases where he is responsible for safeguarding the finances and well-being of these “wards” of the court. Colin’s colleague, Circuit Judge David French who lunches with him regularly, has overseen almost two-thirds of Savitt’s cases. Some lawyers who have opposed Savitt in Judge French’s courtroom say he didn’t disclose that Savitt is the wife of a fellow judge or his social connections to the couple. … Families say they watched slack-jawed as Savitt, 60, and her lawyers siphoned the wealth of their loved ones. They feel they are rendered powerless by judges who rule repeatedly for the judge’s wife. Families fighting Savitt say Colin’s colleagues allow her and her attorneys to pursue what critics of guardianships call “staged litigation” – pursuit of unnecessary legal issues to run up fees. … Colin has been allowed to remain in probate under Peter Blanc and Jeffrey Colbath, chief judges since Savitt became a registered guardian four years ago. While other judges rotate, Colin hasn’t been moved out of the south county courthouse since at least 2008. … Judge Colin and his wife have socialized with one of the judges she appears in front of regularly, The Post has learned. Colin and Circuit Judge David French eat lunch together nearly every day. Colin and French co-hosted a trivia night in May for the South Palm Beach Bar Association. … French did not return repeated attempts for comment.” VD-1-1 Florida Judiciary allowed Honorable Judge Colin not to Circuit (rotate) as allegedly mandated for all USA Circuit Court Judges. This facilitated Judge Colin & collaborators to run an alleged elderly estate looting scam. These Judges are still in place working now with UBS on swindling larger numbers of USA elderly, among other things. It has in fact gotten worse for Florida UBS elderly victims as UBS has been utilizing this Florida judicial scam to dupe and loot their UBS Client estates, especially the elderly . This Judicially related scams have become so profitable in Los Angeles County; Long Island, New York and Miami Dade County through Palm Beach County, Florida it is doubtful the “Rule of Law” can properly exist. Florida as well as other USA states and territories like Puerto Rico UBS Client ravaged victims (see issue 6, VF-4) that it is a USA World disgrace impossible to cover up. Washington Deep State should not complain about “Rule of Law” in other countries until it finally stops USA special handling bias in favor UBS AG against Client victims both in USA State & Federal Courts. This deviousness cannot be refuted since there are both USA State & Federal documents available.

___________________________________________

UBS AVOIDS STATE & FEDERAL CRIMINAL COURT SCRUTINY TO TARGET & LOOT ELDERLY UBS CLIENT VICTIMS.

We have seen how UBS AG (Swiss) has given known quantities of deferred payment cash in various forms to USA Presidential Team UBS and their closest collaborators. This is successfully accomplished through an assortment of exorbitant speaker or consultant fees, Swiss offshore accounts, secret Presidential library foreign laundered gifts as well as other money laundering channels. In consideration for UBS deferred payment largesse, “USA Presidential Team UBS” members (Clinton/BushII/Obama) and their collaborators have allowed UBS to swindle USA Client citizens without fear of USA Federal prosecution. UBS AG and USA Presidential Team UBS are continuing to target, solicit and recruit President Trump into their midst by using the usual Washington carrots and sticks scenario. There are documented causal chain incidences from USA Presidential Team UBS offices to Florida specific judiciary on distinct matters (see issues 4 and 5). Florida Judicial appointments overall have been exemplary and a credit to the State. We are strictly talking about special handling of specific cases.

USA Presidential Team UBS have in their past 24 years of White House control turned a blind eye and a deaf ear towards USA elderly UBS Client victims inalienable rights by allowing UBS documented criminal activities against these UBS elderly Client victims. One of the more grotesque UBS quid pro quo payback schemes is manipulating theft of USA elderly estate wealth through a series of sophisticated schemes to target, solicit, recruit, isolate, control, dupe and loot in order to obtain the “UBS perfection experience”. UBS has had no fear of USA Federal criminal conviction because of corresponding deferred payments to the USA Presidential Team UBS and their collaborators. No UBS directly implicated officer has received any jail time even though they have been caught directly committing crimes (see issue 3, David Aufhauser & David Shulman) (see issue 3, USA Federal Judge Cohn presiding, Ft Lauderdale, Florida USA v UBS AG // UBS v Weil). This is reluctantly changing with an aware Donald Trump Presidency. President Trump will never capitulate to the USA Presidential Team UBS or their UBS AG paymaster. Donald Trump was well aware of our newsletter UBS AG elderly Client victim allegations before becoming President Trump. A reliable Swiss international banking source has said several top Swiss international bankers have expressed their concern regarding the known volatility and questionable UBS AG (Swiss) activities herein mention.

The contorted UBS “perfection experience” aftermath promised by UBS was contorted with the Eunice Bailey Oaks Gardiner body disappearing for approximately six months to allegedly either drain her body of autopsy evidence or more ghoulish reasons. At the end of Eunice’s life she was controlled by her assigned UBS stockbroker family live-ins. She was unknowingly isolated from her family, friends and desired Palm Beach Towers residence.

Eunice Bailey Oaks Gardiner was an international noteworthy woman of fame. She had many suiters during her life wanting to marry her. The most famous was international actor producer Orsen Wells but it did not come to be. Eunice allegedly died living in a small house in Central Florida controlled by UBS operatives. Her name was changed to ostensibly confuse Eunice with another nearby Eunice Gardiner recently deceased. The Palm Beach County Court records were in disarray by co-mingling both Eunice Gardiner Court documents. Again, it is questionable that Eunice is in fact buried under a small plaque in Easthampton, NY. Her immediate family members in Canada and England were continually rebuffed by UBS operatives. Reliable judicial sources have confirmed both Eunice and husband Robert Gardiner were “special handled” by judiciary in Palm Beach Florida and New York under the auspices of UBS. There is a documented paper trail proving beyond any reasonable doubt this successful UBS looting cabal. Issue 5 VE6 will explain the documented UBS procedure of judicial “special handling”.

Eunice Gardiner’s below and the additional story is a true and correct depiction of the underlying UBS manifesto: target, solicit, recruit, isolate, control, dupe and loot. There is an archived paper trail corroborating the end of life episode leading to Eunice’s unfortunate estate looting culminating in her mysterious end as another UBS elderly Client victim.

Eunice Bailey Oaks Gardiner

USA HEIRESS & INTERNATIONAL SOCIALITE WIDOW EUNICE GARDINER’S BODY DISAPPEARS IN UBS SALESMAN’S CUSTODY!

SeniorSavior.com reports: “Eunice’s UBS salesman had sole control over UBS Client Eunice Gardiner’s body before and after her death. According to the Quattelbaum Funeral Home spokesperson, the corpse was shipped to New York at the authorization of Eunice’s UBS bond salesman. Eunice’s body then disappeared, somewhere. No independent party has been able to find out where the Eunice corpse was during that approximately six month interval of time. We do know UBS/Gunster Law allegedly feared exposure of any Episcopal Church intercession into their scheme. Others have said that Eunice had a reliquary next to her bed during her waining years. We do know Eunice emphatically wished to be buried within the Palm Beach Bethesda Episcopal Church columbarium with a substantial bequeath given to the Church. Upon several occasions Mallard took Eunice over to walk in contentment through the Church gardens and look at the columbarium. She frequently said she would lay in repose at Bethesda Church forever near her friends. We do know the Church was allegedly cut out of Eunice’s new will favoring UBS, Eunice’s UBS salesman and Eunice’s initial controversial wills/trusts legal partner at Gunster Yoakley West Palm Beach law firm. There are ghoulish rumors now being bandied about in Palm Beach, Florida as to what somebody was doing with Eunice’s body during that interval of disappearance. Some authoritative individuals suspect she was overdosed or otherwise murdered which would necessitate the body being rotted within an interval of time to get rid of the evidence. Others were initially told she moved to Coronado, California. Still others are wondering if Eunice Gardiner’s body is in fact buried under the small plaque in Easthampton.” VD-2 There was too much disinformation exposed. We have a great deal of documentation on this horrid episode initiated upon Eunice Bailey Oaks Gardiner as a purported UBS Client as well as other Florida elderly by UBS and it’s collaborators.

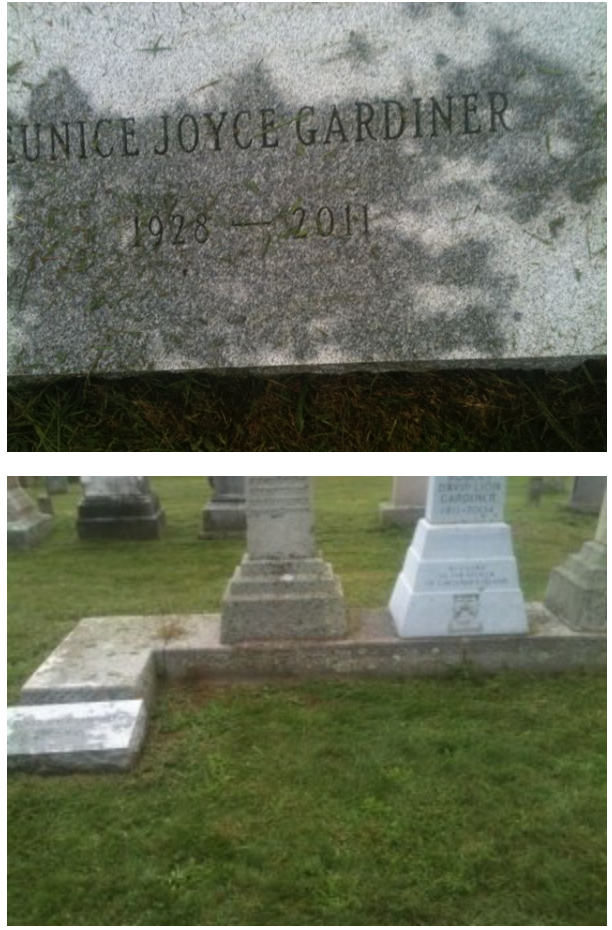

EASTHAMPTON, LONG ISLAND, NEW YORK CEMETERY

A Eunice Gardiner’s inconspicuous flat plaque to the left allegedly noting her grave as Joyce. Research has shown Eunice never used the name Joyce on any documents until the perpetrators started using it. No one knew who Joyce was but for the perpetrators, not even her contacted Canadian and English family. We do know her family noted a never used letter J on her birth certificate. The body may have to be dug up to see if it is in fact Eunice Gardiner in customary repose. Perhaps this will lead to other startling ghoulish discoveries.

_____________________________________________

Daniel A Hanley as Gunster Yoakley partner.

EUNICE GARDINER ADMINISTERED CANCER PAIN DRUGS!

Eunice was twice widowed with no children. Eunice had vast Gardiner Island Family’s Robert L Gardiner and Sir Harry Oaks Family’s son Pitt Oaks respective husband’s wealth bequeathed to her. Eunice Gardiner was said to have been put under excessive spurts of mind altering allegedly pain relieving ovarian cancer drugs when Eunices signature was required for wills/trusts and various other Eunice Gardiner & Robert Gardiner asset movement documents foisted upon her. These court document manipulations were created in favor of UBS, Eunice’s UBS salesman, UBS salesman’s wife and a Gunster Yoakley Daniel Hanley law firm partner (see seniorsavior.com) during those last few months. It is sad that an isolated Eunice was treated so criminally during her last months. During this same time frame the same behavior was allowed in New York when a wealthy isolated elderly Heugette Clarke’s name was also changed to an alias to avoid her searching relatives and friends. Heugette Clarke was confined under an alias in a New York Hospital by the perpetrators. UBS and other perpetrators had judicial collaborators aiding and abetting their successful massive thefts.

_____________________________________________

UBS & COLLABORATING LAWYERS ALLEGEDLY LOOT GARDINER ESTATE CLIENT WHILE UBS BOND SALESMAN HIREE IS STILL EMPLOYED AT MERRILL LYNCH!

Investment News reports: “A four-man team of advisers from UBS Financial Services Inc. who manage $277 million in assets with trailing-12-month production of $2.5 million has joined the Palm Beach, Fla., complex of Bank of America Merrill Lynch. … UBS last week (on or about July 18, 2011) returned the favor, hiring Merrill Lynch broker James H. Maloney (Mahoney) to work in it’s Palm Beach office. According to the firm, he managed $329 million in client assets and had trailing-12-month production of $1.9 million.” VD-3 Let us not forget bartender turned bond broker Mahoney allowed Eunice Gardiner’s Merrill Lynch account to be looted by UBS June 10, 2011 while still working for Merrill Lynch. How did Mahoney allegedly allow UBS to siphon $1,000,000 from Eunice’s Merrill Lynch account? Let us not forget Eunice Gardiner died July 29, 2011 believing she was still a Merrill Lynch bond client.

___________________________________________

Daniel A Hanley, Gunster Yoakley Partner

CONTROVERSIAL PALM BEACH LAW FIRM LINKED TO SCANDAL RIDDEN UBS CITED KICKBACK IN COURT

Orlando Sentinel reports: “Heirs to the Gannett fortune say a law firm improperly put one of its clients in charge of their father’s estate. Frank and Charles McAdam III are suing attorney Daniel Hanley and his West Palm Beach law firm, Gunster, Yoakley & Stewart. The brothers say the law firm wrongly let J.P. Morgan Trust Co. handle the estate of Charles McAdam Jr. Louis Mrachek, who is representing Hanley and the law firm, said his client did not funnel work to J.P. Morgan as some kind of kickback. … Plaintiff’s (McAdam) counsel told the jury that this case is ‘like Robin Hood in reverse. You steal from the rich and put it in your own pocket. That’s what these folks (Daniel H Hanley, Gunster Yoakley et al) did.’ … The court observed that stealing could or might be encompassed within a claim for breach of fiduciary duty.” VD-3-1 Charles McAdam v Gunster Yoakley (on appeal Case # 4D06-1594, West Palm Beach, Florida Courthouse) Daniel A Handley and his Gunster Yoakley & Stewart law firm had been successfully sued for more than $1,000,000 by the Gannet heirs. Similar acts now being perpetrated with UBS upon the estate of Eunice and Robert L Gardiner

_________________________________

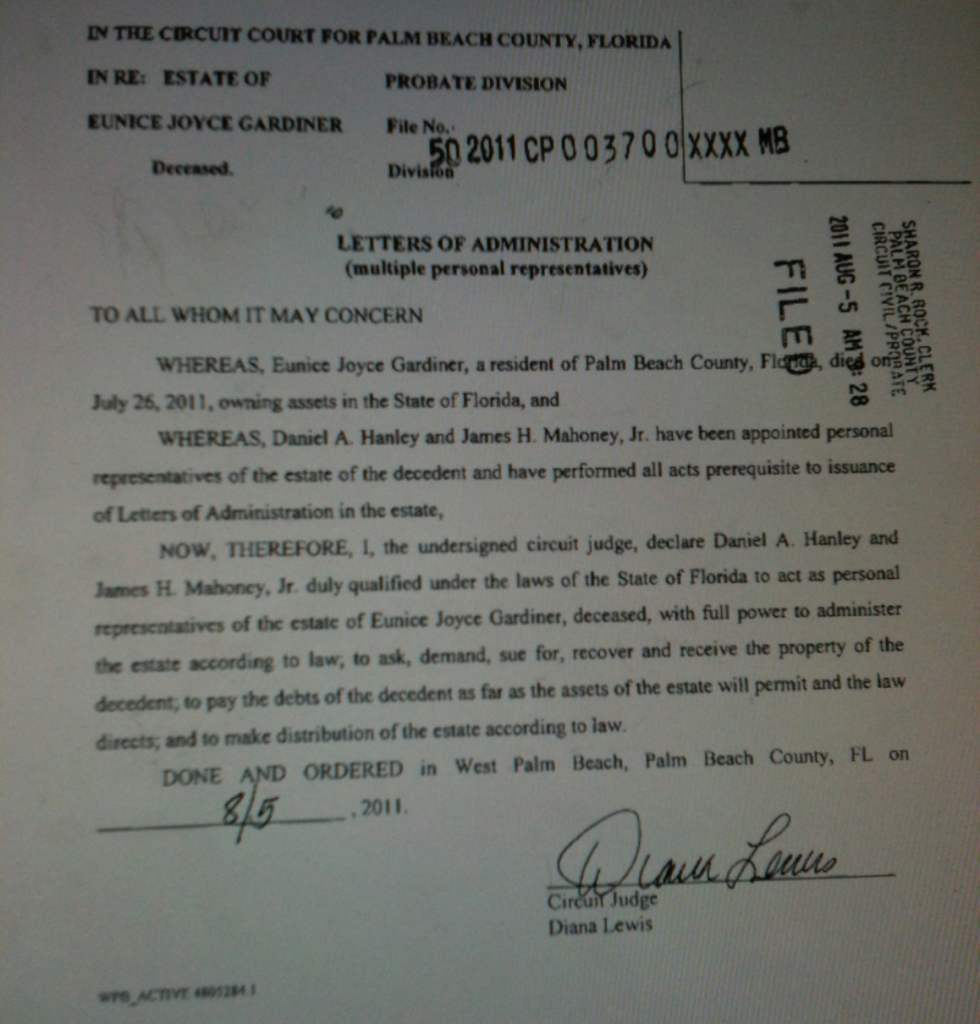

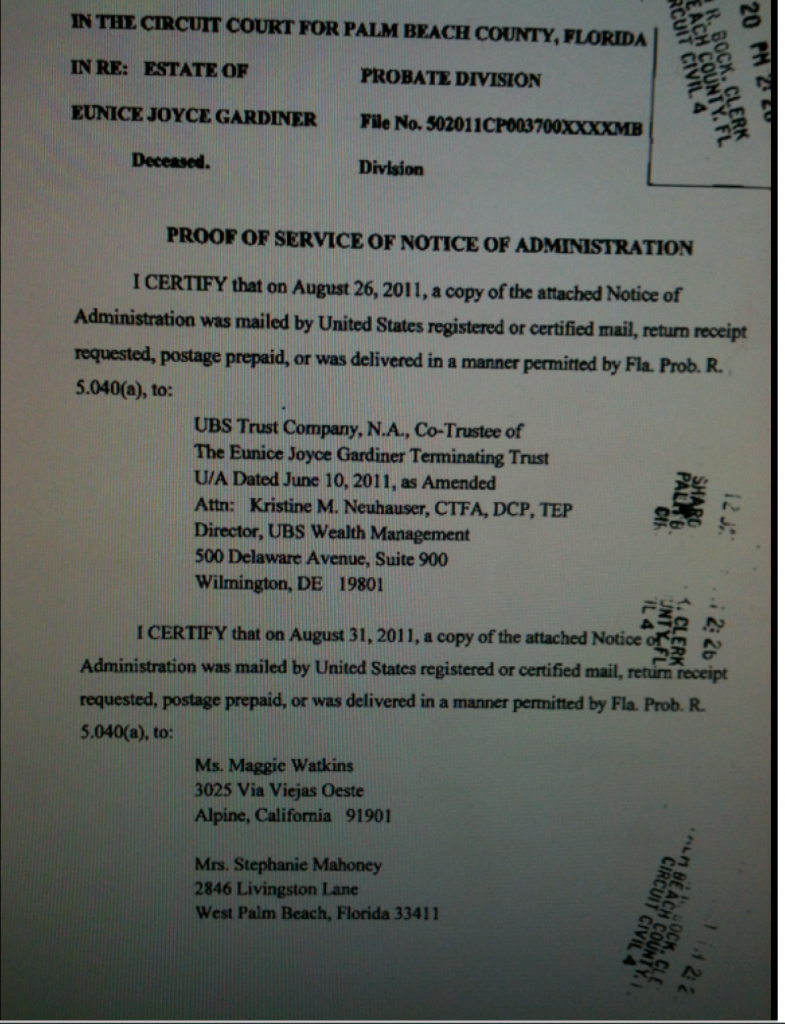

UNINFORMED PALM BEACH COUNTY COURTHOUSE “DULY QUALIFIES” EUNICE GARDINER’S UBS SALESMAN AND CONTROVERSIAL GUNSTER LAW LAWYER.

Eunice Gardiner died July 26, 2011. Judge Diana Lewis of Palm Beach County Courthouse August 5, 2011 signed James H Mahoney Jr and Daniel A Hanley as “duly qualified” personal representatives of Eunice Gardiner’s estate. From information and belief Mahoney/Hanley deviously did not divulge many issues precluding them from being “duly qualified”. Judge Lewis was not dutifully told that UBS salesman and allegedly ex-bartender Mahoney solely handled all of Eunice Gardiner’s investment portfolio. Judge Lewis was not told Hanley was recently involved in Court declared swindling of Gannet Publishing heir McAdam’s estate (see seniorsavior.com). Controversial Daniel Hanley used his home address in the Eunice Gardiner Court documents avoiding mention of his position as a Gunster Yoakley wills trust lawyer dealing with Eunice Gardiner’s will. This creates a facade against any Court record scrutinizing eyes. Like most Florida Judges, we have found Judge Lewis a highly competent Judge with a large docket of cases. Customarily, if there are no opposing parties Judges do have to scrutinize cases in depth. Unfortunately, the Mahoney/Hanley appointments started a causal chain of suspect events leading to the alleged looting of the $147,000,000 Gardiner’s Island Family estate.

__________________________________________

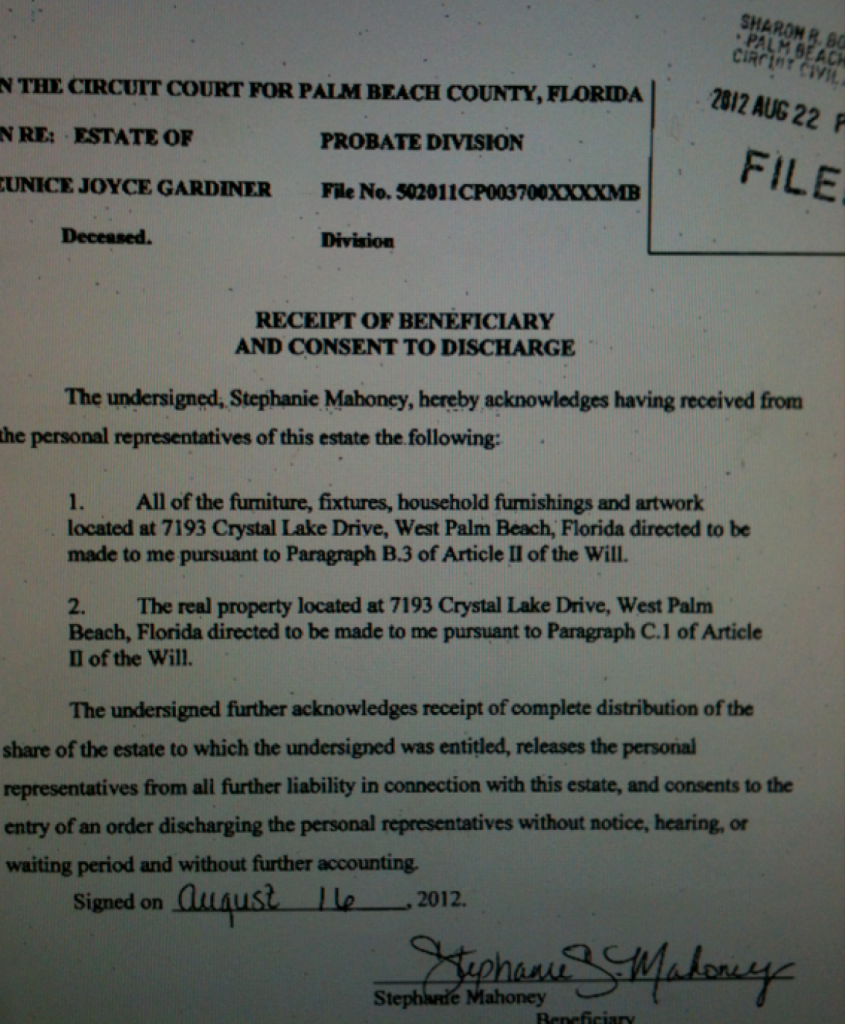

EUNICE GARDINER’S UBS SALESMAN’S WIFE IS MADE BENEFICIARY OF ESTATE HOME AND CONTENTS BY HUSBAND AND GUNSTER YOAKLEY LAWYER AS EUNICE PERSONAL REPRESENTATIVES!

UBS has committed blatant conflict of interest if not criminally taking advantage of an elderly drug addled Eunice. From information and belief Eunice was being given medication more than the power of heroin. This is further compounded with UBS, a UBS salesman and his family isolating as well as controlling Eunice the last months of her life. James H Mahoney even spent the last hours at the foot of Eunice’s deathbed to guard final closure. We see above that Stephanie Mahoney was given ownership of Eunice Gardener’s estate and its contents by trustees UBS salesman and husband James H Mahoney and Gunster Yoakley lawyer Daniel A Hanley. We see that these two men were appointed Eunice Gardiner’s “duly qualified” personal representatives by Gunster lawyer Alexander Woodfield. ____________________________________________

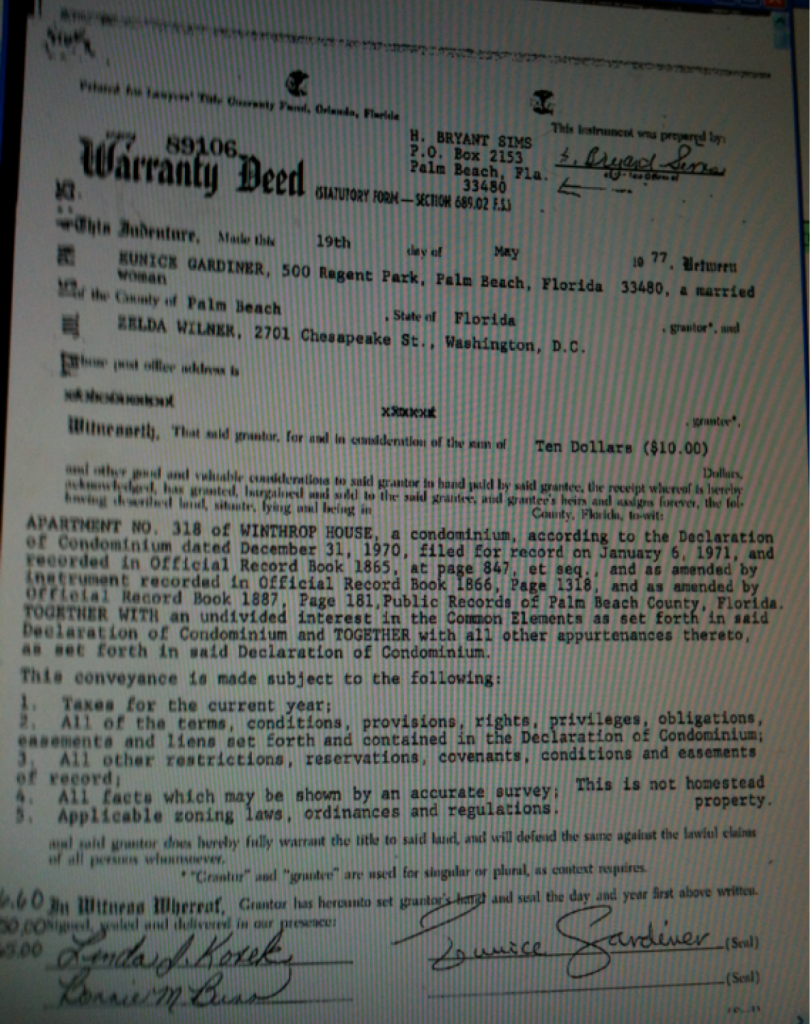

EUNICE GARDINER ALLEGEDLY SIGNS NOTARIZED WARRANTY DEED RIGHTFULLY, EUNICE GARDINER.

May 19, 1977 Eunice Gardiner signed the above notarized document. There have never been any notarized or other documents signed by Eunice Gardiner as Eunice Joyce Gardiner until on or about the time UBS Trust Company, N.A., Co-Trustee of the Eunice Joyce Gardiner Terminating Trust U/A was created. Please note the consistency of the Eunice Gardiner signature. We will see in UBS/Gunster wills/trusts documents created weeks before her death an erratic signature in the name of Eunice Joyce Gardiner.

_______________________________________

UBS USES CLASSIC USA ASSET LOOTING OFFSHORE PORTAL INTO THE GARDINER’S ISLAND FAMILY ESTATE UBS SWINDLE IS DISCOVERED.

June 10, 2011, as Amended, UBS Trust Company, N.A., Co-Trustee of the Eunice Joyce Gardiner Terminating Trust U/A is a highly technical financial vehicle. A UBS reliable source has said it is common for UBS to use these confusing insinuating documents on the USA elderly. N.A. (Netherlands Antilles) has a time worn trick procedure allowing UBS to put a tombstone advertisement solely in a Netherlands Antilles local paper regarding the ownership of a UBS Client victim UBS created trust. If no one of standing answers the advertisement in Netherlands Antilles the trust is immediately converted to UBS AG bank ownership. UBS is skilled at converting UBS Client accounts into there own throughout the World, with the use of dubious UBS created documents.* Please note Eunice Gardiner with ovarian cancer allegedly died of an overdose on July 29, 2011. A concerned Eunice was to meet with trusted Herb Mallard the very next day. She had found out that James Mahoney was actually working with both Merrill Lynch and UBS. This questionable UBS Trust document was created a month before her death when Eunice was taking heavy mind altering medication initiated approximately March 2011. She was vulnerable, isolated and controlled by an ex-bartender alleged Merrill Lynch/UBS salesman who moved into her house. Eunice Gardiner was not of sound mind when signing the many sophisticated UBS/Gunster wills/trusts documents thrust in front of her at Gunster Yoakley. As we see below and with other Court documents, Eunice never used a name of Joyce on any notarized or other documents before being prescribed ovarian cancer mind altering medication in or about March 2011 by her Doctor . Eunice said she did not know why she was directed by UBS/Gunster to sign all documents thereafter using Joyce. It is now believed it was a ploy to further mix her up with the other shortly before deceased Eunice Gardiner.

*We have seen documented evidence of UBS taking UBS Client Mallard’s more than $1,000,000 entrusted assets, shifting them between various UBS companies/accounts and offshore wire transferring them to UBS AG (Switzerland). This was done without the USA Federally mandatory consent of UBS Client Mallard and USA Federal Internal Revenue Service (IRS). The USA Federal IRS political appointees over the sentiment and advice of IRS professionals would take no action against UBS.

________________________________________

Eunice Bailey Oaks Gardiner true & correct name and person as scrutinized by Google search personnel.

UBS & COLLABORATORS CREATE EUNICE GARDINER ALIASES TO HIDE HER! PERPETRATORS FURTHER MIX HER UP WITH ANOTHER PALM BEACH DECEASED EUNICE GARDINER MARRIED TO A HENRY GARDINER.

UBS and collaborating swindlers used aliases to hide Eunice Gardiner from her family and friends. Perpetrators also mixed Eunice Bailey Oaks Gardiner with another Eunice Schirrman Gardiner who had died in West Palm Beach County a few months earlier and who was married to a Henry Gardiner. Many of Eunice Bailey Oaks Gardiner’s friends went to and sent condolences for Eunice Schirrman Gardiner. This also confused many of Eunice’s Palm Beach friends who accordingly thought she was already dead and buried at the Bethesda Episcopal Church columbarium. The director of Quatlebaum Funeral Home said Eunices UBS bond broker took charge of the entire funeral procedure from the beginning to having the body shipped to somewhere in New York. The Director said it was unlike other funeral proceedings with no religious entities, family or friends participating. In the aftermath, one elderly friend of Eunice said: “How can UBS, their lawyers and judges become un-prosecuted elderly grave robbers? Something has to be done to stop this terror on the elderly and their families.”

______________________________

HOW UBS LAUNDERED ROBERT & EUNICE GARDINER’S USA ESTATE ASSETS OFFSHORE TO UBS AG (SWISS) CRIMINAL USE CONVERSION.

Transparency International reports: “America now looks weak on transparency – states including Delaware, Wyoming and Nevada allow beneficial ownership to remain hidden. The US does tolerate these onshore havens, but its federal agencies have aggressively pursued Swiss and British banks. Since 2010, any bank wishing to do business with America (most banks need to deal in dollars) must disclose all US account holders to the Internal Revenue Service, under the Foreign Account Tax Compliance Act. Unfortunately, the flow of information is one way because the US has not agreed to share information on foreign nationals holding accounts in America.

Trusts are particularly controversial, because their existence is usually not recorded by any government.

Hedge funds and other collective investment schemes, many of which are also managed using offshore structures, are another favoured route. Offshore companies can be used to collect deposits from bribes or frauds and those deposits are then moved into legitimate investment schemes with a minimum of questions asked. Profits from the scheme emerge clean and can safely make their way into the ordinary retail banking system.” VD-3-2

_____________________________________

UBS ALLEGEDLY INVOLVED IN FIRST DEGREE FELONY CHARGES AGAINST UBS ELDERLY WIDOW CLIENT VICTIM.

Palm Beach DailyNews reports: “The victim (Helga Marston) suffers from dementia and Alzheimer’s disease, and has been living at the Lourdes Noreen McKeen assisted living facility in West Palm Beach since February 2013. On March 18, 2013, the victim had been evaluated by a doctor, who concluded she had ‘zero’ mental capacity. The doctor said the woman ‘was unaware of her surroundings and described it to be as if she was placed on another planet’. Tsai, 66, is a former interior designer and founder of the Canadian Breast Cancer Foundation. She is the ex-wife of the late billionaire financier Gerald Tsai … Nancy Tsai was booked into the Palm Beach County Jail 1 p.m. Tuesday on first-degree felony charges of exploitation of more than $100,000 from an elderly person and grand theft of more than $50,000 from a person over 65. She was released on a $30,000 surety bond at 8:30 p.m. A call to her attorney, Joseph Atterbury, was not returned by deadline. … (UBS) Financial adviser Dennis T Melchior, Tsai’s boyfriend, acted as broker for the victim’s trust account while employed at UBS Financial Services. He was fired from UBS Palm Beach on April 22, 2013 for failing to tell UBS management of his relationship with Tsai. Although Melchior’s financial broker’s license had been revoked, Tsai added him as an investment adviser to the victim’s trust account and paid him $7,500 monthly since June 2013, according to the affidavit. … Melchior has not been criminally charged. … The police investigation into Tsai was triggered by Financial Industry Regulatory Authority (FINRA) investigation of (UBS financial advisor) Melchior.” VD-4 UBS Wealth Management Representative Dennis T Melchior was UBS salesman/financial advisor to UBS widower Client victim Helga Marston not his girlfriend Nancy Tsai. It is unknown how many fees or account assets UBS had taken out of UBS Client victim Helga Marston’s estate. It is unknown who told FINRA about the UBS alleged scam. FINRA (Financial Industry Regulatory Authority) as the largest private securities regulator in the USA says: “Our chief role is to protect investors by maintaining the fairness of the U.S. capital markets.” From information and belief FINRA is a paper tiger supporting the interests of the regulated like UBS at the expense of the client victims. Since FINRA took no action UBS, UBS salesman/advisor and other collaborators were allowed to go free as well as keep UBS Client victim Helga Marston’s looted estate.

UBS Financial Services salesman/advisor Dennis T Melchior to UBS Client Helga Marston and his girlfriend Nancy Tsai.

__________________________________________

PALM BEACH UBS WIDOWER CLIENT VICTIM OF ANOTHER ALLEGED UBS SWINDLE.

The Toronto Globe & Mail reports: “Born in Barrie, Ont., she was known as Nancy Paul when she started the Canadian Breast Cancer Foundation in 1986 and became a socialite legend on the fund-raising circuit. … Ms. Tsai has been living in Palm Beach following her marriage and 2006 divorce from the late Wall Street fund manager Gerald Tsai. According to records at the Palm Beach courthouse, on Wednesday Ms. Tsai was charged with two felonies: one count of exploitation of an elderly person and one count of grand theft from a person over 65. … The alleged victim is Helga Marston, a World War Two refugee from Romania whose husband, the investment banker Hunter Marston, died a decade ago. … police began the investigation four months ago. That was when financial regulators raised concerns about Dennis T Melchior, a UBS Financial Services broker who worked for Ms. Marston and was also Ms. Tsai’s boyfriend. According to the affidavit, Ms. Marston opened a UBS trust account in 2011 and granted her long-time friend power of attorney, later naming Ms. Tsai as a trustee of the account.” VD-5 It is doubtful a timid FINRA will ever take any further action against UBS or UBS Client victim Helga Marston’s UBS Wealth Management salesman/advisor other than suspending the UBS salesman/stock broker’s license. Again, USA Attorney General Holder and his former Assistant Lanny Breuer are on public record giving UBS immunity from investigation and prosecution. UBS AG is custodian of the Obama Presidential Library+ secret foreign donor numbered accounts, among other things.

Helga Marston

__________________________________

DOES UBS “INCENTIVISE” UBS SALESMEN TO SIGN USA SENIOR CITIZENS AS CLIENTS, ESPECIALLY WITH DEMENTIA AND ALZHEIMERS?

Bloomberg reports: “Weil gave subordinates at UBS incentives to increase their business with U.S. clients, knowing that they were violating the 2001 agreement to identify customer names, prosecutors alleged in the November indictment. In 2002, Weil and other executives hid from the IRS the results of an internal audit that showed the bank wasn’t meeting the terms of the agreement, according to the November indictment.” VD-6 Not covered in these media articles is the fact that UBS has not been investigated, prosecuted and gets to keep the elderly UBS Client’s estate looted through the UBS Financial Advisors. Documents were given to an unknowing UBS Client Mallard by UBS showing UBS unilaterally wire transferred offshore his accounts to Switzerland. Mallard and Gardiner accounts are but two with documented UBS offshore statements, shown in this newsletter. If Mahoney is outed he will most probably follow the UBS/FINRA Melchior punishment scam. FINRA will most probably take Mahoney’s license away, UBS will then fire him while UBS will be allowed to escape yet another criminal violation and keep the Gardiner’s Island Family estate loot. Mahoney will yet be another small player victim in the UBS continuing USA criminal violations saga. Time and again, UBS is constantly hiring salesmen to repeat their alleged criminal process against recruited clients, especially the elderly.

____________________________________________

91 YEAR OLD UBS WIDOWER CLIENT HAS LIFE SAVINGS STOLEN BY UBS WHILE ALERTED USA OCC TAKES NO ACTION AGAINST UBS.

Ripoff Report reports: “The large display ads appearing weekly in the Wall Street Journal, by the New York City Office of World Wide UBS Ag Bank, are quite inviting…’At UBS, we know managing wealth means responding to changes in the market, the world and your life…we consider the perfect time to assess where you are headed as an ongoing conversation called, “You & Us.’ My 91 year old friend and elderly patient, Lester Wilken, of Laguna Woods, CA, trusted UBS to manage all his wealth in the Zurich Bank. … (Wilkins) was so blinded with Macular Degeneration he depended on the eyes of UBS executive director … His Zurich manager, Claude E. Ulmann, informed him, “It is better for me to fly a UBS Power of Attorney to your home in CA (Laguna, California) to arrange the trust … he (Wilkins) furnished us the address of Claude Ulmann so we could request he transfer the $250,000 trust fund he assured Wilken was in place in our name. … Wilken’s … died … The UBS Law firm in Zurich then informed me (heir) they would not honor my UBS Power of Attorney even though Claude E. Ulmann was still employed as one of their executive directors in wealth management … Ulmann not only failed to send papers for the trust transfer, he never provided us with the account number or interest earned or mailed a bank statement showing the balance. … The Comptroller of the Currency (OCC), Administrator of National Banks, Houston, Texas, simply informed us my case was assigned the case # 586634 … by Customer Assistance Group, but no assistance has been forth coming.” VD-7 A pattern is clearly discernible in UBS giving money to the Utah Symphony allegedly for favorable Salt Lake City State and Federal Courthouse treatment. Giving donations to Senator/President Obama through UBS Chairman and custodian Obama Presidential Library+ secret offshore numbered account for foreign donations for immunity from USA Federal investigation/prosecution. All the while, the UBS elderly clients get the shaft. When will UBS ever loose their USA Charter to stop this reign of terror?

________________________________________

UBS southeast USA regional director Brad Smithy is left. UBS customer is center. UBS Price senior vice president Craig Price is right.

UBS DIMINISHES SENIOR VICE PRESIDENT PRICE WEALTH MANAGEMENT IN RETALIATION FOR WHISTLEBLOWING ON MELCHIOR ET AL.

advisorhub.com reports: “Craig D. Price also charged that UBS violated federal law by failing to file Suspicious Activity Reports with the government after he told managers that the colleague and his girlfriend—the former wife of legendary financier Gerald Tsai—were using her power of attorney over the UBS-domiciled trust account of an “extremely wealthy” childless widow in her nineties (Helga Marston) to advance UBS’ image and her paramour’s career by patronizing and sponsoring charitable events in the Palm Beach area with the client’s money. … The lawsuit liberally cites names of the top brass of UBS’s U.S. wealth management unit. In early 2013 Price notified Brad Smithy, then a complex manager and today one of three division directors at the firm (UBS), of his suspicions that colleague Dennis Melchior and his girlfriend Nancy Tsai were raiding the elderly client’s trust account. He made the allegations after reviewing how credit card and account transaction statements of the trust correlated with Melchior’s business calendar, the lawsuit said. The broker allegedly documented six charitable events sponsored or supported by UBS in the first quarter of 2013, including purchasing a table at a ball held at Mar-a-Lago in Palm Beach, and found “many instances of events to benefit UBS directly or to benefit Melchior….which were authorized by Ms. Tsai” and paid from the trust account, the lawsuit said. He sent details in an email to Smithy, with a copy to UBS Private Wealth Management head John Mathews, the lawsuit said. When UBS fired Price on February 29, 2016, his complex and branch managers said the “decision to terminate his employment went all the way to the top, to Tom Naratil, the new President of UBS Americas, Inc.,” according to the lawsuit. … The lawsuit did not directly explain why Price’s charges would be so inflammatory to the firm. … UBS discharged Melchior in April 2013 for loss of “management confidence” relating to conflct-of-interest concerns involving a trust account, according to his BrokerCheck history. The lawsuit said the firm never amended Melchior’s U-5 termination filing to “accurately reflect his financial exploitation” of the elderly investors. Melchior, who the lawsuit said was promoted by UBS in January 2013 and authorized by Smithy to move from Price’s office to a Palm Beach branch, is currently an independent registered investment adviser”. VD-8 UBS is on record within internalrevenue.com issues 5 & 8 of using similar tactics throughout the USA wealthy enclaves. You will there see incidence formats are more complex containing other UBS collaborators who are recruited to insure success. UBS sucks out of USA 29% of it’s World profits, somehow!

_________________________________________

UBS picketers

US seniorsavior.com was initially created to protect Florida senior citizens from white-collar crime. Seniorsavior.com is so upset at UBS taking advantage of the elderly through predatory banking/broker dealer practices they continue to sporadically picket. This group has not used the media exposure for their picketing, yet. It is a good bet they would receive media international attention. Some signs read:

UBS ARE SWISS PREDATORS

UBS SWISS CRIMINALS OUT OF USA

UBS KEEP OFF U.S. SENIOR CITIZENS

IS UBS SECRET BANKER FOR DRUG CARTELS, DICTATORS, CHILD TRAFFICKERS AND U.S. SECRET PRESIDENTIAL LIBRARY FOREIGN CASH?

______________________________________________

Florida elderly are angered Presidents Clinton/BushII/Obama and political appointees would not take any action against UBS criminal activity against elderly UBS Clients, for some reason.

____________________________________________

UBS DENIES BERNIE MADOFF COMPLICITY.

Financial Times reports: “UBS seeks to deny duty over Madoff funds. UBS sought to absolve itself from any duty to safeguard investor assets in a $1.4bn fund that channeled money into Bernard Madoff’s alleged $50bn Ponzi scheme. The Swiss bank used an agreement that denied it was responsible for the assets – even though its marketing documents claimed it would be.” VD-9 Recidivist UBS will never end its sleaze and resulting US crime wave? The UBS Client victims list is allegedly longer than that of UBS business associate Bernie Madoff.

__________________________________________

Collaborators Bernie Madoff & UBS

UBS PROMOTED BERNIE MADOFF TO UNSUSPECTING UBS CLIENTS.

Associated Press reports: “Luxalpha board member Rene-Thierry Magon de la Villehuchet committed suicide last month when he lost $1.4 billion (euro1 billion) that he had invested with Madoff. Both Luxalpha and Luxinvest were promoted by Swiss bank UBS.” VD-10 Time and time again UBS denies complicity only to be found out later. How long is this going to go without prosecution?

________________________________________

Bernie Madoff’s a head!

LUXEMBOURG ATTACKS UBS OVER MADOFF FUND.

Financial Times reports: “UBS, the Swiss bank, was accused of ‘serious failure’ by Luxembourg’s financial regulator over its custodianship of a $1.4bn fund that funneled money into Bernard Madoff’s alleged $50bn ‘Ponzi’ scheme. The regulator ordered the bank to pay compensation, saying the ‘poor execution of its due-diligence obligations constitute a serious failure of its surveillance role as a depositary bank.’ ” VD-11 Master Criminal UBS Chairman created this continuing UBS reign of terror within the USA elderly community. UBS AG Chairman Weil sought out devious swindle schemes within the USA with uncanny efficiency. Be it UBS AG owned Utah Industrial Bank aliases, UBS AG offshore USA recruitment, USA elderly targeting that include raiding elderly private clubs and retirement homes, Bernie Madoff partnership, etc, etc, etc; UBS AG international financial swindles will continue to go unpunished. Dirty hands UBS AG will continue to be given an escape portal allowing their donor recipients to accept UBS AG plausibility of denial from investigation and prosecution. UBS will continue to have a USA Charter. We do not refute reality. We are just corroborating and consolidating UBS AG continuing USA criminal violations.

_____________________________________

UBS SPONSORS PALM BEACH ART SHOW HONEYPOT TO SOLICIT & RECRUIT WEALTHY SENIOR CITIZENS!

Embassyofswitzerland.com reports: “UBS spent millions of shareholder and Swiss taxpayer bailout money to finance an art show fete for the wealthy of Palm Beach. UBS created another honey pot scheme similar to the UBS Miami Basil Art Show. During the first night gala UBS gave wealthy senior citizens Champaign, caviar and other foods meant for the likes of Madam Pompadour, all at the expense of the UBS stockholders and Swiss taxpayers. We were present to this fete and interviewed people who loved all the sumptuous activity but could not figure out why UBS was squandering so much money. It seems UBS insinuated operatives were mentioning the fact that off-shore accounts are available but one would have to email www.ubs.com, call +41 44 298 32 32 or visit the new UBS secured Nassau, Bahamas building for consultations. UBS is continuing to circumvent and flaunt USA Federal law. UBS is not allowed or estopped from talking about such wealth management capabilities in the United States at this time. A Palm Beacher said: ‘I feel sorry for the Swiss people paying millions in taxes for all of this luxurious food and huge art show for Palm Beach.’ Another said: ‘My family lost money to Bernie Madoff who did business with UBS. It is disgusting watching UBS officers swill down expensive food, at least Madoff had class.’ Yet another said: ‘I heard the Swiss government is paying UBS to host this party for the rich of Florida. I am glad I don’t pay Swiss taxes.’ At this very moment 52,000 UBS recruited US wealthy citizens are having their identity betrayed by UBS.” VD-12 It does not take much to connect the dots.

___________________________________

BEANIE BABIES BILLIONAIRE TAKES A HIT FROM UBS.

Huffington Post reports: “These are just a few of the details about Ty Warner, the billionaire creator of the Beanie Baby, revealed in a document filed last week by Warner’s lawyers aimed at reducing his sentence for tax evasion. … Warner, 69, admitted in October that he failed to report income from a UBS account in Switzerland. He plans to pay a $53.6 million fine, according to Bloomberg and faces a prison sentence of up to five years.” VD-13 From information and belief, UBS turned in Warner to enhance the UBS position with Congressional oversight. One can see a UBS pattern of turning in UBS Clients and various entrusting others for USA criminal violations initiated by UBS. UBS “rot at the top” gives deferred payments to recent USA Presidents Clinton and Obama to keep their USA “get out of jail free card” while UBS client victims are treated harshly by Presidential appointees.

_________________________________

UBS ELDERLY WIDOWER CLIENT UNWITTINGLY TAKES BLAME FOR UBS UNDER DUBIOUS CIRCUMSTANCES.

Bloomberg reports: “UBS Client Mary Estelle Curran, 79 pleaded guilty … ‘but there are a significant number of mitigating circumstances in this case,’ one of her attorneys, Nathan Hochman, said … Zurich-based UBS, the largest Swiss bank, was charged with conspiracy … admitting it aided tax evasion … (Curran) who lives in Palm Beach, faces 30 to 37 months in prison under her plea agreement. … Curran, who had a high school education, inherited an undeclared UBS account in 2000 after the death of her husband of more than 40 years, Mortimer … ‘Her husband was in complete control of their finances until he died,’ said Hochman, a former assistant attorney general who oversaw the Justice Department’s tax division. “This was a woman without any financial background at all, none. When her husband passed away, she had no idea how much money there was at UBS.” The case is U.S. v. Curran, 12-cr-80206, U.S. District Court, Southern District of Florida (West Palm Beach).” VD-14 Reliable UBS source has said this is about pressure from Congress upon Holder and UBS to show their resolve! What better sacrifice than UBS Client Mary Estelle Curran with only a high school education who completely relied upon her husband for finances and then UBS. UBS Client Mary Curran still drives a 2006 Toyota Corolla with manual windows. This was supposed to be an easy betrayal of a UBS Client by UBS. It was not.

______________________________

Mary Estelle Curran

OBAMA’S ATTORNEY GENERAL HOLDER & UBS AG TAKE DOWN AN ELDERLY CHURCH GOING UBS WIDOW CLIENT TO IMPRESS USA CONGRESS!

Fortune reports: “Mary Estelle … Curran was supposed to be a showcase take down of users of Swiss bank secrecy, a whopper indictment involving a well-heeled resident of Palm Beach, Fla., who failed to report to the IRS that she held $43 million at UBS, the Swiss bank giant … a sympathetic judge last Thursday gave Curran five seconds’ probation and excoriated the prosecutors … Judge Kenneth Ryskamp of Federal District Court in West Palm Beach, even urged prosecutors to seek a presidential pardon for Curran, a homemaker who said she had relied on advisers and rushed to disclose the accounts she inherited from her deceased husband. … Unbeknown to Curran, UBS had turned over her name to the IRS three weeks earlier … Unlike other tax evaders indicted in recent years, Curran did not add money to the accounts, receive cash in paper bags, use secret credit cards, skim profits from businesses, arrange sham loans, or make extravagant purchases. She still lives in the house, with green and white Formica kitchen counter tops, that she and her deceased husband bought in 1982 … Ryskamp said … government decided they wanted to make a felon out of this woman.” VD-15 A reliable UBS source said UBS and USA Attorney General Holder wanted a media case to show resolve after pressure from Congress. It was decided elderly UBS Client Mary Curran would be an easy mark, the perfect target. Unfortunately for UBS and Holder, an attentive Judge Kenneth Ryskamp saw through the setup UBS ploy. By suggesting an Obama Presidential pardon of UBS Client Mary Curran, the Honorable Judge intimates that he knows who was behind the ploy. Obama/Holder/UBS AG needed a media UBS Client sacrifice for Congress. How many UBS scams are needed to be exposed before UBS looses it’s USA Charter?

___________________________________________

Elderly charge UBS office for their money!

________________________________________________

UBS AGAIN SOLICITS PALM BEACH ELDERLY JEWISH WOMEN WHO SUFFERED THE MADOFF/UBS SWINDLE!

UBS increased the size of their offices and put the UBS logo onto the 440 Royal Palm Building. UBS has attempted to distance themselves from UBS trained ‘incentivised’ UBS salesmen by making them independent contractors, like strip clubs to strippers. This is said to allow UBS senior staff ‘plausibility of denial’ while continuing illegal acts. A UBS reliable source said UBS has lined up several Palm Beach elderly Madoff/UBS victims for the UBS ‘perfection experience’. One of these elderly women is known to be confined to a nearby elderly home. It is unknown how UBS continually gets into private non-profit facilities to recruit elderly patients. Most of those in Palm Beach recruited by Madoff/UBS were members of Temple Emmanuel and/or the Palm Beach Country Club. All have attempted to claw back their estate accounts.

____________________________________

UBS deferred payment scheme bipartisan recipient “USA Presidential Team UBS” triplets pose with their mouths open while taking a breather from sucking on the UBS deferred payment tit.

_____________________________________

UBS DOCUMENTED CRIMINAL MISSTEPS TARGETING PRIMARILY USA ELDERLY VICTIMS.

Below are but a few UBS internet complaint listings within the USA. Clinton/Bush II/Obama all joined the UBS scheme of “take no action” against UBS AG or senior staff by providing UBS “rot at the top” with “get-out-of-jail-free cards”. Among other things but not necessarily all, each of these Presidents are receiving consideration mostly in the form of deferred payments and Swiss secret offshore accounts from UBS. USA Congress has allowed secret UBS Swiss offshore Presidential library accounts+ to attract foreign donors. Reliable sources have said foreign donors fear prosecution by their own countries if this UBS scheme were ever exposed by international media. The Middle East long standing joke is to ask a potentate how much they have given towards Clinton/Bush II/Obama USA “Presidential pyramid” libraries. The victims of this charade initiated by President Clinton and UBS are generally USA elderly citizens who became UBS clients victims through UBS coordinated deceit. We have recently seen the ramifications of the UBS mass swindling of UBS elderly clients in Puerto Rico (Issue 5). This UBS occurrence contributed to the Puerto Rican bankruptcy plight. We see depictions of Clinton/Bush II/Obama holding hands, hugging and other forms of affection for they know President Trump could easily do his job and have them prosecuted. Mubarak of Egypt. Lula of Brazil et al have been criminally prosecuted for much less theft than those involved in the UBS cabal against USA elderly targeted citizens. When will President Trump allow forthright Attorney General Sessions to prosecute these men and their collaborators.

______________________________

NEW YORK ATTORNEY GENERAL ACCEPTS POLITICAL CASH ALLEGEDLY FROM ROBERT L GARDINER ESTATE SWINDLERS, FOR SOMETHING!

New York Times reports: “We try and protect New Yorkers from those who would do them harm,” Mr. Schneiderman said during a recent interview in his Manhattan office. “The biggest threat to New Yorkers right now is the [Trump] federal government, so we’re responding to it.” … How far Mr. Schneiderman is willing to go in taking on Mr. Trump could define his political career, particularly in a blue state where disapproval of the president is high. … Mr. Schneiderman would say little about his potential role as a criminal prosecutor in relation to the Trump administration, except that he hoped it would not come to that. … we’ll do whatever we can do to see that justice is done,” he said. … Regarding Mr. Schneiderman’s myriad legal filings, the White House referred questions to the Justice Department. … “The federal court system is not a substitute for the legislative process,” said Devin M. O’Malley, a spokesman there. “The Department of Justice will continue to defend the president’s constitutional and statutory authority to issue executive orders aimed at securing our borders, protecting U.S. workers, promoting free speech and religious liberty, among many other lawful actions.” VD-16 Eric Schneiderman is believed to have known of the New York Wills & Trusts lawyer scams but took no action. Eric finally quit when accused of brutality towards women.

New York Attorney General Eric Schneiderman

AG Schneidermin could have spoken with forked tongue. Why did he allow the continuing estate thefts in New York and Florida. What is extent of political donations from UBS and their collaborators?

We have had elderly Heuguette Clark estate scandal where she was disappeared under an assumed name in a New York City Hospital until her 100th year death. Whereupon, known participant ‘keepers’ demanded an unknown confidential settlement from her estate.

The Ted Ammon Easthampton, NY $18,000,000 estate was looted with $2, 000,000 remnant left for the victimized two children.

Kevin J Collins, Southampton, NY entire estate of $40,000,000+ allegedly looted by Curtis Mallet partner whereupon the Attorney General’s office did not take any action. During the same interval, Curtis partner took wife Louis Collin’s $20,000 jewelry hidden in her closet and immediately converted it into cash using her sales slip. Curtis Mallet Partner allegedly told jewelry store manager Louis Collins was dead and thus no longer needed the jewelry. After Louis got out of the far away Mt Sinai Miami hospital she walked down Worth Avenue whereupon she saw her jewelry in the window of the jewelry store. She went in to a frightened manager that had been told she died by the Curtis Mallet partner. We have all receipts and other relevant documents to the whole sordid scheme. Schneiderman’s office took no action against Curtis Mallet partner despite irrefutable evidence receipts, documents et al. Curtis Mallet Law partner made his children and successor children trustees of Kevin J Collins estate with one and his heirs managing all cash, in perpetuity. New York Attorney General Schneiderman’s office would take no action. All incriminating documents are available on a confidential internet site similar to our format. The Curtis Mallet lawyer gave wife Louis Collins $2o,000 per month for living expenses of three homes where she cried and finally said “It is God’s will.”.

_______________________________________________

Huguette Clark

HEIRESS HOSPITAL PATIENT GETS UBS TYPE TREATMENT OF ISOLATE, CONTROL, DUPE AND LOOT WHILE UNDER LAWYER AND ACCOUNTANT CONTROL!

Associated Press reports: “Now the court-appointed official overseeing copper heiress Huguette Clark’s estate wants all these gifts – and more – back. Saying the recipients manipulated the reclusive multimillionaire into lavishing largesse upon them during her long life, public administrator Ethel J. Griffin is trying to reclaim a whopping $37 million for the $400 million estate. … Besides seeking an order for return of those gifts, the administrator asked a court last month to investigate whether a hospital where Clark lived should have to give back a $6 million painting by French pre-Impressionist Edouard Manet … While clashes over who got what and how during someone’s lifetime crop up in many will fights, the staggering size, two-decade timeframe and uncommon circumstances distinguish the dispute surrounding Clark’s gifts. … A court will likely have to reconstruct the intentions and mental state … and discern whether manipulation or gratitude was behind the gift-giving. Another issue is how well Clark was advised by her lawyer and her accountant. Both have come under scrutiny for their management of her affairs. … The public administrator’s court papers portray a frail, secluded Clark exploited by a scheming retinue. But recipients say Clark was a generous, independent-minded woman who did exactly what she wanted in enriching people around her.” VD-17

Perpetrators used the same UBS mantra as UBS allegedly teaches its sales trainees and happened to Eunice Gardiner. They isolated Huguette in a New York Hospital, controlled her by giving her an alias name so relatives and friends could not find her, duped her into thinking they were her friends and lastly looted her estate. Huguette did get media coverage that caused the appointment of a New York public administrator. She was put in charge of reclaiming or clawing back the Huguette Clark estate property. Palm Beach County judiciary and others actually assisted UBS and their other collaborators in the looting of the Eunice & Robert Gardiner estate. It was internationally noticed Palm Beach Post rarely reported the UBS and collaborators reign of terror over unsuspecting recruited Palm Beach elderly UBS Client victims. It has since been purchased by a Japanese admirer of President Trump. The frightened elderly are hoping judicial law and order will return and prevail over Palm Beach wills & trust law, in particular.

_________________________________________

Actor Phillip Seymour Hoffman before and just after he purchased high quality heroin at the New York sale. The once only bulk import of heroin was allegedly financed partially using deceased Robert L Gardiner Estate assets.

EUNICE & ROBERT GARDINER ESTATE ASSETS WERE SAID TO BE USED AS SEED $ FOR MASSIVE ONE TIME ONLY HEROIN PURCHASE?

There was part of the Robert L Gardiner Estate [Gardiner’s Island] $147,000,000 estate assets that at least one of the New York swindlers gave AG Eric Schneiderman’s political donor office for an expected run for Governor. We do not know what happened to the cash after AG Schneiderman resigned for molesting women. During this interval the “in play” Gardiner estate cash was also allegedly used as seed money for a substantial New York once only heroin deal through Turks & Cacaos connections. A reliable source area contractor said everybody in drowsy Providential knew of the operation from spotters hired by local operators. The contractor said local crime figures have surveillance spotters at the airport and docks. There is only a slight sense of fear amongst the citizens that local criminals are allowed to intermingle with international crime syndicates with a sense of impunity for this provides sustenance to the economy. The real villains to the economy to be scrutinized are thought to be international law enforcement.

In one incident during this episode, a black private jet landed at the Providential airport with two thought to be USA Enforcement Agents in black suites and black sunglasses. They were depicted as looking like actors out of central casting for a Ghost Busters film. This is said to have caused much laughter in Providential before the mysterious two alleged Agents left the airport. Allegedly the seed money drug deal part was reimbursed to the Gardiner estate asset pool upon the windfall heroin sales profits. It was said to be a once only hush hush operation. We know no more nor have we any documentation about this episode. The disclosing contractor left Turks & Cacaos and is said to be living in USA. It is public knowledge there were numerous New York area overdoses with this high quality heroin, including actor Phillip Seymour Hoffman. Hoffman was interviewed by a television network and spoke extensively about the rampant sale of high quality heroin incident before he himself succumbed to his own overdose.

__________________________________________

UBS MANTRA OF TARGET, SOLICIT, RECRUIT, ISOLATE, CONTROL, DUPE AND LOOT IS USED AGAINST EUNICE BAILEY OAKS GARDINER

The Robert L Gardiner estate remnants from the New York venue were transferred to infirm wife Eunice Bailey Oaks Gardiner who had been urged to purchase a remote domicile in West Palm Beach, Florida West of the Florida Turnpike. Eunice did not drive and was dependent upon others. Eunice wanted to be with her friends Brownie, Doris and others by living at Palm Beach Towers near them. The condominium building included a restuarant, hair stylist et al at Palm Beach Towers. It has everything a woman needs inside the substantial inter coastal water view building next to the Flagler Museum. At the very time, some of the Florida UBS collaborators were in the midst of being adjudged negatively by a Palm Beach jury for swindling the Gannet Publishing heirs (see seniorsavior.com). Eunice was isolated as much as possible from her Palm Beach condo and friends. An ex-bartender turned Merrill Lynch/UBS bond broker was assigned to infirm Eunice Gardiner. Eunice came less and less to her once a week luncheons with the girls at the same table at a private club. Her UBS broker and his family moved into her remote house with isolated Eunice. From information and belief this is said to be an un-prosecuted USA Federal offense. Among other things but not necessarily all, Eunice’s name was also changed to mimic another unrelated nearby Eunice Gardiner who had recently died. Eunices Palm Beach friends and family were told she had died as the other deceased Eunice Gardiner in fact died. Others were told she had moved to the San Diego, CA area, et al .

LONG ISLAND, NEW YORK RETIRED JUDGE BLOCKED AND OBFUSCATED BY UBS COLLABORATORS

A Long Island Judge concerned about the Gardiner estate disposition has called New York lawyer estate swindling collaborations a reprehensible Long Island Judicial cottage industry eroding USA rule of law. One has only to look at the aftermath of all these incidents to see who the winning swindlers were, although it is unknown how the loot has been divided. Among other incidents but not necessarily all, Daniel Hanley and UBS are now co-trustees of Eunice Gardiner Foundation they set up. Daniel A Hanley and his Gunster law firm are clearly depicted in a similar series of acts against the Gannett Publishing heirs alarming case (see seniorsavior.com) as perpetrating defendants.

_______________________________

Daniel A Hanley partner at Gunster Yoakley, West Palm Beach, Florida

$1,000,000 MALPRACTICE AWARD AGAINST DANIEL A HANLEY, GUNSTER YOAKLEY LAW, PALM BEACH, FLORIDA WHILE IMPLEMENTING SIMILAR ALLEGED SWINDLES WITH COLLABORATOR UBS AGAINST ROBERT & EUNICE GARDINER ESTATE AT THE SAME TIME!

Law.Com reports: “A unanimous panel of the 4th District Court of Appeal upheld a $1 million legal malpractice judgment against the law firm Gunster Yoakley & Stewart awarded to the heirs of the Gannett newspaper fortune. The case arose from a dispute over the estate of Charles V. McAdam Jr., a wealthy Palm Beach, Fla., resident who was married to Sarah Gannett — daughter of Frank Gannett, the founder of one of the largest newspaper chains in the country. His two sons sued Gunster, shareholder Daniel A. Hanley and JPMorgan for breach of fiduciary duty, constructive fraud, civil conspiracy and unjust enrichment. On Wednesday, the 4th DCA panel, in an opinion written by Judge Mark E. Polen, said the “plaintiffs showed that their father’s intent, as expressed in his will, was frustrated by the negligence of Gunster Yoakley and that, as a direct result of such negligence, their legacy was diminished. Attorneys for two sons of McAdam could not be reached for comment. Gunster Yoakley did not provide comment by deadline Wednesday. The firm’s attorneys, Louis Mrachek and Alan Rose of Mrachek, Fitzgerald and Rose in West Palm Beach, did not return phone calls seeking comment. “ VD-18 UBS & Gunster partner Daniel A Hanley are now in control as trustees of the Robert L & Eunice Bailey Oaks Gardiner estate said to be worth $147,000,000 before questionable known and unknown depletions.

________________________________

Palm Beach County Judge Martin Collin

PALM BEACH, FLORIDA JUDICIAL PROFILE!

uglyjudge.com reports: “Judge Martin Colin above is an example of many judges who oversee conservatorships and guardianships in America today. They get away with it because the victims are defenseless and easy targets. … This is just the tip of the iceberg of millions of dollars stolen by criminals wearing black robes of shame and lawyers who prey on the elderly and defenseless…. This is how dishonest judges who are really criminals get away. They resign and hide under a rock. While they should be arrested and jailed and publicly punished. Back in the day they stoned them or hanged them to instill fear. Today they run away with huge benefits and salaries getting hired by other county or legal firms. … The stench emanating from Probate courtrooms all over the country, and especially the largest and wealthiest counties in Florida is overpowering to everyone but the Judges who oversee the system and the lawyers and predatory guardians they shield from criminal prosecution.” VD-19 Reliable sources; including a retired Palm Beach County Judge, USA Federal Judge and sundry honest lawyers who are concerned about the blatant UBS Palm Beach incursions similar to Puerto Rico (see issue 6, VF4). In essence, all of these reliable sources say any judge or lawyer on the Broward or Palm Beach County Judicial food chain who does not “get along, go along” is summarily disciplined by ostracism (see issue 5). This behavior is said to have really intensified with President Clinton and UBS collaborations.

____________________________

UBS VICTIM COMPLAINT USA LISTINGS TO BE PERUSED BY READERSHIP.

We have compiled below a list of UBS victim complaints, especially UBS elderly victims. Remember the UBS salesman mantra is target, solicit, recruit isolate, control, dupe and loot. The UBS Client then can receive the UBS “perfection experience”. Let us not forget the USA Presidential Team UBS is receiving deferred payments from UBS in consideration for UBS work during their tenure.

https://www.topratedfirms.com/brokers/customer/ubsfinancialservices-review.aspx

______________

http://www.ripoffreport.com/reports/relevant/ubs-consumer

______________

https://www.topratedfirms.com/brokers/customer/ubsfinancialservices-review.aspx

______________________________

https://www.sec.gov/litigation/complaints/2008/comp20824-ubs.pdf

___________________________

https://ag.ny.gov/sites/default/files/press-releases/archived/UBS.Complaint%20and%20Summons.FINAL.Signed.pdf

_______________________

seniorsavior.com

_______________________________

https://www.bbb.org/new-jersey/business-reviews/consumer-finance-and-loan-companies/ubs-financial-services-inc-hq-in-weehawken-nj-22000870/Alerts-and-Actions

____________________________

==========================