AMERICAS

BAHAMAS VF1

BRAZIL VF2

PANAMA VF3

PUERTO RICO (USA) VF4

TURKS & CAICOS VF5

________________________________________

BAHAMAS

New UBS Nassau office located in a secured area free from USA and other foreign law enforcement.

BAHAMIAN LEAKS FOCUS ON UBS & CREDIT SUISSE.

swissinfo.ch reports: “One out of every ten offshore companies registered in the Bahamas since 1990 has been created by Swiss banks UBS and Credit Suisse … UBS and Credit Suisse came second and third in a ranking of institutions setting up the most offshore companies for clients. First place went to Panama law firm Mossack Fonseca, which was at the centre of the Panama Papers scandal in April. … The Bahamas have been placed on a “grey list” of uncooperative tax havens by the Organisation for Economic Cooperation and Development (OECD).” VF1-1 UBS continues to use their USA presence to allude to their nearby offices in Nassau for further offshore clarifications. Nothing has changed ibut for an increase in Clinton/Bush/Obama deferred payments via exorbitant speakers/consulting et al fees.

________________________________________

UBS STARTS USA HONEYPOT EVENT SOLICITING WITH MIAMI ART BASEL SALES PEOPLE DIRECTING USA RICH TO BAHAMAS FOR OFFSHORE CONSULTATIONS.

A reliable UBS source has divulged that UBS USA salesmen are allegedly directing USA citizens to the new UBS Bahamas secure offices for offshore consulting. It is doubtful a President Trump will still allow UBS to solicit USA offshore accounts. Donald Trump neither needs nor wants UBS deferred payments as the Clinton/Bush/Obama regimes have openly laundered through speakers/consulting fees.

=============================================

BRAZIL

BRAZIL INVESTIGATES UBS ALLEGED CRIMINAL ACTIVITY.

Wikipedia reports: “In an article published by Reuters, Brazilian public prosecutor Karen Kahn announced that several employees of UBS … were under investigation by federal authorities. … police arrested 20 people, including bankers at UBS … after the discovery of illegal activities including money laundering, tax evasion, fraudulent banking and operating without a banking license.” VF2-1 These are considered very serious charges against UBS employees, yet again. It is an open secret that UBS has allegedly been soliciting international organized crime elements throughout the world. Money is money!

____________________________________________

UNLIKE USA, BRAZILIAN PRESIDENTS AND THEIR CLOSEST POLITICAL APPOINTEES CAN GO TO PRISON FOR CRIMES.

BBC reports: “Prosecutors allege Lula received ‘illicit benefits’ from the kickbacks scheme, such as having one of the construction firms involved in the scandal renovate a luxury beachfront apartment and a ranch owned by Lula’s family. They say that ‘the suspicion is that the improvements and the properties are bribes derived from the illegal gains made by OAS [construction firm] in the Petrobras graft scheme’. Investigators say they also have evidence that in 2014 the ex-president received at least $270,000 (£190,000) worth of furniture and improvements for the beachfront apartment in Guaruja. They say they are also looking into sums paid to Lula by construction firms involved in the scandal as donations or speaking fees. Lula has denied any wrongdoing. Lula was the political mentor of current President Dilma Rousseff. As early as 2014, President Rousseff acknowledged that “this [scandal] may change the country forever’. Ms Rousseff chaired the Petrobras board of directors from 2003 to 2010. She has denied knowledge of any wrongdoing but many of her critics have questioned how she could not have been aware of such a wide-ranging kickback scheme at Petrobras while she held a senior position at the oil giant. Supporters and opponents of Lula gathered outside Lula’s house and the police station where he was being questioned and shouted slogans for and against the former president. His supporters say Lula’s detention is part of a dirty war against the former leader, who recently hinted that he was considering running for president in the 2018 election. A spokesman for the Lula Foundation called his detention ‘an assault against the rule of law that impacts all of Brazilian society’. But public prosecutor Carlos Fernando dos Santos Lima said that the move showed that no-one was beyond the power of the law in Brazil. ‘Anyone in Brazil is subject to be investigated when there are indications of a crime,’ he said.‘ ” VF2-2 UBS, Obama, Holder, Breuer, Clintons et al are well within these Brazilian judicial crime parameters but in USA they go unprosecuted, somehow.

_______________________________________

Andre Esteves

UBS AG MOTTO COULD BE: BUY HIGH SELL LOW TAKE FROM PERCEIVED VULNERABLE CLIENTS TO MAKE UP DIFFERENCE!

Reuters reports: “Brazilian billionaire Andre Esteves is in talks with an investor group from Singapore to sell a stake of about 15 percent of his Banco BTG Pactual SA … Esteves and partners had bought back the bank from UBS AG (UBS.N) for $2.5 billion last year.” VF2-3 UBS AG allegedly bought BTG high and sold low after running into criminal charges in Brazil. In essence, UBS AG was kicked out of Brazil, selling BTG back to Esteves and cronies for a low price. UBS AG has allegedly promised the Brazilian Government not to do bad things anymore if they can come back (See Issues 2 & 10). They are buying another Bank from Deuchabank at a high premium. UBS AG continues to buy high and sell low making up the losses by allegedly fleecing USA elderly clients victims.

____________________________

UBS & AIG BRAZILIAN SWINDLE!

Brazil Magazine reports: “the Brazilian federal police unleashed a concerted raid … using 280 federal agents in three states to break a criminal scheme concocted with the help of Swiss financial institutions to launder Brazilian money and send it overseas. … Operation Kaspar II (A deliberate slight to UBS AG Chairman Kaspar Villiger.) carried out 21 warrants of arrest and 44 search and seizure orders in the states of São Paulo, Bahia and Amazonas. Among those detained were Swiss banks UBS and Credit Suisse officials as well as an executive of US-based insurance giant AIG.” VF2-4 We see UBS and AIG have been linked in criminal activity internationally. Both have been rewarded by their Washington political operatives with US tax payer bailouts over and above their criminal earnings. Washington has yet to investigate the UBS sanitizing and purging of the UBS mortgage department just before the Swiss government bailout.

_____________________________________

UBS & BRAZILIAN INTRIGUE CORRUPTION!

Fazenda.org gave us emails from Brazilian bribe solicitation conduits before they were hacked. As usual with the corrupt, UBS has allegedly been a noted player in Brazilian corruption interaction. Fazenda.org was shut down by for some unknown reason. This was reported to google which said it was a hacking group from Brazil after fazenda.org. USA Federal intelligence wanted to prove the hacking group and the Brazilian Government could be one in the same or at least colluding with each other. By using fazenda.org as a decoy, it was determined that Brazilian Presidential bribes were actively pursued. The Brazilian impeachment of Dilma Rouseff has been predicated upon criminality common in Washington as part of the “get along go along”, “pay to play” etc criminality. Why is it that President Dilma Rouseff is prosecuted when USA Presidents are immune?

_______________________________________________

Brazil President Dilma Rousseff

PRESIDENT DILMA ROUSSEFF OFF TO JAIL!

Stratfor reports: “For the past two years, Brazil has been mired in the costliest corruption scandal ever uncovered in a democracy. Evidence surfaced in 2014 that contractors in Brazil had formed an alliance to overbid on projects for government-owned energy company Petroleo Brasileiro (Petrobras). Contractors pocketed the extra cash and bribed politicians and Petrobras executives to keep quiet. The scandal — the investigation of which came to be known as ‘Operation Carwash — was so blatant and implicated such prominent political figures that it shocked Brazil, a country accustomed to high-level corruption. And now the odds that Brazil’s president, Dilma Rousseff, will survive the fallout are looking slimmer and slimmer. … In any corruption campaign, various targets emerge as scapegoats who embody the scandal. Once they have been dealt with, citizens — and lawmakers — can be satisfied with the campaign’s success and move on. Rousseff, as the leader not only of the country but also of Petrobras during much of the time period under investigation, has come to emblemize Brazil’s corruption. If at least two-thirds of Brazil’s lower house (342 of 513 congressman) vote in favor of Rousseff’s impeachment on April 17, the president will be one step closer to ouster. The case would then go to the Senate. Once a simple majority in the Senate accepts the impeachment case, she would be forced to step down for up to 180 days while it is evaluated. If two-thirds of the Senate members vote to impeach Rousseff, Vice President Michel Temer would officially assume the presidency, where he would be challenged with stabilizing the country politically and economically.” VF2-5 USA Presidents have been accepting deferred payments laundered through exorbitant speaking/consulting fees for favors done while in office. We are about to see Obama follow Clinton and Bush families into the same scheme without repurcussions. How come Brazil prosecutes its Presidents and their family members while USA Presidents like Clinton/Obama avoid prosecution and jail time? How come Chelsea Clinton and husband avoid jail time? What gives?

_______________________________________

Panama’s Mossack Fonseca Brazilian dubious connections.

UBS INSINUATES ITSELF IN WORLD GOVERNMENTS AND CRIMINAL CARTELS.

Forbes Magazine reports: “According to Brazilian newspaper O Estado de São Paulo, several current and former Brazilian government officials belonging to almost every political party are allegedly implicated. Among them, João Lyra, a former deputy and once Brazil’s richest parliament member according to the ICIJ, was named for not disclosing an offshore holding or Swiss bank account. … Operation Car Wash, the largest corruption sweep in modern Brazilian history, led to the arrest of billionaire banker Andre Esteves (who has since been released and is under house arrest.” VF2-6 We have seen a bit of UBS successful corruptive schemes within Washington where the perpetrators avoid prison and are allowed to keep the money. Brazil is more forthright by convicting even the highest politicians and expropriating bribes.

_____________________________________________

UBS/BRAZILIAN BANKER/SAUDI ROYAL FAMILY/MOSSACK FONSECA/DRUG CARTELS!

ICIJ reports: “ ‘For years, the Swiss banking giant UBS and a Panama law firm named Mossack Fonseca embraced each other in a mutually profitable relationship. UBS had customers who wanted offshore shell companies to keep their finances hidden. And Mossack Fonseca, one of the largest creators of offshore companies in the world, was happy to sell them. … Mossack Fonseca employee Dieter Buchholz argued that his firm had no idea who really owned some of the companies created for UBS customers, because the bank had withheld that information. UBS executive Patrick Küng objected, saying Mossack Fonseca was ‘in violation of the Swiss money laundering code,’ and he was ‘seriously’ contemplating reporting the law firm to the authorities, according to emails describing the encounter. …The structures UBS created through Mossack Fonseca ranged from offshore companies controlled by Muhammad bin Nayef bin Abdulaziz Al Saud, the Crown Prince of Saudi Arabia, to companies controlled by Roberto Videira Brandão, convicted of fraud in the collapse of a Brazilian bank, and Marco Tulio Henriquez, a Venezuelan banker and fugitive charged by the U.S. Department of Justice with money laundering for drug cartels.” VF2-7 The glue that seems to hold crime together is UBS and copycat banks.

_____________________________

UBS RETURNS TO BRAZIL, AGAIN.

Reuters reports: “Sao Paulo-based Consenso, a wealth management and multi-family office, manages around 20 billion reals ($6.13 billion) in assets. UBS, with more than $2 trillion in invested assets, will acquire a significant stake … It comes on the back of a challenging period for UBS in LatAm, which included a leadership change, the departures of key bankers in Mexico and billions in withdrawals in 2016 by clients participating in tax amnesty programs. The situation improved somewhat in the first quarter of 2017 with net new money in UBS’s emerging markets division”. VF2-8 UBS left BRazil under a cloud of questionable actions,but is now back for more, somehow.

_______________________________

Tainted Brazilian flag!

UBS SNAPS UP BRAZIL’S LARGEST FAMILY OFFICE.

Finews reports: “UBS has bought a majority stake in Sao Paulo-based wealth manager Consenso … The Swiss banks plans to fold its existing Brazilian business into Consenso. UBS didn’t disclose financial details for the merger … For long-time observers of UBS, the deal provides a sense of deva-ju: the Swiss bank bought Banco Pactual in 2006 to break into the ultra-hot Brazilian market, then promptly sold it three years later when its financial crisis losses began piling up. Pactual, of course, went on to a corruption scandal of its own, when majority owner Andre Esteves was arrested last year as part of a wider corruption probe. He has since been released is remains an advisor to Pactual. … UBS employs 250 staff in Brazil.” VF2-9 It is unknown which faction has envited ubs back to brazil after leaving under a cloud!

_______________________________

Vibrant left leader now a tired former Brazilian President.

WHY DOES USA ALLOW CLINTONS/BUSH II/OBAMA UBS BRIBES WHEN BRAZIL SENDS PRESIDENT LULA TO PRISON FOR LESS?

Brasília (AFP) reports: “Brazil’s former president Luiz Inacio Lula da Silva was sentenced to nearly 10 years in prison for graft on Wednesday — a stark fall from grace for the iconic leftist leader, and the latest twist in a sprawling political corruption probe engulfing Latin America’s largest economy. Lula, who ruled Brazil from 2003-2010, was convicted and handed a 9.5-year prison term for accepting a bribe of a luxury seaside apartment and $1.1 million. … The conviction nevertheless landed a heavy blow on the prospect of Lula making a political comeback in presidential elections due in October next year. The verdict also sent a dramatic message to much of the rest of Brazil’s political class that they, too, risked falling afoul of the anti-graft drive. … “Between the crimes of corruption and money laundering, there are sufficient grounds for sentences totaling nine years and six months of incarceration,” Moro said in his verdict. … Moro sentenced an influential minister in the Lula and Rousseff governments, Antonio Palocci, to 12 years in prison for corruption. … Odebrecht (international company) gave $3.7 million to Lula so he could buy land to build the Lula Institution highlighting his political legacy”. VF2-10 This clearly puts the onus on USA to prosecute Clintons/Bush II/Obama/UBS for much worse crimes over many more years, especially against USA elderly UBS Client victims. Perhaps nations should look into other Odebrecht World contracts for more crimes.

___________________________________

USA PRESIDENTS CLINTON/BUSH II/OBAMA AVOID BLATANT CRIMINAL JUSTICE WHILE BRAZIL PRESIDENTS ACCEPT JAIL FOR LESS.

Washington Post reports: “A financial scandal cost then-President Dilma Rousseff her job in 2016. Her replacement, Michel Temer, spent the past year fighting corruption allegations. In the Rio state, former governor Sergio Cabral was sentenced in June to 14 years in prison for his part in the massive corruption and bribery scandal known as Lava Jato, or “Car Wash.” Authorities say he received more than 224 million reais, or about $67.6 million, related to construction projects, including one involving the government-controlled oil giant Petrobras. The broader Car Wash scandal has rocked Petrobras, causing it to lose billions of dollars and slash spending.” VF2-11 Washington Post reports on Brazil Presidential and UBS collaborative crimes with accompanying jail sentencing but will not report on Clinton/Bush II/Obama similar unprosecuted USA crimes. What gives!

=================================

PANAMA

Jurgen Mossack & Ramon Fonseca

UBS PANAMA PAPERS WORLD SCANDAL!

Bloomberg reports: “International Consortium of Investigative Journalists (ICIJ), drawing on 11.5 million records extracted from Panama -based law firm Mossak Fonseca, describes the contortions UBS and other banks went through as they struggled to distance themselves from clients’ offshore companies amid U.S. scrutiny. … as UBS was trying to deal with a U.S. Department of Justice Investigation into illegal tax shelters … (UBS) sought to pull back from the shell companies according to the ICIJ report … In a meeting … with Mossack Fonseca, the (UBS) bank’s asserted the law firm should be responsible for identifying shells’ owners, while the law firm insisted it didn’t know who some of them were because the bank had withheld the information, according to the report. insisted it didn’t know … because the bank (UBS) had withheld the information, according to the report. … Last year UBS unit pleaded guilty to one count of wire fraud.” VF3-1

_____________________________________

PANAMA PAPERS WHISTLEBLOWER SPEAKS.

HP reports: “BERLIN (Reuters) – Sueddeutsche Zeitung said on Friday that the source of millions of documents leaked to the German newspaper from Panamanian law firm Mossack Fonseca had sent them a manifesto, saying his motivation was the ‘scale of injustices’ the papers revealed. The source had never before publicly stated why he leaked the documents, now known as the Panama Papers … The source was critical of banks, financial regulators, tax authorities, the courts, and the legal profession, as well as the media, saying he had offered the documents to several major media outlets that had chosen not to cover them. ‘The collective impact of these failures has been a complete erosion of ethical standards, ultimately leading to a novel system we still call Capitalism, but which is tantamount to economic slavery.’ ” VF3-2 We media collusion with advertisers and other pressure points stifles transparency of events corrupting Democracy.

_______________________________________

BROOKINGS INSTITUTE SPEAKS OF MOSSACK FONSECA ABSENCE OF USA CITIZENS.

Karen Dawisha of USA Brookings Institute reports: “I’m not convinced of everything else Gaddy writes (investigation), but not this. Americans aren’t in #panamapapers because US has Delaware.” VF3-3 We have reported in Issue 5, UBS allegedly stole more than $1,000,000 of more than $10,000,000+ from Eunice Gardiner of Palm Beach County, Florida Merrill Lynch bond account. This was initiated just after Eunice was diagnosed with cancer of the ovaries and was given severe mind altering pain pills. Unknown to Merrill Lynch their bond broker allegedly worked with UBS in creating a Eunice Gardiner Trust NA. Eunice Gardiner’s bonds were filtered through UBS Delaware before being offshore transferred to untraceable Netherlands Antilles. The Merrill Lynch broker quite Merrill Lynch then waited a few weeks before joining UBS. Eunice died a few weeks later. The broker was at the bottom of her bed when Eunice died and then subsequently moved into Eunice’s Palm Beach County estat with his family. Much of Eunice’s estate belongings were transferred to the brokers wife through questionable court submitted documents.

_______________________________________

Prior UBS banker Bradley Birkenfeld

UBS & MOSSACK FONSECA SCANDAL

CNBC says UBS whistleblower banker Bradley Birkenfeld reports: “The CIA I’m sure is behind this (Mossack Fonseca), in my opinion … Quite frankly, my feeling is that this is certainly an intelligence agency operation. … We knew that firm very well in Switzerland. I certainly knew of it … So what you would have is Panama operating as a conduit to the Swiss banks and the trust companies to set up these facilities for clients around the world … But they selectively bring the information to the public domain that doesn’t hurt the U.S. in any shape or form. That’s wrong. And there’s something seriously sinister here behind this.” VF3-4

====================================

PUERTO RICO

UBS 1285 Avenue of Americas New York City USA headquarters with UBS reliable source right side middle signal.

PICTURE OF UBS RELIABLE SOURCE SIGNALING CAUSES UBS INTERNAL HEADQUARTERS PURGE

A reliable UBS source signal is displayed for us to see from the middle right side of the UBS New York City midtown headquarters. Our UBS “fact checkers” corroborate vital information we receive as true and correct. Our UBS fact checkers have been a bane upon UBS because they evidence interoffice self serving UBS Americas criminal activities. UBS Chairman Bob McCann’s office direct involvement in the Puerto Rico UBS elderly Client swindles (see issue 6, VF4-28 & 29) as well as UBS General Counsel & UBS AG (SWISS) Group Managing Board member David Aufhauser and David Shulman UBS Global Municipal Securities Chief (see issue 5, VE1-14) criminal activities of insider trading come to mind. We will hear of many UBS regional swindles against UBS Clients as they are planned before implementation (see issue 6, Puerto Rico VF4-1 >).

______________________________________

UBS vulture symbol readying for attack on Puerto Rican Clients.

PUERTO RICO NEXT UP ON UBS SCHEME TO DECIMATE UBS CLIENT USA ELDERLY VICTIMS.

We will now see the UBS planned scheme to decimate UBS Puerto Rican Clients be enacted through a USA Presidential Team UBS scheme implemented by USA Attorneys’ General Holder & Lynch et al. UBS Group Executive Board will continue to be impervious to any and all USA criminal law. Gate keeper blind eye & deaf ear routine of political appointees like FBI Director James Comey, Attorneys General Loretta Lynch & Eric Holder et al is but a glimpse of what is to happen to UBS Client USA citizens. A reliable UBS New York headquarters office source has already informed us where the next swindle is to take place. Only the election of President Donald Trump has “temporarily” impeded the implementation. Everything else is ready to be initiated.

________________________________________

UBS AG SECRETIVE GROUP EXECUTIVE BOARD CREATES PUERTO RICO SWINDLE BY PRIMARILY TARGETING ELDERLY UBS CLIENTS .

InvestmentNews reports: “The value of proprietary closed-end bond funds heavily invested in Puerto Rican municipal debt and created by a unit of UBS AG (secretive Group Executive Board) is plummeting … The impending scrutiny by plaintiff’s attorneys comes more than a year after the Securities and Exchange Commission flagged UBS Financial Services Inc. of Puerto Rico for sale practices surrounding the municipal securities. In 2008 and 2009, the firm’s ‘former CEO and its head of capital markets made misrepresentations and omissions of material facts to numerous retail customers in Puerto Rico regarding the secondary market liquidity and pricing of UBS Puerto Rico non-exchange traded closed-end funds,’ according to the firm’s profile on the BrokerCheck data base maintained by the Financial Industry Regulatory Authority Inc. It paid $26.6 million in fines and restitution to settle the SEC action. In addition, UBS has suffered a series of costly missteps recently. In August, UBS AG, the Swiss parent, agreed to pay $120 million to settle a lawsuit by investors who accused the bank of misleading them about the financial condition of Lehman Brothers Holdings Inc. in connection with the sale of structured notes.” VF4-1 UBS and Utah Industrial Bank cartel attempted to ship the UBS victims to Utah controversial State and Federal courts. Secretive Group Executive Board UBS is a member of the cartel. Sherman Anti Trust Law declares USA Cartels illegal. President Obama is on record in internalrevenue.com saying he was going to shut Utah Bank Cartel down but has failed to do so. Obama has appointed prior UBS Chairman Robert Wolf his bagman to collect speakers and consulting fees as deferred payments after 1/1/17. UBS is currently scheming with Utah political operatives and lobbyists to bar their “Executive Boards” from pending and future criminal judgements against them. Both Utah Senator Orin Hatch and UBS Group Executive Board are on record as saying such.

__________________________________________

UBS office in San Juan, Puerto Rico

_______________________________________

UBS AG PUERTO RICO SWINDLE WAS YEARS IN THE PLOTTING!

CNBC reports: “CNBC obtained 2,000 pages of documents, which detailed the dialogue among executives at UBS related to the firm’s proprietary bond funds, which were majority comprised of Puerto Rico debt. The funds, which were not traded on a public exchange, collapsed four years ago, causing thousands of residents on the island to lose their savings. … Due to a loophole in a 77-year-old piece of U.S. legislation, none of the funds was regulated by the Securities and Exchange Commission. … “Lobbyists retained by UBS Puerto Rico have tried relentlessly to gut the bill or block it,” a Velázquez spokesman said. “What they call modifications would actually prevent the bill from safeguarding Puerto Rico’s most vulnerable investors. One need only follow the money and they can draw their own conclusions.” VF4-2 UBS AG use of Washington lobbyists in defending USA World Territory financial loophole manipulations cannot pass the smell test. World vulnerable countries should be put on notice and clear their UBS AG collaborators.

_______________________________

UBS depicted as vulture by mass of picketers.

UBS PUERTO RICO CLIENT VICTIMS FIGHT BACK.

Yahoo.com reports: “But investigating magistrate Jose Castro at the court in Palma de Majorca upheld a lawsuit brought by Manos Limpias (Clean Hands), a pressure group that has brought numerous corruption cases against public figures. “We have made history,” said the group’s leader Miguel Bernad. ‘If it was not for our suit, there would have been no charges. Everyone is equal before the law.’” VF4-3

_____________________________________

UBS INSINUATES INTO CLIENT DIVORCE AND IS PUNISHED!

Reuters reports: “A UBS AG unit must pay more than $4.7 million to a customer’s former spouse who alleged that the firm improperly released accounts worth $12 million to her ex-husband despite a court order freezing those assets, a U.S. federal judge has ruled. … ‘UBS respectfully disagrees with the court’s decision in this matter,’ a UBS spokesman said, adding that the firm intends to appeal.” VF4-4 UBS seems to have attempted to benefit in a divorce by disappearing husbands Court frozen assets.

____________________________________

USA FINRA ORDERS UBS TO PAY FOR PURPOSEFULLY CONSENTRATING UBS CLIENT ACCOUNTS.

Investment News reports: “UBS Group AG’s wealth management business for the Americas must pay more than $470,000 to three investors who claimed damages because their accounts were over-concentrated in Puerto Rico bonds that plunged in value, according to the Financial Industry Regulation Authority Inc.” VF4-5 As we have seen, this is a common ploy of UBS. Has FINRA been pliable to UBS AG Washington lobbyists wishes in general. World nations should beware of UBS collaborators.

_______________________________________

DEL MORAL v. UBS FINANCIA | Civil No. 08-1833 (PAD). | 20160405770 | Leagle.com

UBS AG (SWISS) UBS BANK USA INITIAL SWINDLES SHOW PUERTO RICO JUDICIAL AND REGULATORY OVERSIGHT VULNERABILITIES LATER EXPLOITED BY UBS AG.

UBS Assistant UBS AG (Swiss) Global General Counsel Craig E Darvin reported directly to UBS AG (Swiss) Global General Counsel David Aufhauser. Soon after this UBS AG Judicial and Regulatory trial run UBS AG began looting their High Net Worth Client designated victim list, especially elderly (see issue 4). This depicted swindle used successfully implemented UBS AG scams. UBS AG knows it and it’s top officers are impervious to either loosing their USA Charter or going to jail for insider trading et al, especially after giving dubious deferred payments to “USA Presidential Team UBS”. Then again, USA Presidential fear they will be outed by President Trump.

_____________________________________

THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF PUERTO RICO

MADELEINE CANDELARIO DEL MORAL

Plaintiff,

v.

UBS FINANCIAL SERVICES INCORPORATED OF PUERTO RICO

Defendant.

CIVIL NO. 08-1833 (PAD) VE4-7

_________________________________

UBS SWINDLES PUERTO RICO VICTIM CLIENTS USING “THE WHOPPER”.

Investment News reports: “Regulatory Authority Inc. fined UBS $18.5 million for supervisory failures related to the funds. The fine includes $11 million in restitution to 165 (UBS) customers who took losses from the funds, which posted a dramatic drop in value … The SEC (UBS) settlement, which includes $15 million in disgorgement, interest and penalties, which will go to a fund for harmed (UBS) investors, is tied to the firm’s supervision of a former broker in Puerto Rico who fraudulently had customers take out tens of millions of dollars in loans … The (UBS) broker, Jose Ramirez Jr., who was known as ‘the whopper,’ according to plaintiff’s attorneys, increased his own compensation by $2.8 million by having customers take out the securities-backed loans … SEC’s Division of Enforcement. ‘UBS PR (Puerto Rico) lacked reasonable systems for ensuring compliance with the firm’s prohibition on loan recycling and to ensure that brokers adequately conveyed the risks involved in lines of credit.’ VF4-8

_____________________________________

UBS “SWINDLES” PUERTO RICO WOMAN.

Reuters reports: “The (UBS) investor, Christel Marie Bengoa Lopez, filed the case in 2014, seeking $2 million in damages. She had invested a $5 million gift she had received after her father sold his business, according to a statement of claim. Her UBS broker promoted the funds as safe and conservative investments. He also suggested that Bengoa Lopez tap a UBS-issued credit line, using her investments as collateral, to buy an apartment. But when the funds became worth less than the loan balance, UBS demanded payment in full. The arbitrators, as is typical, did not provide reasons for their decision. UBS, in September 2015, agreed to pay almost $34 million to settle charges from the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority (FINRA), Wall Street’s industry-funded watchdog, that it failed to supervise sales of the funds it sponsored to clients in the U.S. territory.” VF4-9

________________________________

UBS PUERTO RICO PAYS 34M FINRA SETTLEMENT FOR FINANCIAL CRIMES PATTERN BLAMED ON LOW UBS LEVEL SALESMEN.

The Fly reports: “The SEC charged UBS Financial Services Inc. of Puerto Rico and a former branch manager for failing to supervise a former broker who had customers invest in UBSPR affiliated mutual funds using money borrowed from a UBSPR affiliated bank. UBSPR and the bank prohibited using such loans to purchase securities and the practice exposed investors to losses while producing profits for the former UBSPR broker, the SEC alleged. UBSPR agreed to settle the SEC’s charges by paying $15M in disgorgement, interest, and penalties, which will be placed into a fund for harmed investors. The former branch officer, Ramiro L. Colon III, agreed to a settlement in which he will pay a $25,000 penalty and be suspended from a supervisory role for one year. Separately, the SEC filed a complaint in federal court in Puerto Rico against Jose Ramirez, Jr., a former registered representative in UBS PR’s Guaynabo branch office. The SEC alleges that Ramirez increased his compensation by at least $2.8M by having certain customers use proceeds from lines of credit with UBS Bank USA to purchase additional shares in UBSPR closed-end mutual funds. The SEC appreciates and recognizes the assistance of FINRA, which announced an action today against UBSPR for the firm’s violation of its rules on supervision and principles of trade. UBSPR agreed to settle FINRA’s charges by paying a $7.5M fine and interest on up to $11M in restitution to more than 150 investors in the closed-end funds.” VF4-10 We see media go “along get along” scheme of reporting without commenting on UBS pattern of similar crimes within the World. Media is sometimes seen attempting to hustle advertising from UBS after such questionable coverage.

______________________

UBS PUERTO RICO SWINDLE PROTESTS EXPAND IN USA.

Stamford Advocate reports: “Puerto Rican activists gathered outside the UBS building in downtown Stamford Wednesday morning to oppose the company’s lending practices … The Stamford protest was one of four other similar demonstrations Wednesday in Florida, Massachusetts, Illinois and New York … A representative from UBS could not be immediately reached for comment.” VF4-11

______________________________

UBS BOND SWINDLE AGAINST PUERTO RICAN UBS CLIENTS TO COST UBS STOCKHOLDERS BILLIONS!

The Street reports: “UBS Financial Services Inc. must pay a prominent Puerto Rican businessman and his wife $15.2 million in compensatory damages and interest related to their losses in closed-end Puerto Rico bond funds, a panel of arbitrators at the Financial Industry Regulatory Authority ruled … In a filing with the Securities and Exchange Commission on November 2, Zurich-based UBS AG said that is has been subject to $1.9 billion in claims related to Puerto Rico municipal bonds and closed-end funds managed or co-managed by the firm in Puerto Rico. Already, the firm has paid out $740 million to claimants, the filing said.” VF4-2 Puerto Rico is doing an exceptional job at rectifying UBS swindles of it’s citizens. This has yet to be allowed by Washington on USA mainland.

____________________________________

UBS SWISS SECRETIVE GROUP EXECUTIVE BOARD FORCED TO PAY CLIENT VICTIMS.

Wall Street Journal reports: “A unit of UBS Group AG agreed to pay roughly $34 million in settlements with U.S. regulators regarding the sale of Puerto Rico bond funds that plunged in value in recent years. Tuesday’s settlements come as Puerto Rico’s financial crisis is drawing increased scrutiny from U.S. lawmakers and regulators. A measure to establish more robust federal oversight over Puerto Rico’s mutual-fund industry was introduced.” VF4-12

__________________________________________

UBS REPETITIVE FRAUD CAUSES FINRA TO AWARD UBS CLIENTS.

Reuters reports: “Securities arbitrators have ordered UBS AG to pay an investor $1.45 million for losses incurred by its Puerto Rico closed-end bond funds, according to a ruling. A Financial Industry Regulatory Authority (FINRA) arbitration panel in San Juan, late Thursday, found two UBS units liable in the case, which alleged securities fraud, misrepresentation and other misdeeds, according to the ruling.” VF4-13

_____________________________________________

UBS PUERTO RICAN COURT LOSSES MOUNT.

Daily Business Review reports: “UBS Financial Services Inc. was ordered to pay $18.2 million to a family who invested in funds containing Puerto Rican municipal bonds … The Financial Industry Regulatory Authority arbitration award issued Wednesday to retired Puerto Rican auto executive Victor Gomez Jr. and his family includes about $4 million in punitive damages against UBS, which faced allegations it recklessly allowed a broker to commit fraud and violations of securities law. A spokesperson for UBS did not respond to a request for comment by deadline.” VF4-14 We have documented evidence proving UBS keeps staff that is not caught being “incentivied” by UBS to commit illegal acts.

_______________________________

UBS as vulture feeding on UBS Client victim.

NOTICE TO UBS PUERTO RICO CUSTOMERS: KLAYMAN & TOSKER FILE $8.5 MILLION AGAINST UBS.

Yahoo Business Wire reports: “According to the Claim, the Claimant entrusted assets to UBS with the investment objective of capital preservation. … The Claimant believed the purchases were consistent with their low risk tolerance. … Had this information and the true nature of the risk of the recommended allocation been known to Claimant or properly disclosed, he would not have invested his assets in these products. The sole purpose of this release is to investigate, on behalf of our clients, the sales practices of UBS in connection with investment recommendations provided to their customers. … K&T is a leading national securities law firm which practices exclusively in the field of securities arbitration and litigation, on behalf of retail and institutional investors throughout the world in large and complex securities matters. The firm represents high net-worth, ultra-high-net-worth, and institutional investors, such as non-profit organizations, unions, public and multi-employer pension funds. K&T has office locations in California, Florida, New York and Puerto Rico.” VF4-15

_________________________________

UBS as vulture stalking Puerto Rico Client victims, especially defenseless elderly.

UBS SOLD MORE THAN $10 BILLION SPECULATIVE FUNDS TO UNKNOWING CLIENTS, ESPECIALLY ELDERLY.

Investment News reports: “One plaintiff’s attorney, Lars Soreide, said he filed a Financial Industry Regulatory Authority Inc. complaint against UBS Financial Services of Puerto Rico last week on behalf of a 70-year-old retiree … She opened a line of credit with UBS that ‘she used to buy her home, and is now selling the portfolio to cover the equity line she took out,’ said Mr. Soreide. ‘She relied on the income [from the municipal holdings] to pay for retirement, and UBS has been liquidating the holdings to pay interest on margin loans.’ Making matters worse for UBS, which has a recent history of costly embarrassments, the firm has put one broker on administrative leave after claims emerged that the adviser encouraged clients to buy securities on a line of credit …” VF4-16

_________________________________

ELDERLY CLIENT WINS ARBITRATION FOR FRAUD AGAINST UBS.

Investment News reports: “A Finra arbitration panel awarded nearly $9 million to an investor who claimed that he was hurt by the purchase of Puerto Rican municipal bonds and closed-end bond funds bonds from UBS Financial Services Inc. … punitive damages were awarded because UBS gave the investor, Luis R. Romero Lopez, multiple loans with which he continued to buy more bonds.” VF4-17 It may sound as UBS is loosing money but in actuality UBS only gives back a fraction of their UBS Client swindles in the form of nominal fines and awards. To big to fail or jail as well as Obama/Holder statements that no “UBS” bank hierarchy goes to jail is still lurking about. Chairman McCann was caught formulating the UBS Puerto Rico swindle and he was allowed to continue the swindle. We have seen UBS General Council David Aufhauser avoid jail for numerous thefts and other UBS misdeeds. After being USA Federal criminally caught, Aufhauser was then allowed to go through the Washington revolving door to return as lawyer/lobbyist at Williams & Connely as a dignified Partner.

_____________________________

UBS PUERTO RICO CRIMES AGAINST UBS CLIENTS CONTINUES TO BE HEARD IN COURTS.

“FINRA claim against UBS Financial Services Incorporated of Puerto Rico and UBS Financial Services, Inc. (collectively “UBS”) for $15 million. The claim has been filed in the wake of Puerto Rico’s recent bankruptcy filing, which is the largest in U.S. Municipal history. According to the Claim, the Claimant entrusted his retirement assets to UBS with an investment objective of current income and capital preservation. Contrary to these objectives, UBS concentrated his account in Puerto Rico Government Bonds and its proprietary Puerto Rico closed-end bond funds, which are leveraged with UBS Bank USA Loans. … The sole purpose of this release is to investigate, on behalf of our clients, the sales practices of UBS in connection with unsuitable investment recommendations provided to their customers.” VF4-18 We are attempting to tell the World about how known UBS criminal schemes work. World authorities will have a much easier job of monitoring and scrutinizing UBS behavior in there countries.

______________________________________

UBS BROKER IS BARRED FROM SECURITIES INDUSTRY.

Stockbrokerfraudblog.com reports: “Ronald Broadstone, an ex-UBS (UBS) broker, has agreed to be barred from the securities industry. The Financial Industry Regulatory Authority is the one that brought the ban, accusing him of misusing and misappropriating customer monies, settling a customer case without telling his firm, and taking part in unauthorized trading.” VF4-19

_________________________

AGAIN, UBS ORDERED BY FINRA TO PAY UBS CLIENT VICTIM.

Stockbrokerfraudblog.com reports: “Once again, a Financial Industry Regulatory Authority (FINRA) panel has ordered UBS Financial Services (UBS) to pay a large arbitration award to an investor. Dr. Luis E. Cummings … In his Puerto Rico bond fraud case, Cummings accused UBS of negligence, recklessness, deceit, fraud, and fault. Meantime, the brokerage firm is once again claiming that this is yet another investor who was experienced enough to make a “fully informed decision”. VF4-20

____________________________

UBS Ordered to Pay Another $18M in Puerto Rico Bond Fraud Case

click on above caption

Stockbrokerfraudblog.com reports: “few weeks after a FINRA arbitration panel ordered UBS (UBS) to pay $18 million in a Puerto Rico bond fraud case … the Gomez family claimed they lost $22.87 million from investing in Puerto Rico securities. UBS Puerto Rico (UBS-PR) brokers had purportedly suggested the Gomez family invest in Puerto Rico bonds despite the fact that they wanted investments that were safe. The family relied on the funds from their investments to cover their living expenses. UBS argued that Mr. Gomez was an experienced investor.” VF4-21

_________________________________

UBS symbol of vulture devouring another UBS Client victim.

UBS SCAMS CLIENTS, AGAIN.

Stockbrokerfraudblog.com reports: “(FINRA) arbitration panel says that UBS Financial Services (UBS) must pay $18.6 million to customers Rafael Vizcarrondo and Mercedes Imbert De Jesus … The two investors, both UBS clients, accused the broker-dealer of breach of contract, breach of fiduciary duty, and other securities violations. They claim that UBS placed their money in unsuitable investments and did not properly supervise the broker who worked with them. … The firm (UBS) has already paid out $740 million to claimants.” VF4-22 UBS AG use of pliable FINRA is quite noticeable.

___________________________________

UBS CONTINUES PUERTO RICO SCAMING!

Stockbrokerfraudblog.com reports: “The FINRA panel ordered UBS to pay $549,000 in compensatory damages to a defunct car rental business belonging to Luis Vega, as well as over $165,000 to Teresa Rosas, who is Vega’s former wife. The firm must also pay over $100,000 in costs and hearing session fees. … Vega and Rosas filed their case against UBS accusing the brokerage firm of securities fraud, negligence, recklessness, and deceit.” VF4-23

__________________________________

USA LAW FIRM ADDS UBS AG (SWISS) AS ONLY WORLD BANK AMONG CRIMINAL FRAUDSTERS AND SCAMMERS LIST OF INTEREST. USA ENFORCERS AND REGULATORS WHO NOW PROSECUTE UBS AG UNDER PRESIDENT TRUMP ARE ALSO LISTED UNDER “TOPICS”.

Shepherd, Smith, Edwards & Kantas USA law firm legal actions.

TOPICS

Please click on UBS (103) and see the law firm’s successful prosecutions of UBS.

No other bank in the World has been added to the prestigious Shepherd, Smith, Edwards & Kantas USA law firm list of shame. This should be considered internationally alarming since USA Presidents Clinton/Bush/Obama and their collaborators continue to receive millions USA$ from aiding and abetting UBS in it’s USA perpetrations, especially against USA elderly client victims. We commend this ethical law firm for their work. The Swiss Government and USA should be embarrassed at this World disclosure. How long must USA elderly become UBS clients victims before UBS deferred payments to Clinton/Bush II/Obama and their collaborators is stopped. UBS AG must loose it’s USA Charter.

_______________________________

DID UBS AG SCAMS ON PUERTO RICAN ELDERLY UBS CLIENTS BRING DOWN THE PUERTO RICAN ECONOMY?

USA National Law Review reports: “UBS Financial Services is being sued for $4.5 million by the beneficiaries of a trust. The suit says that UBS breached its fiduciary duty to the beneficiaries by mismanaging the trust’s assets. … Ms. Carmona and the other beneficiaries claim UBS intentionally kept the trust’s funds in its own closed end funds that it managed. By doing so, the brokerage firm continued to earn underwriting and management fees. At one point, the trust was worth $1.8 million, now it is worth less than $1000.According to the lawsuit, ‘The UBS defendants engaged in a systematic plan to prevent Sánchez Carmona, the beneficiary of the Hargen Trust, from collecting her benefits as she was entitled’. UBS has disclosed that it faces $1 billion in complaints tied to its Puerto Rican bond funds. That loss figure may be low, however, since UBS reportedly sold $10 billion of Puerto Rico closed bond funds. Those funds lost much of their value during the summer of 2013 as investors panicked. … Tens of billions of dollars worth of bonds were issued by Puerto Rican issuers. UBS is at the forefront of the controversy.” VF4-24 It is now believed UBS criminal activities against elderly clients in Puerto Rico severely crippled the Puerto Rican economy. Despite media coverage, Clinton/Bush II/Obama would take no action against UBS senior staff, for some reason!

___________________________________

UBS FACES CRIMINAL PROBE OVER PUERTO RICO BONDS.

SEC News reports:“U.S. authorities are probing UBS AG (UBSN.VX) for criminal fraud … At issue is whether UBS executives in Puerto Rico and in the United States knew proceeds from loans made by a Utah unit of the Swiss bank were used in a way that violated its own lending rules. If they knew about the practice and did not stop it, they could be criminally responsible for the alleged fraud. The investigations are the latest headache for UBS, which has faced myriad lawsuits and probes since the financial crisis.” VF4-25

_________________________________

UBS AG vulture fund followers symbol finishing off another Puerto Rican elderly citizen!

UBS’S CRIMINAL PUERTO RICO ACTIVITY STEALS ASSETS OF UBS ELDERLY CLIENTS!

SEC News reports: “UBS PR [Puerto Rico] ‘willfully violated Section 17(a) of the Securities Act, which prohibits fraudulent conduct in the offer and sale of securities, and Sections 10(b) and 15(c) of the Exchange Act and Exchange Act Rule 10b-5, which prohibit fraudulent conduct in connection with the purchase or sale of securities.’ ,,, The SEC Order, … discusses at length a voluminous number of misrepresentations and omissions in relation to these funds, which purportedly represented ‘the largest single source of revenue for UBS PR.’ The SEC found that the ‘market values’ reported by UBS PR were ‘misleading’ because they were ‘simply what UBS PR thought they should be, not true market prices’ Despite warnings and concerns in 2008 about the concentration of customer investments in these funds, UBS PR continued to promote the sales of these funds through its financial advisors. In response to high levels of these funds being owned by UBS PR on its own books, the SEC details how UBS PR encouraged sales to customers and reduced its inventory by ‘undercutting customer sell orders.’ … UBS failed to disclose to investors the risk associated with the UBS PR CEBFs in that they are leveraged, lack diversification and trade on a secondary market that is controlled and operated by UBS. This lack of liquidity increases the risk to the funds. In addition to the recommendation to buy CEBFs, UBS recommended that investors open a Line of Credit through UBS Bank USA with the CEBFs as collateral for the loan.” VF4-26

______________________

LAWSUIT CLAIMS UBS SCAMMED PUERTO RICO CITIZENS, ESPECIALLY ELDERLY.

Forbes reports: “Puerto Rico (UBS PR) created 23 closed-end funds filled with mostly government-related debt of Puerto Rico. UBS underwrote over $10 billion worth of bonds earning over $200 million in underwriting fees. It then received commission on trades of the closed-end funds, earned fees as the funds’ investment advisors and got management fees for overseeing the funds. It was a win, win, win, win, win, for UBS PR. … Many of those who bought were looking for, and were sold by UBS PR, a safe investment to fund their retirement. … the actual UBS PR statements to clients reflected “market values” that were based on UBS PR’s own valuation calculation. … the SEC instituted a proceeding against UBS PR … Its conclusion was that ‘UBS was propping up the closed-end mutual fund market by buying up shares at the same time it promoted the funds as highly liquid.’ … UBS PR has countered the lawsuit by arguing that the statute of limitations for the plaintiffs to bring their action had passed stating that the investors were “injured” when they purchased shares in the fund … not when they realized their investment was junk.” VF-27 UBS with malice did target and purposely swindle wealthy in Puerto Rico, especially the elderly. Like in Palm Beach, Florida and other USA wealthy enclaves. Time and time again UBS has initiated the same swindling technique in the face of FINRA, SEC and other USA regulators. UBS’s successful solicit, recruit, isolate, control, dupe and loot mantra against USA elderly is now so well known many countries intelligence agencies believe UBS AG is a Swiss card carrying member of the USA Deep State. The World of Finance. We are now seeing UBS planning more USA solicit, recruit, isolate, control, dupe and loot scams against Florida elderly.

_____________________________

UBS Chairman Robert McCann!

WHY DID OBAMA ALLOW UBS CHAIRMAN MCCANN’S OFFICE TO TARGET AND SWINDLE 10% OF PUERTO RICO’S GDP BY SELLING NEAR WORTHLESS UBS BOND FUNDS TO UBS ELDERLY CLIENTS?

CNBC reports; “They show UBS executives sought to withhold stress-test results from their brokers and did not translate research reports and other fund documents to Spanish. … Due to a loophole in a 77-year-old piece of U.S. legislation, none of these [UBS] funds was regulated by the Securities and Exchange Commission … Switzerland-based UBS, which is one of the world’s largest banks and oversees more than $913 billion in total assets, had rebounded from its own near-death experience during the financial crisis. It was imperative that the firm seek to keep the risky bond funds off of its own balance sheet … brokers and financial advisors started receiving an influx of calls from investors because the prices of the bond funds had declined. … A [UBS] team of brokers from Puerto Rico sought to disguise some of these risks from their clients on the island, according to internal UBS emails reviewed by CNBC. … UBS never translated this report, or any of its Puerto Rico-related reports from English to Spanish, according to sworn testimony by Ubinas [UBS Puerto Rico CEO]. This despite the fact that a large majority of Puerto Rico residents do not speak English fluently. Fund prospectuses, as well as quarterly and annual reports, also were never translated. … One of them showed that a group of UBS Puerto Rico brokers met with top executives in New York and New Jersey in mid-2012.” VF4-28

__________________________________

UBS Chairman of Americas Robert McCann’s Obama instilled arrogance depicted!

UBS AMERICAS CHAIRMAN ROBERT MCCANN’S OFFICE TACIT CONTROL OF UBS PUERTO RICAN ELDERLY INVESTMENT CLASS SWINDLE.

CNBC reports: “Throughout 2012, discussions over some of the [UBS Puerto Rican] funds’ more troubling features rose all the way to top executives at UBS Americas … Robert McCann, the CEO of UBS Americas … was not only fully aware of the issue but knew the consequences if the firm [UBS] didn’t dial back leverage. … Moody’s Investors Service cut the rating of the island’s [Puerto Rican] bonds to just above junk status … The day of the downgrade, a flurry of internal emails was sent to and from executives at UBS Puerto Rico and UBS Americas questioning how this would impact thefunds. It caught the attention Robert McCann [UBS Americas Chairman]. One email showed that the results of a stress analysis on how the downgrade would impact the firm’s [UBS] balance sheet were delivered directly to McCann. … UBS’ spokesman said in the statement. “There were no undisclosed issues with the [UBS] Funds.”

The regulators’ [FINRA & SEC] charges included that the firm misrepresented and omitted material facts about the closed-end [UBS] bond funds to investors and failed to monitor the combination of leverage and concentration levels in customer accounts, according to the settlement documents. …’in favor of two UBS executives facing SEC civil charges, the SEC’s Chief Administrative Law Judge concluded that UBS’s disclosures about the [closed-end funds] were accurate,’ the firm’s spokesman points out in a statement. UBS has disclosed in regulatory filings that the [Obama] Department of Justice is conducting a criminal inquiry into the impermissible reinvestment of the non-purpose loan proceeds, in regard to the Puerto Rico funds. ‘We [UBS] are cooperating with the authorities in this inquiry,’ the filing states.” VF4-29 We will now see how UBS has been setting up southern Florida elderly investor class for a similar swindle. It is said UBS viciously fought against a President Donald Trump because he was to disrupt the UBS reign of terror onto the USA elderly investment class. The Clinton’s continue to be given speakers and consulting fees, Clinton Canadian Foundation donations, deferred payments, secret Presidential library+ Swiss accounts, ad nausea. Among other things but not necessarily all, these cash flows are for the Clinton’s past collaborations with the Swiss Government over UBS proven and continuing USA criminal activities [see fugitive from USA justice UBS Chairman Raoul Weil]. UBS and it’s USA collaborators are attempting everything possible to destroy the Trump Presidency.

_______________________________________

PUERTO RICAN UBS CLIENTS NEVER STOOD A CHANCE IN THE UBS SWINDLE.

Investment News reports: “A Finra all-public arbitration panel has found UBS liable for breach of contract and unsuitability in a customer complaint involving Puerto Rican bonds, and ordered UBS to pay compensatory damages trustee of his law firm’s pension plan, charged that UBS had engaged in misrepresentation, negligence, breach of contract, breach of fiduciary duty, over concentration, unsuitability, unauthorized trading and use of loan facilities, unjust enrichment and failure to supervise in connection with recommendations to invest in Commonwealth of Puerto Rico bonds and two UBS bond funds. All claims under the Puerto Rico Uniform Securities Act were dismissed.” VF4-30 There is a reason UBS AG created a strategy to solicit, recruit, isolate, control, dupe and loot the entire UBS AG Client investment class. As we have seen in UBS AG implementing their UBS Client “perfection experience” the first order of business is to reduce any means for UBS Client victims to fight back. This entails diminishing regulation enforcement and UBS favorable local and Federal Courts. In Utah (see issue 5) 3rd District and Federal Courts repeatedly lie to the World by saying Utah UBS Bank USA is USA Federally regulated. The Utah Department of Financial Institutions repeatedly says it is not.

_________________________________

Seth A Klarman CEO of Baupost Vulture Fund following UBS Puerto Rico Client swindles for scraps!

HARVARD ESCAPES THE WRATH OF PUERTO RICAN STUDENT PICKETING AND GETS TO KEEP THE VULTURE FUND ENDOWMENT!

Harvard Crimson reports: “hundreds of protesters marched across Harvard’s campus to demand that the University divest from the Baupost Group [CEO Seth A Klarman], a hedge [vulture] fund with holdings of Puerto Rico’s debt. … The economics that undergird arguments about divestment from Baupost are undoubtedly more nuanced, and it is questionable how the protesters’ demands for Harvard to “divest from hate” by divesting from the Baupost Group will help Puerto Rico. … It is also important to recognize that, though the protesters refer to those at Baupost as ‘vultures, … Any potential sale would have no effect on the amount owed by Puerto Rico to its creditors. … If the Baupost Group and other creditors were to instead forgive Puerto Rico’s debt, as President Donald Trump suggested, the effects would be uncertain, as economists remain divided on the issue.” VF4-31 We have been watching the UBS Puerto Rican scheme for more than a year before media UBS inquiries. Harvard, Baupost, CEO Seth Klarman and the protestors miss the underlying larger more sordid issue. UBS allegedly planned the scheme of swindling UBS Puerto Rican Clients, especially the elderly a year before media notice. As corroborated, this particular scheme paperwork went directly to the desk of UBS Chairman Bob McCann.

The hurricane scenario was unfortunate collateral damage that ended up as a convenient diversionary aftermath. As we see herein, UBS has been successful at swindling their especially elderly UBS Clients in areas of the World prone to pliable politicians and judiciary. One only has to look through our corroborating documents to see reality. It is easier for us to watch the growing number of visible “vulture funds like Seth Klarman’s that visibly follow UBS to the next World target. Vulture funds know UBS has prepared the targeted area with their collaborators.

We are currently watching the next UBS World target of UBS vulnerable Clients, especially the elderly. We just have to let UBS continue and provide knowledge of the collaborators, after the fact. It is easy for “vulture funds” who follow UBS for an easy remnant profit pickings.

____________________________________

FINRA “AWARDS” PITTANCE TO UBS CLIENTS DAMAGES OVER PUERTO RICO UBS BOND SCAM!

Investment News reports: “The clients, all residents of Puerto Rico, claimed UBS violated the Puerto Rico Uniform Securities Act and engaged in securities fraud, common law fraud and constructive fraud, in addition to breaching its fiduciary duty and negligently supervising its personnel. … The clients originally asked for compensatory damages in the amount of $840,000 plus punitive damages, interest, costs, expert witness fees, Finra fees and attorneys’ fees. All were denied”. VF4-32

________________________________

UBS Puerto Rico secured branch.

Windowless UBS Puerto Rico branch typical of UBS World security concerns. In cities UBS usually has their office on the third floor > to avoid UBS swindled clients from harming staff members. It is strange that UBS still has Clients unaware of UBS dubious practices. We have already depicted numerous UBS offices destroyed.

ASTUTE PRESIDENT TRUMP VAGUELY WARNED OF UBS PUERTO RICO SWINDLE!

Forbes reports: “Puerto Rico Debt Crisis: Lawsuit Claims UBS Scammed Island Residents. In a lawsuit filed in the Southern District of New York (Case No: 1:15-cv-02859), individual investors tell how they are feeling the pain of losing billions of dollars in closed-end mutual funds filled with Puerto Rico government debt. Those investors are not Wall Streeters, but retirees, or near retirees, all of whom are residents of Puerto Rico. … U.S. District Judge Sidney H. Stein issued an Order last December allowing plaintiffs to move forward with claims that they were mislead by UBS Financial Services Inc. Puerto Rico (subsidiary of UBS Financial Services) VF4-33 If there were no President Trump the UBS Presidential Team USA triplets Clinton/Bush II/Obama would have been four, yet again, joined in the elderly looting under a President Hillary. They would have obfuscated any USA Federal investigation of UBS AG, given a get-out-of-jail-free card to UBS AG senior staff and then told the World UBS AG was to big to fail. In consideration, a President Hillary would receive the usual UBS deferred payments for doing such. Instead, President Trump gave the World a warning on UBS AG criminal activities.

________________________________

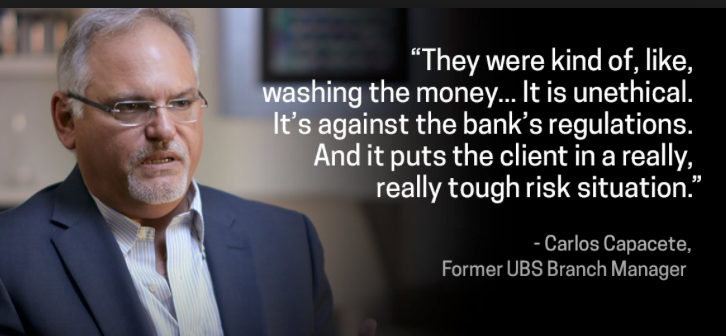

UBS SENIOR OFFICER ANALYSES UBS PUERTO SWINDLE

pbs.org WGBH reports: “UBS insider is speaking out publicly about the bond frenzy that pushed the island into default, and then landing it in bankruptcy just four months before the storm. … UBS helped fuel the crisis, encouraging the local government to take on billions in debt. As that debt grew, the Puerto Rican government failed to maintain the island’s basic needs … Capacete worked for more than 25 years for UBS Puerto Rico, an offshoot of the Swiss finance giant and the largest wealth manager on the island. He rose through the ranks of the bank, becoming the head of the largest branch on the island, in Hato Rey, the central banking district in San Juan. … Capacete said, ‘wasn’t just for the bond funds. He says the {UBS} bank was also pushing financial advisers to sell Puerto Rican clients more loans, using their bond investments as collateral. That’s when Capacete grew suspicious. … it didn’t make any sense to me that these people (UBS advisors) were doing so much business doing loans.’

He began looking into it. “And then one day, this (UBS) client comes up to me and tells me, ‘Hey, you know what? Are you aware of what they’re doing in this other branch?’ And I said, ‘Tell me.’ And he told me the (UBS) scheme. They were taking out the loan. The (UBS) adviser was telling them to take the money to a local bank, keep it there for one or two weeks, bring back a similar amount and use it to buy more Puerto Rico funds.’

Capacete believed it was against banking rules to use these kinds of loans to buy securities like the Puerto Rican bond funds. He worried clients did not understand that by using loans to buy more bonds, their losses would be magnified if the market failed. Alarmed, he alerted compliance officials at the (UBS) bank in May 2012, but said he heard nothing until the following February, when he got a visit from two compliance officers from UBS’ U.S. headquarters. One of them speaks and says, ‘We understand that you’re concerned whether there are financial advisers doing non-purpose loans for purpose’ which means misusing the loan program,’ Capacete said, recounting the meeting. ‘And I said, ‘Yes I am’. And she said ‘Well, we’d like you to know that we’ve completed an investigation and that we have found no such instances.’ The loans were profitable, he said, ‘and I was the one that was … spoiling their party.’ Soon, investors big and small saw their portfolios drop. Puerto Ricans, who’d been heavily concentrated in the island’s bond funds, were hit especially hard, with losses in the billions.

Securities and Exchange Commission, which in 2015 settled with UBS for $15 million over allegations that one broker had engaged in the loan scheme. The settlement said UBS’s failure to catch the broker was ‘due to a clerical error’ yet was still a ‘significant lapse.’ UBS did not admit guilt by settling.

UBS declined to be interviewed, but in response to questions, called Capacete a disgruntled former employee who has sued the bank on multiple occasions. The bank said the terms of its loans are fully disclosed to clients and that the bank performed an internal investigation that found only one broker had misused its loan program. ‘After a thorough investigation confirmed the allegations, the broker in question was terminated,’ the statement said. UBS also pointed to a separate SEC finding that found it had not misled its clients.

The bank continues to face fallout over its Puerto Rican bond funds. In all, UBS Puerto Rico has paid over $65 million in regulatory fines, and to date, more than 1,900 UBS customers in Puerto Rico have filed claims against the bank. More than half of those cases have settled with damages estimated at more than $350 million, according to the Securities Litigation Consulting Group, which has provided expert witnesses in cases against UBS. ‘The problem is the risk that the clients were being put into, that they didn’t understand,” Capacete said. “Whenever you recommend a strategy to a client, you better make sure that it’s suitable for them because if not, you’re responsible.’ ” VF4-34 Did UBS initially swindle Puerto Rican UBS clients because they were considered second class USA citizens? UBS associate Bernie Maddoff’s swindling victim assets are almost fully paid. Why not use the same USA government criminal claw back procedure against UBS, UBS collaborators and UBS vulture fund followers? Why should the Puerto Rican community be treated any differently? It has always been more lucrative for UBS to pay the USA Presidential Team UBS their deferred payments to enable swindling of UBS elderly Clients than abide by USA Federal regulations.

______________________________________

UBS AG Group Executive Board Chief Sergio Ermotti

WHY DOES UBS AG CHIEF ERMOTTI LIE ABOUT LYING? ERMOTTI IS REPETITIVELY CAUGHT IN THE BIGGER LIE THEORY AND SHOULD BE BROUGHT TO CRIMINAL JUSTICE, ALONG WITH UBS AG LOOSING IT’S USA CHARTER.

CNBC reports: “ ‘When there is scope for admitting something went wrong, we do that,’ Ermotti said. However, if ‘we believe that there are situations where people are just trying to take advantage of something, then we will fight and we will just try to present facts.’ …He was referring to the tsunami of arbitration claims that have been filed against UBS by Puerto Rico-based investors for — among other counts — breach of fiduciary duty, negligence and fraud. … ‘Until 2013, it was very difficult to predict that things could…evolve in such a way,’ Ermotti said. No ratings agencies, ‘nobody was waving their flag about the danger of Puerto Rico.’ However, a CNBC investigation in December showed that a mere few months after Ermotti took over as CEO in November 2011, it was clear not only to the ratings agencies, but also to UBS, that Puerto Rico’s credit was deteriorating. … ‘We are trying to clearly [and] constructively find resolutions,’ Ermotti said. ‘The truth of the matter is we are very committed to Puerto Rico.’ … UBS has disclosed in regulatory filings that the Department of Justice is conducting a criminal inquiry … ‘We are cooperating with the authorities in this inquiry,” the filing states.’ ” VF4-35 Both UBS Americas Chairman Mc Cann and UBS AG Group Executive Board Chief Ermotti have been caught red handed swindling Puerto Rico UBS Clients, especially elderly victims. USA Presidential Team UBS triplets Clinton, Bush & Obama have made considerable fortunes from their UBS AG deferred payment schemes.

_______________________________________

Puerto Rican homeowners abandoning homes after UBS Client swindles while UBS aftermath vulture funds swoop in to take whats left over!

UBS PUERTO RICO CLIENT SWINDLE WAS A SUCCESS BUT FOLLOWER VULTURE FUNDS MAY HAVE TROUBLE PICKING THE PUERTO RICAN UBS CLIENT VICTIM BONES

Bloomberg reports: “Distressed-mortgage investors are descending on troubled Puerto Rico. There are big names among them: Goldman Sachs Group Inc. and Perella Weinberg Partners and TPG Capital. What’s luring them is the opportunity to scoop up home loans and foreclosed properties for pennies on the dollar. … “A lot of competitors came in,” said Sam Kirschner, an investor with New York-based CPG Real Estate, which partnered early on with Goldman and Perella Weinberg. … And all these hedge funds — we were getting calls from 10 hedge funds a week, saying we would like to partner on such and such a portfolio.” … In many cases, the investment vehicles snapping up homes left behind are structured as private equity funds, and returns aren’t disclosed to the public. Goldman, Perella Weinberg and TPG Capital all declined to comment, as did Lone Star Funds, another group that’s been active on the island.” VF4-36 Did UBS initially swindle Puerto Rican UBS clients because they were considered second class citizens? UBS associate Bernie Maddoff’s swindling victim assets are almost fully paid. Why not use the same USA government criminal claw back procedure against UBS, UBS collaborators and UBS vulture fund followers? Why should the Puerto Rican community be treated any differently?

______________________________________

Capable Puerto Rico Governor Ricardo Rossello gets ready for UBS & vulture fund no nonsense claw backs.

PUERTO RICO GOVERNOR GOES AFTER VULTURE FUNDS FOLLOWING UBS CLIENT VICTIM SUCCESSFUL SWINDLES.

New York Post reports : “hedge fund executives who are peeved at the moves proposed by Puerto Rico Gov. Alejandro García Padilla to restructure $70 billion in debt. The governor’s proposal calls for stiff haircuts on payouts on various bonds.The governor’s proposal calls for stiff haircuts on payouts on various bonds. On some sales-tax-backed bonds, he has proposed paying 54 cents on the dollar. Some of those bondholders on Wednesday countered his proposal by offering a plan that would pay them 100 cents. In light of the battle over how much bondholders will be paid, trying to sell other investors on pumping more money into the island’s assets is an uphill fight, sources said. ‘Why would someone invest in Puerto Rico when they are going to default on federally constituted debt?’ one source said.” VF4-37 UBS has been very successful swindling USA Clients, especially elderly UBS Clients. This has caused many USA vulture funds to follow UBS around to exploit the next UBS Client swindle. UBS vulture fund followers have made billions USA$ off picking the bones of UBS Client victims. USA Presidential Team UBS triplets and their un-prosecuted collaborators took no action against UBS AG. In consideration, they have received millions USA$ as laundered deferred payments.

________________________________

Vulture!

John Paulson like vulture funder Seth Klayman is looking for Harvard justification when predating Puerto Rico citizenry!

WILL PUERTO RICANS REVOLT AGAINST UBS SWINDLING, UBS COLLABORATORS & UBS VULTURE FUND FOLLOWERS?

The Guardian reports: “Some of the locals were less than pleased about the sight of some of the world’s richest people (vulture funders) lounging on Puerto Rico’s idyllic beaches plotting how to get even richer by exploiting the island’s $72bn debt crisis – a crisis that has pushed millions into poverty and brought the island’s schools and hospitals to breaking point. … Outside protesters and politicians marched holding placards accusing the investors of being criminals and destroying their country. … More than 1,000 people, including private equity tycoons Nicholas Prouty and Michael Tennenbaum, have already taken advantage of the island’s “aggressive tax incentive” laws 20 and 22 that allow Americans to pay zero tax on US income if they spend at least 183 nights on the island. They also get to keep their US citizenship and passports, which they would have to surrender if they moved to other tax havens like Singapore. … Paying zero tax is possible because Puerto Rico is a territory of the United States, not a full state. … Protesters outside the convention centre said they blamed outside investors (UBS & vulture funds) for the country’s precarious debts and they don’t think it’s fair to invite rich people to the country and pay no tax when local people have to pay taxes while enduring declining public services in order to try to repay the island’s debt. [A] concierge, who declined to provide their name, said many clients treat living on the island as a chore they have to endure in order to save money on tax. “They just want to make more money,” the person said. “They don’t want to be in Puerto Rico, they don’t care for Puerto Rico, they don’t interact with the local people. They are just coming here to buy up our land, and pay no tax. It’s really bad, it is horrible.” VF4-38 Puerto Ricans have rebelled against injustice and asset swindling in their past. It would not take much among the Puerto Rican citizens to rebel against UBS and their vulture fund followers. In fact, many USA mainland citizens may think about joining them. This mass theft by UBS, their vulture fund followers and collaborators during the Clinton, Bush II & Obama regimes must be repaid.

__________________________________________

UBS associate Bernie Madoff

HOW COME BERNIE MADOFF/UBS ET AL SWINDLE VICTIMS RECEIVE BETTER CLAW BACK TREATMENT FROM FINRA THAN UBS PUERTO RICAN CLIENT SWINDLE VICTIMS?

Economist reports: “Irving Picard, the bankruptcy trustee overseeing the liquidation of Mr Madoff’s firm, announced that a fund set up to reimburse customers would make its ninth distribution, of $621m, bringing the total handed out so far to $11.4bn. Another $1.8bn is held in reserve for contested claims. This is on top of a separate distribution of $723m last November from a separate fund run by the Department of Justice. Another $3bn remains to be distributed in that fund and the bankruptcy trustees hold out hope that substantially more will be recovered and returned. … The fraud was able to continue for so long because Mr Madoff had a remarkable ability to attract money and deflect regulators. … the edifice collapsed clients lost homes and retirement savings. Some charities had to close their doors … the Justice Department looks at individuals who lost money, even if they invested indirectly through a fund. … Each of the account-holders in the bankruptcy action have received at least $1.4m and in total, 64% of claims have been covered. Full satisfaction would require $4bn-5bn more, plus the money held in reserve. The Justice Department sent cheques to 25,000 in an initial distribution and will send more money to more people soon. But a full reimbursement would require perhaps another $10bn. … The bankruptcy trustees have operated by suing entities that may not have done anything illegal but whom they regard as having received inappropriate payouts … This has been a vast operation, occupying up to 300 lawyers at one point, and now perhaps 100. … Efforts are under way to recover up to $5bn from overseas funds in several countries, including several offshore tax havens but also Britain, Ireland, Israel, Switzerland and Luxembourg.” VF4-39 How come the same USA Obama Department of Justice Madoff investigation vigor was not being used against UBS in their Puerto Rico Client swindles? We already know Obama was accepting deferred payments from UBS, for something. We already know AG Holder was slow walking any investigation of the UBS Puerto Rico Client swindles. Drain the swamp of USA Presidential Team UBS Washington leftovers and treat UBS Puerto Rican Client victims with respect. Give them the same considerations as the Madoff/UBS et al swindle victims and claw back their money.

___________________________________

USA FINANCIAL REGULATORS (FINRA) ET AL ASSISTED MADOFF/UBS VICTIMS AGAINST UBS BUT IGNORE FLORIDA AND PUERTO RICO UBS ELDERLY CLIENT VICTIMS.

CNN MONEY reports: The court-appointed trustee for the recovery of assets stolen by Bernard Madoff has sued UBS AG for $2 billion, accusing the Swiss financial firm of participating in Madoff’s Ponzi scheme. Trustee Irving Picard filed the suit in U.S. Bankruptcy Court in Manhattan, alleging 23 counts of financial fraud and misconduct against UBS (UBS) for collaborating in Madoff’s scheme. The trustee seeks “at least $2 billion for equitable distribution to [Madoff] victims with valid claims.” VF4-40

============================