ASIA/PACIFIC

AUSTRALIA VH1

BANGALADESH VH2

BRUNEI VH3

CHINA VH4

HONG KONG VH5

TAIWAN VH6

INDIA VH7

INDONESIA VH8

JAPAN VH9

MAYLASIA VH10

MYRANMAR/BURMA VH11

NORTH KOREA VH12

PHILIPPINES VH13

SINGAPORE VH14

_________________________________

UBS AG (Swiss) crumbles in Asia

UBS SAYS IT HAS “HIGH HOPES” IN ASIA BUT WE KNOW DIFFERENT!

Many readership are mainly concerned with the UBS history of their litigious contentious nature against their UBS clients. UBS has had a special relationship with a Washington Deep State faction under the Clinton/Bush II/Obama Presidencies to the detriment of USA clients and the World in general. The countries most affected by UBS devious behavior herein mentioned are now told to be vigilant and scrutinize. One must be courteous to UBS Group Executive Board but not to the detriment of national security or vital interests. In particular, Asian financial regulators have recently been scrutinizing and commenting upon our synopsis of UBS World dubious machinations. We have been told UBS competitors are using our newsletter to win over UBS customers, senior staff et al. No where is this more prevalent than in mainland China, Hong Kong, India and Singapore for they are the UBS main targets at this juncture in time.

==========================================

AUSTRALIA

ASTUTE AUSTRALIAN REGULATORS INCREASE SCRUTINY OF UBS.

Reuters reports: “UBS, who was advising the partial sale of an electricity network in the country’s biggest ever privatization, removed negative parts of a supposedly independent analyst report after the state’s government ordered it to do so. … UBS Securities’ control framework relating to its research function, and its compliance with that framework, at the relevant times was not adequate for an investment bank of UBS’ size and complexity.” VH1-1 It is well known with international industry Australian Federal regulators are scrutinizing UBS ethics.

_______________________________________

Reuters connotes a falling UBS logo, for a reason.

UBS WEALTH MANAGEMENT TELLS CLIENTS NOT TO WORRY ABOUT THEM QUITTING AUSTRALIA!

ABC News reports: “UBS Australia is splitting off its wealth management business but advising clients not to be concerned. ‘There is no immediate impact on your investment management arrangements,’ UBS Wealth director Lachlan Downe wrote to clients today. ‘The intention is to create a business with the breadth of investment offering of the the current UBS Wealth Management and the benefit of access to independent service providers.’ The transaction has the blessing of UBS. ‘UBS is very supportive of a successful transition for clients and we will be committed to an ongoing positive wealth management relationship with you,’ wrote Mr Downe. … The launch of Crestone ends a long period of uncertainty for UBS Wealth, which has seen profits falling and staff reductions, as well as falling behind on technology advances.” VH1-2 UBS finally admits they were loosing money in UBS Wealth Management in Australia and decided to quit. We are now seeing other Asian Governments following Australia to be free of UBS fraud allegations. A reliable New York political source says Asia has been watching the UBS/Clinton/Bush/Obama creating for them and their Washington political appointees a self serving USA kleptocracy.

______________________________________

UBS QUITS AUSTRALIAN WEALTH MANAGEMENT FOLLOWING A “REVIEW”!

Wall Street Journal reports: “UBS AG said it plans to withdraw from its Australian wealth-management business, leaving senior employees to strike out on their own following a management buyout. The Swiss bank said Tuesday it made the decision to cease providing wealth-management services in the country following a review of its operation. Mike Chisholm has stepped down as head of the Australian business unit and, together with a group of former senior advisers from UBS, has established independently owned Crestone Wealth Management. Alain Robert, global vice-chairman of wealth management at UBS, said the decision to quit wealth-management operations in Australia was based on a number of factors. The industry was experiencing substantial changes due to increased regulatory and client requirements that had made it increasingly difficult to operate on a sustainable basis in Australia, he said in a statement.” VH1-3 UBS has given numerous excuses on it’s Australian Wealth Management shutdown. The most credible is UBS was being investigated by Australian Securities and Investments Commission (ASIC).

______________________________________

UBS SAYS IT IS SHUTTING DOWN AUSTRALIAN WEALTH MANAGEMENT AMID COMPETITION FROM OWN BROKERS!

Bloomberg reports: “UBS Group AG is shutting its Australian wealth-management unit amid competition from local brokerages. The unit’s former head, Mike Chisholm, and some senior advisers are creating Crestone Wealth Management … Most of the client advisers and senior managers from the UBS business have indicated their intention to join Crestone, it said. The Swiss bank’s exit comes after a more than month-long review and as local firms expand in wealth management in a bid to tap the nation’s pension savers and rich investors. … UBS’s global wealth-management business model ‘has become increasingly difficult to fully operate on a sustainable basis in the local market, which is dominated by a brokerage-based system,’ (UBS) Global Vice Chairman for Wealth Management Alain Robert said. The wealth industry is facing ‘increased regulatory and client requirements which have led to increasingly complex operational processes,’ he said. Crestone intends to use UBS’s economic and equities research, and its capital-markets deal flow, according to its statement. The firm said it’s also in talks with domestic banks about product offerings, without being more specific.” VH1-4 UBS excuse cannot pass the smell test. Reliable source says it was Australian Securities and Investments Commission (ASIC) investigation.

______________________________________

UNDER A CLOUD UBS SELLS UBS AUSTRALIAN WEALTH MANAGEMENT TO STAFF.

The smh.com reports: “The staff of UBS Wealth Management have rebranded the business Crestone, following a management buyout. … It is understood Crestone will be entirely owned by its staff.The new company’s global reach, along with its newly developed IT platform and its independence are expected to be held up as a key selling points. Earlier this year UBS Wealth Management opted to stop servicing clients with less than $1 million managed by the firm. That strategy is likely to be continued under the Crestone badge as it focuses on family office, and its high-net-worth and ultra-high-net-worth clients. It is understood Crestone will be entrusted with a AAA custodian ranking, due to be revealed in the coming weeks. It is negotiating with two big global players for its new IT platform, which will be independent from UBS.” VH1-5 From information and belief UBS was being investigated for fraud by Australian Securities and Investments Commission (ASIC).

_______________________________________

Honorable Prime Minister Malcolm Turnbull of Australia

_________________________________________

HONORABLE MIKE BAIRD CLASH WITH UBS CAUSES INVESTIGATION INTO UBS FRAUDULENT PRACTICES!

The Sidney Morning Herald reports: “Investment bank UBS’ run-in with Prime Minister Baird’s government over the sale of NSW’s poles and wires electricity assets has sparked an extensive review of investment bank practices and the results are not pretty.

So ugly is the result the Australian Securities and Investments Commission (ASIC) has warned the people often known as the smartest men and women in the room it will take action against the culprits if the poor behaviour continues.

________________________________________

Honorable Premier Mike Baird of New South Wales

__________________________________________

The ASIC review of investments banks found that not only do the heavyweights of Australia’s financial system have difficulty in managing their conflicts of interest they also financially reward staff for potentially conflicted behaviour.

Managing conflicts of interest are crucial for investment banks because often one part of the bank is advising on an asset sale or an initial public offering while the bank’s research arm is producing research for the investment banks’ investor clients about the quality of the assets or the IPO.

The most high-profile example of investment banks having issues managing their conflicts of interest is UBS Securities’ ‘research note-gate’ of 2015.

In that instance, UBS – which was managing the $13 billion sale of the NSW government’s Transgrid poles and wires business and producing research for its clients on the sale – dramatically changed its research opinion on the sale process from ‘Bad for the Budget, good for the state’ to ‘Good for the state’ within the space of four hours.

The sudden change in UBS’ research opinion led to a NSW parliamentary inquiry, which heard UBS senior brass had been influenced by the Baird government to change its research opinion.

____________________________________________________

_________________________________________________

_________________________________________________

The UBS poles and wires incident followed on from an earlier one where UBS and Citi analysts downgraded gold miner Newcrest Mining’s forecasts just days before the company revealed $6 billion in write-downs.

ASIC took no action against UBS Securities after the bank acknowledged ASIC’s concerns and hired an external expert to review its controls and practices.

The ASIC review into the wider investment bank community also found there was inadequate training for ensuring research independence among the investment banks it reviewed and instances of “inadequate separation” of research, sales and corporate advisory teams.

‘We have concerns that staff trading can lead to personal interests taking precedence over client interests, which can result in poor advice and poor outcomes for clients,’ the ASIC report said.

‘This risk is heightened around the release of research and capital-raising transactions,’ the report found.

_______________________________________________________

______________________________________

______________________________________

ASIC said it had also found ‘instances of remuneration structures where research remuneration decisions, including discretionary bonuses, took into account research analyst involvement in marketing corporate transactions.

The review also found ‘instances with mid-sized firms where research reports on a company were authored by the corporate advisory team that advised the company on a capital-raising transaction or had an ongoing corporate advisory mandate’.

Further, the review found research department budgets were subsidised by corporate advisory revenues and investor education roadshow expenses incurred by investment banks, including overseas travel, were being funded by corporate issuers.

ASIC’s review of how company floats are managed also found a slew of conflicted behaviour, including research analyst involvement in IPO pitches and promises to corporate clients that research will be provided.

‘We observed one instance where an independent adviser communicated an expectation, before the award of an IPO mandate, that the mandated firms’ research analysts would provide research, assist in marketing the offering, and share un-redacted research with the corporate issuer and the independent adviser before the research was published,’ ASIC found. ASIC will complete its full review of IPOs later this year.” VH1-6 The Australian Government is free of Prime Minister and political appointee deferred payments schemes from UBS that are laundered through speakers/consulting fees, as in the USA. There are no opaque Australian Prime Minister libraries+ secret UBS/Swiss bank accounts accepting secret UBS/Swiss bank controlled foreign cash as in the USA Presidential Library+ deposits. USA has been a UBS assisted kleptocracy under Clinton/Bush/Obama regimes. Unlike the USA, Australian regulators have correctly monitored UBS client accounts, especially UBS elderly clients. USA Clinton/Bush/Obama regimes have expedited the UBS theft of elderly client victim assets, for something. The truth is the best defense. Sunshine is the best disinfectant.

_______________________

DID UBS MEDIA REPORT AUSTRALIAN LIAR LOANS TO GET EVEN?

Business Insider reports: “The UBS banking team has released its annual survey on factual inaccuracies in Australian mortgage applications … one third of mortgage applications contained factual inaccuracies — the highest level in the three-year history of the report. The analysts referred to such discrepancies as ‘liar loans’ — a phrase made popular in the US during the global financial crisis to describe loans approved with poor documentation.” VH1-7 It is ironic UBS is so sacrosanct when UBS and Lehman were said to have triggered the USA 2008 World crash. Perhaps a knowing UBS AG scrutinizes other countries because of it’s past involvement!

____________________________

UBS AUSTRALIAN SENIOR OFFICER STABBED.

Daily Mail reports: “One the top executives at UBS investment bank has been stabbed in the arm and back during an attempted robbery outside his luxury home on Sydney’s north shore. … Kevin Bush, 50, was walking along the footpath towards his $6 million Mosman home on Wednesday night when he was approached by two men with a knife. … Police said Mr Bush was stabbed in the arm and back during an ‘altercation’ with the two men. … A spokeswoman for UBS said Mr Bush was ‘recovering at home’ after his ordeal, and hoped he would be ‘back at work soon’. VH1-8 UBS has had many senior staff members are known involved with suicides, murders et al. Most of these are whisked away as incidental occurrences. This could actually be a robbery attempt in a wealthy Sidney neighborhood.

________________________________

AUSTRALIAN BILLIONAIRE JAMES PACKER LEAVES UBS AG AS FINANCIAL ADVISOR.

afr.com reports: “When it comes to enduring client-banker relationships in the Australian market, not too many have been as high-profile as that of Crown billionaire James Packer and UBS chief Matthew Grounds. … it was difficult to escape the striking conclusion that the Packer/Grounds association is dead … Crown announced that Packer’s private company Consolidated Press Holdings is expecting to sell Crown shares, but retain a 47 per cent holding … who was handling CPH’s shares in the market on Monday? UBS? Nope. The equities desk at Goldman Sachs.” VH1-9 Our UBS AG World causal chain of misdeeds are circulating but we do not know if James Packer was told by competitors, astute Australian regulators or just a friend.

==============================

BANGALADESH

UBS CEO COMMENTS UPON UBS PEDDLING QUESTIONABLE SECURITIES TO UNKNOWING CLIENTS.

Independent Bangladesh reports: “Massachusetts regulators said the Swiss bank (UBS) had also agreed to pay civil fines totaling 150 million dollars as part of a pact with state authorities. … UBS would be the first bank to make all its clients ‘whole.’ The bank has denied any wrongdoing. At the heart of regulators’ probes is the question of how the banks marketed the securities to investors. Some investors have claimed that the banks misrepresented how quickly the securities could be redeemed if an investor decided to cash them in. US banks and UBS marketed billions of dollars’ worth of the complex securities in recent years … They provided a rich business for many banks prior to the market’s collapse in February which left panicked investors scrambling to redeem their holdings and nursing paper losses.” VH2-1 UBS top employees seem to be in denial of their dubious behavior. They are continuing a pattern some think is criminal in nature, especially Federal prosecutors in Miami and Brazil.

===========================================

BRUNEI

PRINCE JEFFERT GETS INVOLVED WITH UBS AFTER BEANIE BABIES SWINDLED BY UBS!

Vanity Fair reports: “In the New York court, Derbyshire testified on Jefri’s plan to sell the hotels. The prospective buyer was Ty Warner, the Beanie Babies billionaire (see issue 4, VD-12). Warner particularly wanted Hotel Bel-Air, but it was a trinket in Jefri’s world, priced at only $200 million (and returning only $3 million in annual profit), whereas the Palace was priced at $600 million and had a $50 million profit. (Through an executive at his company, Warner declined to comment.) … the prince summoned Derbyshire and Zaman to a four-eyes meeting in his Place Vendôme residence. They were joined by two bankers from UBS Zurich. It was agreed that one of them should “open an account at UBS Zurich to receive the $575 million, the sale proceeds, but [the banker] wasn’t confident that UBS wouldn’t treat those funds as being captured by the Brunei freezing order,” Derbyshire testified. “And they wanted a written opinion from me.” (Stewart says the UBS Zurich account had been disclosed to the B.I.A., and the B.I.A. had also heard rumors of the impending sale of the hotels. According to Richard Chalk, “We wrote a warning letter [to Ty Warner] that you ought to be aware that this is beneficially owned by the B.I.A. and there’s a freezing order in place. And that really put the kibosh on it.”) VH3-1

===================================

CHINA

UBS CHAIRMAN SERGIO ERMOTTI IS BETTING ON CHINA!

Bloomberg reports: “UBS Group AG will double its staff in China over five years, adding about 600 people as Chief Executive Officer Sergio Ermotti bets a time of volatile markets is as good as any for ramping up operations. … UBS will start its biggest push in China against a backdrop of convulsions in the nation’s equity and currency markets and as some competitors pare back Asian operations. … UBS was the top non-Chinese bank for domestic investment banking for the first time since 2012, the New York-based research company (Freeman & Co) estimates.” VH4-1 UBS cannot afford many more “misshaps” in the Far East, especially with China.

_______________________________________

SHANGHAI COMPOSITE INDEX SHOWS NO CONFIDENCE IN UBS CHAIRMAN ERMOTTI’S CHINESE STRATEGY.

Swissinfo.ch reports: “UBS Group AG’s plan for an unprecedented expansion in China is turning up the heat on Goldman Sachs Group Inc., the only global securities firm that can fully compete with it on the mainland. …China limits overseas firms to minority stakes in domestic securities joint ventures, which are largely excluded from lucrative businesses such as secondary-market trading in Chinese debt and equities, as well as from managing money for wealthy clients. Banks which want to widen their operations need to apply for extra licenses or set up additional joint ventures. … Investment banks typically see an onshore presence as mainly a platform for advisory work for Chinese companies overseas, such as issuing stock or bonds and counseling them on acquisitions. … Wealth management holds particular allure, given China’s soaring number of millionaires … ‘China is a great opportunity like it has been for the last 20 years,’ (UBS Chairman) Ermotti said in Shanghai, adding that times of volatility and challenges ‘are also the good times to plan for the future, and that’s the reason why we are starting to implement our strategic plan.’ … His (Ermotti’s) comments were followed by the Shanghai Composite Index sliding 5.3 percent.” VH4-2 Shanghai Composite Index clearly showed no confidence in what UBS Chairman of Group Executive Board was espousing. In fact, a one day 5.3% Index decline attributed to Ermotti’s utterances showed he was not properly briefed beforehand by UBS China staff.

_______________________________________

UBS COLLABORATES WITH FRAUDULENT CHINESE COMPANIES.

Deal%book: “UBS, the Swiss bank, could face fines or suspensions from working on deals in Hong Kong as a result of an investigation by regulators in the city. … Hong Kong has ranked as one of the world’s biggest markets for I.P.O.s for a decade, driven by a wave of blockbuster listings of mainland Chinese companies. But some of these have turned out to be frauds. … The company, which UBS helped to list in 2014, had previously been targeted by short sellers.” VH4-3 Short sellers or those betting against UBS are a red flag to regulators. Many of the UBS onerous transactions are exposed to World regulators this way. This is one reason UBS has recently found it easier to collaborate with USA Presidents and their political appointees in swindling USA elderly.

.

___________________________________

UBS GROUP TARGETS ASIA.

Bidness ETC reports: “The Asian debt-financing division includes the bank’s capital market business related to Asia, and the ‘leveraged-finance originations’ of the firm. These operations include cash and derivatives, structured-financing business, and special solutions group. … The European lender is making a move to enhance operations in Asia, by improving operations and market penetration. … Since Asian markets began rallying in 2016, it has become an attractive region to capitalize on. In addition, UBS’ French subsidiary faces witness tampering allegations.” VH4-4 UBS has been repeatedly attempted to shut our newsletter down for reporting truth. Reliable sources have said UBS Clinton family business ties cannot be used until Hillary wins! This UBS Washington corruption is exactly why Trump is winning. We have been reporting it in each of our issues but UBS criminal violations continue despite blather from Washington. From information and belief, establishment publishers will not print anything against UBS no matter how criminal their behavior.

________________________________________

Wise Chinese General Secretary, concerned with UBS Swiss regulation, takes deliberation for Swiss “talks”.

CHINESE COMMUNIST PARTY GENERAL SECRETARY CURTAILS OFFSHORE CORRUPTION.

New York Times reports: “(Beijing under the leadership of Chinese Communist Party General Secretary Xi Jinping) Xi’s enormously ambitious initiative to purge the Chinese Communist Party of what he calls ‘tigers and flies,’ namely corrupt officials and businessmen … financial journalist for the weekly business magazine Caijing … New China News Agency, the People’s Daily, and CCTV. … Central Commission for Discipline Inspection (CCDI). Long one of the Party’s most powerful, secretive, and feared internal organs, the CCDI is dedicated to ‘maintaining Party discipline.’ … first, how to maintain ‘ideological discipline’ among its almost 89 million members in a globalized world awash with money, international travel, electronically transmitted information, and heretical ideas. Second, how to cleanse itself of its chronic corruption, a blight that Xi has himself described as ‘a matter of life and death.’ … banking (all the major banks also belong to the government), officials vetting the deals find themselves in tempting positions to supplement their paltry salaries by accepting bribes or covertly raking off a percentage of the action. … banking (all the major banks also belong to the government), officials vetting the deals find themselves in tempting positions to supplement their paltry salaries by accepting bribes or covertly raking off a percentage of the action.” VH4-5 UBS has accentuated China as their best Asian target. UBS secretive Group Executive Board Chief Sergio Ermotti’s recent aggressive utterances have duly caused the concern of General Secretary Xi Jinping through metaphorical illustrations.

_________________________________

UBS CREATES HONEYPOT IN CHINA!

Bloomberg reports: “In 2014, the Swiss and Chinese central banks signed a three-year currency-swap agreement that can be used to borrow as much as 150 billion yuan.” This conversion has facilitated China capital flight. UBS is prime implementor of capital flight in the World.” VH4-6 The USA presidential race has caused UBS to be seen as a main corruptor of Clinton/Bush/Obama Presidential regimes. USA citizens are suffering as a consequence, especially UBS elderly client victims.

__________________________

UBS FACILITATING CHINA SECRET CAPITAL FLIGHT.

Telegraph reports: “The IIF (institute of international finance), the chief global body for the banking industry, calculates that capital outflows from China reached $676bn last year. The central bank has been burning through foreign exchange reserves to offset the bleeding and shore up the currency — A lot of this is a capital outflow below board through inflated trade invoices and other forms of subterfuge, and some of it is ending up in the London property market, (IIF’s Mr Collyns, a former assistant US Treasury Secretary) said.” VH4-7 UBS is on record as the most agressive offshore banking facilitator. General Secretary Xi Jinping is now attampting to staunch the bleeding outflow of capital by the corrupt to the likes of UBS.

______________________________________

CHINESE GOVERNMENT CLAW BACK OLIGARCH STOLEN MONEY.

Telegraph reports: “operation, named Operation Fox Hunt, was part of a worldwide effort by Beijing to repatriate fugitives and recover funds suspected of being tied to criminal activity. … Ministry of Public Security figures that more than 930 suspects worldwide had been repatriated under the program since last year. Those being sought by China are believed to be prominent expatriates, some wanted for economic corruption or for what China considers political crimes, the newspaper reported.” VH4-8 UBS has been heavily soliciting newly minted Chinese and other Asian oligarchs to hide their assets in UBS secret Swiss numbered accounts. Oligarchs throughout Southeast Asia are then subject to UBS theft using rigged Swiss Courts. Among other things,Swiss Courts demand Foreign victims translate legal actions into French, German and Italian. This has created a huge Swiss translation industry. UBS and Swiss Court collaborators know oligarchs are then on their own since they have no recourse by being considered economic fugitives in their own countries. UBS cynically calls their swindles “operation perfection experience”. UBS headquarters Zurich is the wealthiest city in the World.

__________________________________

CHINESE HUNT FOR CORRUPT OFFICIALS AND BRIBERY CASH.

.BBC News reports: “Chinese officials in the US are searching for the exiled brother of a disgraced top aide to former President Hu Jintao … He is accused of accepting huge bribes personally and through his family. His arrest is part of a crackdown on corruption by President Xi. Ling Jihua’s brother moved to the US in 2013 or 2014, according to media reports. Beijing began an initiative called Sky Net in April to help bring to justice allegedly corrupt officials who had fled overseas. … He is accused of accepting huge bribes personally and through his family. His arrest is part of a crackdown on corruption by President Xi. Ling Jihua’s brother moved to the US in 2013 or 2014, according to media reports. Beijing began an initiative called Sky Net in April to help bring to justice allegedly corrupt officials who had fled overseas. … More than 930 suspects around the world have been repatriated to China since last year under the programme, the newspaper said. China has been pushing for talks with the US on an extradition treaty. The fugitives sought under Operation Fox Hunt are believed to be prominent expatriates, sought for economic corruption or what China considers political crimes.” VH4-9 This Chinese stolen money will be re-stolen by UBS and other Swiss Banks under ruse.

___________________________________

UBS INVOLVED IN CHINA CORRUPTION.

The Guardian reports: “Former premier Li Peng is known by his detractors as the butcher of Beijing for his part in the bloody crackdown on the 1989 Tiananmen Square protests. In 1994, a BVI company called Cofic Investments Limited, ultimately owned by his daughter Li Xiaolin, was incorporated. Her fortune has been estimated at $550m, and she has made a name as China’s “power queen” after a career spent running electricity-generating businesses. … Li is noted in China for conspicuous consumption … inquiries were made with the Geneva law firm that represented it. Cofic’s directors at this time were two partners in the firm, Charles-André Junod and Alain Bruno Lévy. Its shareholder, however, was a secretive Liechtenstein entity called Fondation Silo, whose beneficial owners were named by Junod as Li and her husband. … Cofic held a Swiss bank account at UBS” VH4-10 Chinese top destinations for alleged fugitives are the United States, Canada, Australia and New Zealand. UBS is known to turn in UBS offshore Clients to curry favor with these countries.

____________________________________________

UBS LOOSING MARKET SHARE IN ASIA.

Fortune.com reports: “The banks’ (UBS) business has also been eroded by local competitors, notably aggressive Chinese firms. One of the sources said UBS’s cuts could involve as many as 20 bankers. UBS has about 550 investment bankers in Asia including China, a source said. A spokesman for UBS in Hong Kong declined to comment. … after leading the equity capital market (ECM) league table in Asia for several years, UBS fell to fourth place in the first nine-months of the year from second in the same period a year earlier, the data showed. UBS co-head of equity capital markets (ECM) for Asia, Damien Brosnan, will leave the Swiss investment bank at the end of the month.” VH4-11 China, Hong Kong and Singapore seem to be wisely following wealth management in Australia sick of UBS dubious business practices. With local competitors are more inclined to abide with government banking regulations.

______________________________

WILL SWISS EMOTIONAL HOLD ON CHINA RUB OFF ONTO UBS?

Finews reports: “Harvest Global Investments is a unit of Harvest Fund Management, a China-based asset manager. Ties between Switzerland and China have run deep for years: Chinese leader Xi Jinping in January spent four days in Switzerland on a state visit. One of the first countries to recognize the new People’s Republic of China in 1950, Switzerland has since then fostered close trade ties, and the alpine nation has bid to become a renminbi trading hub and to help China liberalize.” VH4-12 How long will China politely carry UBS?

_____________________________

HAS UBS FAILED IN ASIA?

Reuters reports: “Two senior bankers working for UBS Group AG (UBSG.S) in Asia have left to join Citigroup Inc (C.N), adding to other top bankers who have left the Swiss bank in the region in the last few months. … UBS has had a number of senior level departures in Asia in the last six months. … UBS was a powerhouse in Asia equity capital markets and along with Goldman Sachs Group Inc (GS.N), it dominated the league tables from 2002. But in the past two years its performance has suffered as Chinese investment banks made inroads.” VH4-13

_________________________________________

Russian USA Treasury holdings Chart from 2009 > May 2018.

A USA $ SEVERE WORLD FALL MAY BECOME PERMANENT.

The dollar has lost almost half its purchasing power since 1990. For more than a hundred years, the USA Treasury Department has created inflated dollars while destroying the wealth of World savers through inflation throughout the World. (It is common knowledge World elderly put USA $ under their mattress or other hiding place for wealth safety.) This perceived security was enabled by USA dollar (herein $) being pegged to oil prices and thus the World must purchase oil with the USA dollar. March 2018 China created the gold backed yuan to purchase oil. This will allow the World to separate from the USA $ when buying oil. This very likely will causally initiate a USA $ inflation resulting in a marked loss of USA $ value. As China’s yuan gains international trust the World will be inclined to move away from the USA $ based on intangibles in favor of the Chinese yuan based upon gold.

We do know both China, Russia et al readers are acutely aware of how USA Presidential Team UBS triplets (Clinton, Bush, Obama) have allowed the decimation of USA elderly accumulated earnings entrusted to UBS (see issues 4, 5 and issue 6, VF4 Puerto Rico). In consideration, UBS AG has given the Presidential triplets transparent and opaque deferred payments. It was with deep irritation when President Trump would not join the USA Presidential Team UBS in the UBS elderly USA client swindle. President Trump has been considered an enemy by USA Presidential Team UBS, UBS AG and their collaborators. The World is continuing to see the Presidential triplets and UBS use their collaborators to diminish President Trump’s positive World agenda. Meanwhile, USA elderly UBS Clients continue to suffer from UBS swindles based upon UBS mantra of target, solicit, recruit, isolate, control, dupe and loot. It is sad.

_____________________________________

HOW GRADUAL OR THOROUGH WILL CHINA DECIDE TO BE IN DUMPING THEIR USA TREASURY HOLDINGS? DOES USA HAVE PLAN C?

Daily Mail reports: “A US Treasury report released on July 18 shows that Russian holdings of Treasury securities declined by 84 per cent between March (2018) and May (2018), down to just $14.9 billion from March holdings of $96.1 billion. … Russia’s financial sector, including some top state banks, are essentially barred from US capital markets by the sanctions. A new round of sanctions took effect in April, targeting 24 Russian oligarchs and 12 related companies, in response to accusations of ‘worldwide malign activity’ by the Russian government. … China remains by far the largest holder of US Treasury securities, holding $1.18 trillion at the end of May. Japan is second, with $1.06 trillion.” VG11-7 When China starts selling it’s considerable USA Treasury securities there should be dramatic and perhaps permanent repercussions with a crashing USA $.

________________________________

UBS BRINGS RETIREE BACK IN ASIA AS LAST RESORT TO STEM STAFF LOSSES.

Bloomberg reports: “UBS Group AG has brought David Chin out of retirement to run its investment bank in Asia, as it seeks to stem a wave of defections of China-focused bankers. … Chin, who retired from UBS in 2015, will rejoin the bank … Chin’s return follows a flurry of departures of its China-focused investment bankers. … Since mid-April, four managing directors in UBS’s China investment-banking division have left the bank, including the head and deputy head for the country. … In his new role, Chin will focus on ‘actively reducing bureaucracy’ as well as ‘ensuring clear and full accountability,’ ” VH4-14

_____________________________

UBS ASIA BANKING CANNOT KEEP STAFF!

Finews reports: “Switzerland’s biggest lender has seen a number of bankers exit its investment banking business in Asia over recent months and replaced them swiftly. … Over the past decade, the Swiss bank has built one of the largest China-focused investment-banking businesses and while China remains a key market, UBS wants to pay more attention to other parts of Asia. … Recently, Sam Kendall, head of corporate client solutions Asia Pacific region, said that UBS is committed to strengthen the business across Asia, especially in Southeast Asia, South Korea and India.” Asian banking industry sees otherwise. UBS is loosing excellent staff replaced with amateurs.” VH4-15 UBS is dying of a thousand cuts no matter what staff says to the contrary.

______________________________

UBS AG TARGETS CHINESE CONSUMERS BY USING UBS AG PRIVATE FUNDS!

Finews reports: “Switzerland’s biggest bank will move quickly to make the best use of the advantage it has over rivals in getting better access to the market of a billion sparsely banked consumers. … The private funds business is the last piece of the puzzle that UBS is putting together to tap into the gigantic market … We help foreigners invest in China, and also help Chinese invest overseas. Now, we will help Chinese invest locally.” VH4-16 UBS will have to engage a Chinese partner who will then oversee UBS machinations. UBS will be on a tight leash to maintain ethical posture.

______________________________

YET AGAIN, SWISS BANK REGULATORS TURN BLIND EYE AND DEAF EAR TO UBS CHIEF ERMOTTI DISREGARDING “KNOW YOUR CUSTOMER”.

Finews reports: “UBS is catering to an opaque Chinese conglomerate [HNA] that other Wall Street banks are shying away from. The lucrative mandates stand in contrast to the Swiss bank’s reputation as a safe and secure money manager. … UBS’ role is eyebrow-raising because financing to an opaque Chinese firm at a time of intense scrutiny of such conglomerates is jarring compared to the image the Swiss bank projects – that of a stable and reliable wealth manager. … In fact, mystery enshrouds the origin of much of the $40 billion that HNA has spent to diversify globally with major equity stakes. So mysterious that several of Wall Street biggest banks have pulled back from doing business with HNA. … The reasons lie in internal controls and so-called know your cushttps://statedepartment.org/wp-admin/edit.php?post_type=pagetomer, or KYC, rules, which the Chinese conglomerate seems unable to fulfil[l] to the satisfaction of many investment banks. … A spokesman for UBS said the bank wouldn’t comment on HNA.” VH4-17 Yet again, UBS AG Swiss Chief Ermotti is playing a dangerous game of flaunting the international banking “rules of engagement”. No more has this been successful than in the USA by giving Presidents’ Clinton/Bush II/Obama deferred payments, while gaining access to the USA elderly UBS client victims assets. Chinese Government works closely with its business sector to stave off any embarrassing deviousness of entities like UBS.

_________________________

CHINA PROWESS ADVANCES, WITH CAUTION TOWARDS THE LIKES OF UBS AG.

straitstimes.com reports: ” China is fashioning a new form of multilateralism, one in which it sets the tone and defines the rules of the game. This strategy will advance its economic and political influence in a far more effective manner than a unilateral approach built on brute economic force, a tactic that has produced mixed results for China so far. … China has become the second-largest economy and one of the biggest traders in the world, allowing it to hold sway within the WTO. The country is now one of the prime users of the WTO dispute-settlement process, which it uses to protect its own interests and to aggressively counter trade actions brought against it by other countries. … With its rising economic clout, China has also been able to increase its voting shares at international financial institutions such as the International Monetary Fund (IMF) and the World Bank. At these organisations, the US and other advanced Western economies together still have the dominant voting power. So, China has been subtle in its approach, creating alliances with other emerging-market countries such as India and Russia to advance its priorities. … China has also been effective at pulling potential geopolitical rivals into its economic embrace. Countries such as India and Russia are competitors in many areas. But Beijing has corralled these and two other major emerging-market economies, Brazil and South Africa, into economic alliances. … China’s vision of multilateralism will certainly serve China well, allowing it to expand its economic and geopolitical influence in a manner that will become ever harder to resist. Whether this will be good for the world remains to be seen.” VH4-18 Chinese Government is resolute regarding it’s convictions. It knows UBS AG is devious and willing to pay for access. The World has seen within our content Presidents Clinton/Bush II/Obama willingly accepting UBS deferred payments while giving UBS unregulated access to now USA elderly UBS client victims, among other things. Asian Infrastructure Investment Bank (AIIB) initiated under the auspices of China is more meritorious than IMF and World Bank.

_____________________________

UBS MOVES IN ON CHINA BUT MAY BE IN FOR A SUPRISE!

Finews reports: “UBS took a big step towards expanding its stake in a decisive Chinese partnership, in a bid to eventually control the majority. … Zurich-based UBS isn’t wasting any time: the Swiss bank [UBS] has applied to take a 51 percent stake in its Chinese joint venture, UBS Securities Co … The bank [UBS] currently holds one-quarter of the entity, which unites the four Chinese firms Beijing Guoxiang Asset Management, China Guodian Capital, COFCO Group and a Guangdong transport firm.” VH4-19 UBS AG operates thinking each country does not know UBS AG inflicted turmoil within others. Chinese regulators new the recent UBS AG Singapore and Puerto Rico episodes as they played out. Unlike past USA Presidential Team UBS, President Xi’s office is very protective of the Chinese citizenry, especially the elderly.

________________________________

UBS AG IS PLAYING A DANGEROUS GAME WITH CHINESE AUTHORITIES

Finews reports: “UBS is the market leader in private banking for wealthy Asian clients. …Ultra-wealthy Chinese often use export firms who generate profit abroad, which are then invested outside China. A lot of mainland Chinese assets are invested in Hong Kong company shares, which in turn are booked with Swiss financial institutions, as one banker told the paper. This is still legal, but there are apparently other, more risky, loopholes waiting to be exploited. Some assets for instance are moved from China to Hong Kong using illegal currency exchange bureaus. Another favored route is that via the tax havens in the Caribbean, with Hong Kong – and Swiss banks – as the final destination. … The Chinese authorities are probably aware of the detours and shortcuts , and one has to ask for how much longer they will be tolerated. …Both UBS and CS maintain such holdings in China, and are keen to expand them. This means they are reliant on the goodwill of the Chinese authorities. It wouldn’t be the first time that Swiss banks threaten smoothly functioning businesses by exploiting such loopholes.” VH4-20 It is only a matter of time and Chinese authorities are a very patient group.

____________________________________

UBS AG HYPOCRITICALLY CRITIQUES CHINESE BANKS & REGULATORS

Bloomberg reports: “China’s banks have managed to sidestep the severest curbs on their shadow banking activity, suggesting the real pain of the deleveraging process lies ahead, according to a report by UBS Group AG. … A squeeze on their interbank borrowing was mitigated through extensive use of a short-term funding instrument called negotiable certificates of deposit, the report by UBS analysts … Regulators have clamped down on interbank activity because some banks had used it to boost shadow loans and add leverage.” VH4-21 Who is UBS AG to comment on Chinese Banks when UBS AG is seen throughout the World as having a poor rating for their devious crimes herein reported.

___________________________________

UBS AG CHIEF CUTS ASSET MANAGEMENT JOBS TO FOCUS ON CHINA

zacks.com reports: “UBS Group AG (UBS – Free Report) is focusing more on growth in China, along with sustainable and passive investment strategies, it has started slashing jobs at its asset management unit … Notably, in order to revamp and fix the company’s asset management division, Ulrich Koerner, the unit’s chief, has been disposing off assets, reviewing offerings and pushing into passive investment strategy products … Along with an increased focus on passive products, Koerner’s focus has also been to grow in Asia. … Last year, the company availed a private funds license in China, which permitted its investment management unit to manage money for mainland institutional and high-net-worth investors in the region. VH4-22

________________________________________________

Russian USA Treasury holdings Chart from 2009 > May 2018.

A USA $ SEVERE WORLD FALL MAY BECOME PERMANENT.

The dollar has lost almost half its purchasing power since 1990. For more than a hundred years, the USA Treasury Department has created inflated dollars while destroying the wealth of World savers through inflation throughout the World. (It is common knowledge World elderly put USA $ under their mattress or other hiding place for wealth safety.) This perceived security was enabled by USA dollar (herein $) being pegged to oil prices and thus the World must purchase oil with the USA dollar. March 2018 China created the gold backed yuan to purchase oil. This will allow the World to separate from the USA $ when buying oil. This very likely will causally initiate a USA $ inflation resulting in a marked loss of USA $ value. As China’s yuan gains international trust the World will be inclined to move away from the USA $ based on intangibles in favor of the Chinese yuan based upon gold.

We do know both China, Russia et al readers are acutely aware of how USA Presidential Team UBS triplets (Clinton, Bush, Obama) have allowed the decimation of USA elderly accumulated earnings entrusted to UBS (see issues 4, 5 and issue 6, VF4 Puerto Rico). In consideration, UBS AG has given the Presidential triplets transparent and opaque deferred payments. It was with deep irritation when President Trump would not join the USA Presidential Team UBS in the UBS elderly USA client swindle. President Trump has been considered an enemy by USA Presidential Team UBS, UBS AG and their collaborators. The World is continuing to see the Presidential triplets and UBS use their collaborators to diminish President Trump’s positive World agenda. Meanwhile, USA elderly UBS Clients continue to suffer from UBS swindles based upon UBS mantra of target, solicit, recruit, isolate, control, dupe and loot. It is sad.

_____________________________________

HOW GRADUAL OR THOROUGH WILL CHINA DECIDE TO BE IN DUMPING THEIR USA TREASURY HOLDINGS? DOES USA HAVE PLAN C?

Daily Mail reports: “A US Treasury report released on July 18 shows that Russian holdings of Treasury securities declined by 84 per cent between March (2018) and May (2018), down to just $14.9 billion from March holdings of $96.1 billion. … Russia’s financial sector, including some top state banks, are essentially barred from US capital markets by the sanctions. A new round of sanctions took effect in April, targeting 24 Russian oligarchs and 12 related companies, in response to accusations of ‘worldwide malign activity’ by the Russian government. … China remains by far the largest holder of US Treasury securities, holding $1.18 trillion at the end of May. Japan is second, with $1.06 trillion.” VH4-23 When China starts selling it’s considerable USA Treasury securities there should be dramatic and perhaps permanent repercussions with a crashing USA $. The question will then be to see if the USA plan C works.

==================================

HONG KONG

HONG KONG REGULATORS PROBE UBS INITIAL PUBLIC OFFERINGS, AMONG OTHER THINGS!

Associated Press reports: “Hong Kong regulators probe UBS on initial public offerings Associated Press reports: “Swiss bank UBS said Friday that Hong Kong regulators are investigating its work on some initial public offerings on the southern Chinese financial center’s stock market. UBS also said that the city’s Securities and Futures Commission notified it this month of plans to take action against the bank and certain unnamed employees over its work as a sponsor of those IPOs.” VH5-1 It seems the word is out in Asia on UBS devious banking habits while USA Presidents Clinton/Bush/Obama and their immediate political appointees eagerly signed up for UBS deferred payments laundered through speaker/consulting fees, among other things.

_____________________________________________

UBS CANNOT PASS SMELL TEST IN HONG KONG!

Reuters reports: “Hong Kong I.P.O.s that the bank (UBS) worked on and that later proved problematic included China Metal Recycling and China Forestry, both of which have entered liquidation.” VH5-2 Unlike Washington accepted pay to play scandals, UBS may be doomed in mor ethical Asia.

________________________________________

Joseph Chee

UBS LOOSES TOP ASIAN BANKERS, SOMEHOW!

FineNews reports: “UBS is losing another top shot investment banker at its Asia-Pacific division. The capital markets business in the region proves difficult terrain for the Swiss No. 1. The Asia-Pacific unit within the UBS investment bank has another departure to deal with: Joseph Chee has left the bank, «Reuters» reported today. He was the head of corporate client solutions for Asia and the point person for Chinese state and private companies looking for capital. Chee, a veteran UBS manager, will set up his own fund, «Reuters» said. The Swiss bank declined to comment. Chee’s departure is the second at UBS Hong Kong within a short time. Damien Brosnan, the co-head of the unit, in December left the company after only seven months. His predecessor, Saurabh Beniwal, had left the bank in August. UBS has lost market share in the equity capital markets of Asia over the past years as Chinese competitors started to make inroads in the business, winning important IPOs and share emissions.” VH5-3 These UBS top bankers leave after seeing UBS ethical lapses, among other things. Why should these ethical bankers taint their reputations.

________________________________________

UBS IS LOOSING IT’S TOP ASIAN STAFF, FOR A REASON!

Bloomberg reports: “Joseph Chee, UBS Group AG’s Asia investment-banking head, has resigned, according to people with knowledge of the matter. … Mark Panday, a Hong Kong-based spokesman for UBS, declined to comment. … As head of Asia corporate client solutions, Chee was responsible for overseeing UBS’s regional mergers advisory, capital markets and financing for companies, financial institutions and private-equity firms. He was left as sole head of the business after Saurabh Beniwal’s departure last year. The group’s Asia head of technology, media and telecommunications, Michael Aw, left at the end of 2016, people familiar with his exit said Friday.“ VH5-4 As we predicted, UBS trains it’s best and brightest only to have them leave. No banker wants to put up with UBS Group Executive Board low ethics, corresponding law suits and criminal charges. This top staff pattern of quiting UBS is not going to stop in the forceable future.

________________________________________

HONG KONG GATEWAY TO UBS CLIENT MONEY LAUNDERING!

Wall Street Journal reports: “The U.S. crackdown on clients of UBS AG is widening into a global hunt, with the government detailing in court documents how the Swiss bank and outside advisers helped Americans hide money using enterprises set up in Hong Kong. … Separately, the U.S. has been pursuing a civil case against UBS. … Hong Kong, of course, can be used as a legitimate tax-planning jurisdiction and gateway to mainland China. … According to a person familiar with the UBS structures, a number of outside fiduciary advisers offered templates for setting up offshore structures on behalf of UBS clients. … UBS and the Swiss government had claimed that UBS couldn’t provide account identities to the U.S. because it violated Swiss privacy law.” VH5-5 Asian Governments embarrassed with UBS banking “missteps”.

____________________________________

UBS FIRES ASIAN BANKERS OF UHNW CLIENTS!

Reuters reports: “UBS Group AG has cut a handful of private bankers from operations in Singapore and Hong Kong in recent weeks including a senior catering for the super rich in Southeast Asia … UBS is the largest private bank in Asia Pacific in terms of assets managed. It has more than 2,800 employees in the wealth management division, the most for any private bank in the region.” VH5-6

___________________________________

UBS shabby, tacky and dangerous bill board on top of Hong Kong building. It is astounding the Hong Kong regulators would allow such a monstrosity.

UBS attractive, decent and safe roof logo in Switzerland. Does UBS demean Hong Kong in business as well?

____________________________________

HONG KONG FINANCIAL REGULATORS PROBE UBS ON IPO’s

Associated Press reports: “Swiss bank UBS said Friday that Hong Kong regulators are investigating its work on some initial public offerings on the southern Chinese financial center’s stock market. UBS also said that the city’s Securities and Futures Commission notified it this month of plans to take action against the bank and certain unnamed employees over its work as a sponsor of those IPOs.” VH5-7 Why does Swiss Government allow UBS to taint the Swiss brand with questionable banking practices?

________________________________

UBS FRAUD COLLABORATION WITH CHINESE COMPANIES!

Deal%book: “UBS, the Swiss bank, could face fines or suspensions from working on deals in Hong Kong as a result of an investigation by regulators in the city. … Hong Kong has ranked as one of the world’s biggest markets for I.P.O.s for a decade, driven by a wave of blockbuster listings of mainland Chinese companies. But some of these have turned out to be frauds. … The company, which UBS helped to list in 2014, had previously been targeted by short sellers.” VH5-8 Short sellers or those betting against UBS are a red flag to regulators. Many of the UBS onerous transactions are exposed to World regulators this way. This is one reason UBS has recently found it easier to collaborate with USA Presidents and their political appointees in swindling USA elderly.

__________________________________

_______________________________

_______________________________

UBS SLASHES HONG KONG STAFF.

efinancialcareers reports: “UBS is cutting the senior ranks of its private bank in Singapore and Hong Kong. But when these managers eventually join rival firms they will look to poach some of their former UBS team members. … The redundancies are part of a cost-cutting exercise announced by UBS wealth management head Juerg Zeltner earlier this month and targeted at non-client facing roles. … The danger for UBS is that they may try to entice the relationship managers who reported into them at UBS to join them at their new banks.” VH5-9 UBS reduces it’s staff in an attempt to save market share in Asia.

___________________________

UBS TO SOLICIT MORE HONG KONG MILLIONARES.

Fortune.com reports: “UBS plans to hire about 100 wealth management client advisors over the next two years in Hong Kong, the biggest wealth hub in Asia-Pacific, to grab a bigger share of the fast-growing mid-tier millionaire segment. … The high-net-worth business offers a better return on assets than that offered by the ultra-rich segment, UBS’s Humair said. The bank already covered three out of five billionaires in the region and almost 90% in Hong Kong, he added. … Total household wealth in Asia Pacific grew by 4.5% in 2016 from a year ago, compared to a drop of 1.7% in Europe and 2% growth in North America, according to Credit Suisse global wealth report.” VH5-10 UBS questionable yoyo mentality in Hong Kong continues to cause notice within Chinese Government and Hong Kong officials. We can only see UBS loosing top clients to more controlled regional banks as competition in time. A reliable Hong Kong official has said: “UBS will always be looked upon wth suspicion. We read on computer news what they do to Puerto Rico and Florida elderly. We have to tolerate UBS for political reasons.”.

___________________________

3 MORE UBS CHINA INVESTMENT BANKERS LEAVE.

Finews reports: “ Managing Directors Wang Cheng, Ding Xiaowen, and Frank Sun have all left UBS in Hong Kong. Xiaowen, who ran UBS’s onshore securities joint venture before relocating to Hong Kong in the past year, will be joining Tianfeng Securities as Head of investment banking, based in Wuhan. Cheng, who was Deputy Head of Investment Banking for Hong Kong, is said to be joining Morgan Stanley as Vice Chairman of Asia Pacific investment banking.” VH5-11 What is astounding is that Cheng is going to the USA firm Morgan Stanley. This can only mean These Asian bankers want to leave UBS and are not partial to a Chinese or other Asian bank. This is very problematic for UBS who has said differently to reliable source investors.

____________________________

UBS CONTINUES TO ILLEGALLY TARGET HONG KONG BUT STILL AVOIDS LOOSING IT’S CHARTER, SOMEHOW!

Finews reports: “The Hong Kong financial market regulator is keeping a watchful eye on Switzerland’s UBS. A further case involving questionable activities by an investment banker has now come to light. … UBS has been under the supervision of the regulator since last fall. SFC had threatened to impose sanctions on UBS and its staff or retract the banking license in connection with IPO practices.

In January of 2017 it was made public that SFC had investigated the role of UBS in the IPO of China Forestry Group and had ordered compensation payments.” VH5-12 Hong Kong astutely is scrutinizing UBS actions under their governmental control. It is highly likely that UBS will initially loose it’s charter within the Asia/Pacific area. UBS has been proven to be criminally entrenched in such areas as USA, Africa and Middle East and will reluctantly give up it’s control.

_______________________________

DESPERATE UBS USES DIRTY TRICKS TO POACH AT DEUTSCHE BANK.

Businessinsider.com reports: “A dispute over hiring in Asia between UBS and Deutsche Bank resulted in UBS being left out of a rights issue from Deutsche Bank earlier in 2017 … Tensions developed after UBS hired Deutsche Bank’s most senior wealth management executive in Asia, Ravi Raju, in October 2016. UBS had also reportedly tried to hire more Deutsche staff after poaching Raju, with the FT (Financial Times) reporting that some UBS staff members had told Deutsche employees that the German lender “might not be there in a few years time … UBS was subsequently excluded from the list of eight banks underwriting this years rights issue, with people with inside knowledge told the FT that Deutsche executives had ‘sin-binned’ UBS as a result.” VH5-13 If readership reads our corroborating documents the UBS pattern of World financial deviancy will be apparent. In actuality UBS has a slim chance of any discernible advances in Asia, hence the UBS dirty tricks against other European/USA bank.

_________________________________________

UBS LOOSES TOP HONG KONG DIRECTOR TO SMALL JULIUS BAER.

Finews reports: “Julius Baer has added to its Hong Kong work force by hiring from a fellow Swiss private bank. Nelson Ip has joined Julius Baer in Hong Kong, finews.com has learned. Ip was previously director of products and services at UBS. He worked with UBS in Hong Kong for over nine years, most recently working with ultra-high net worth clients. … UBS in its half year report published last week recorded a slight fall in the number of client advisors in Asia. … The region’s largest wealth manager reported 1,008 private bankers in the second quarter, compared to 1,025 in March.” VH5-14 UBS continues to loose credibility in the Asian market but fails to address the problem. One only has to look at this and our other newsletters to readily see the problem yet to be respectfully handled.

__________________________________

CITI BANK HIRES 2 SENIOR UBS STAFF FOR CHINA.

Reuters reports: “Two senior bankers working for UBS Group AG in Asia have left to join Citigroup Inc … UBS has had a number of senior level departures in Asia in the last six months. … UBS was a powerhouse in Asia equity capital markets and along with Goldman Sachs Group Inc, it dominated the league tables from 2002. But in the past two years its performance has suffered as Chinese investment banks made inroads.” VH5-15 How long can UBS survive defections in Asia?

_________________________________-

UBS LOOSES MORE BANKERS IN CHINESE MARKET BUT EXUSES DO NOT HOLD UP!

Reuter’s reports: “Two senior bankers working for UBS Group AG (UBSG.S) in Asia have left to join Citigroup Inc (C.N), adding to other top bankers who have left the Swiss bank in the region in the last few months. … UBS was a powerhouse in Asia equity capital markets and along with Goldman Sachs Group Inc (GS.N), it dominated the league tables from 2002. But in the past two years its performance has suffered as Chinese investment banks made inroads. … Separately, Citi on Thursday said it had hired Alison Harding-Jones, UBS’s head of Asia Pacific M&A, as its new head of EMEA (Europe, the Middle East and Africa) M&A and vice-chairman of EMEA corporate and investment banking.” VH5-16 UBS is known as a place to learn the good/bad contrast and then leave to more responsible banking endeavors.

________________________________

Andrea Orcel

UBS UNDER HONG KONG SECURITIES INVESTIGATION.

Financial Times reports: “UBS, the only active bank in the equities market known to be under investigation by Hong Kong’s Securities and Futures Commission, has not sponsored a single deal this year … Andrea Orcel, global head of UBS’s investment banking arm, said the bank felt it had a “very strong case” … The industry has paid hundreds of billions of dollars for misdeeds from money laundering and mis-selling to sanctions-busting and fixing interest rate markets. … Last year the bank warned it could face a suspension from sponsoring IPOs following the regulator’s probe.” VH5-17 Asian countries are getting smart on UBS et al criminal activities. Asian financial companies have hired away smart Asian bankers from UBS to expose UBS devious schemes to regulators. The only ones that seem to be clueless are UBS AG shareholders.

_____________________________

UBS ET AL HONG KONG INVESTIGATIONS CONTINUE.

Finews reports: “Securities and Futures Commission in Hong Kong … accused UBS as well as Standard Chartered and others of market misconduct in the public listing of China Forestry Holdings [SFC]. … UBS is still being probed over the 2009 IPO of China Metal Recycling as well as that of Tianhe Chemicals … The SFC’s own investigation into the 2009 IPO would continue despite the withdrawal of one lawsuit, one person with knowledge of the matter told «Reuters» . This could result in some action against the banks.” VH5-18 World litigant UBS continues to create it’s World noted “misconduct”.

______________________________

HONG KONG SUSPENDS UBS AG GROUP EXECUTIVE BOARD AS UNDERWRITER.

Bloomberg reports: “Hong Kong has used UBS Group AG to send a harsh message to investment banks: Take your job as a gateway to initial public offerings seriously. With deals starting to boom again and the city’s exchange planning to allow dual-class shares, regulators are right to adopt a tougher stance. The Securities and Futures Commission suspended UBS from sponsoring Hong Kong offerings for 18 months and handed it a HK$119 million ($15.2 million) fine, the Swiss group said in its annual report released Friday. UBS is appealing the ruling, which related to a particular IPO that it didn’t identify. … ut landing the role of sponsor is generally a path for banks to take the job of lead underwriter, also known as joint global coordinator, so the SFC ban will indirectly hurt.” VH5-19

__________________________________

HONG KONG SECURITIES REGULATOR (SFC) PROSECUTES UBS AG FOR NOT KEEPING PROPER MANDATORY UBS CLIENT DOCUMENTS.

Financial Times reports: “Hong Kong’s securities regulator [Securities and Futures Commission] hit UBS with a fine for failing to keep proper track of its trading activities for clients. …The SFC said the Swiss bank did not apply proper controls to log transactions and client consents…. The fine comes as Zurich-based UBS appeals an 18-month suspension … The SFC said its investigation into trading showed that the bank could only provide about half of its consent records relating to client facilitation”. VH5-20 UBS AG uses this procedure for their solicit, recruit, isolate, control, dupe and loot mantra in their UBS Client swindling “perfection experience”. USA authorities do not enforce these matters while while accepting UBS AG deferred payments. The recent USA Puerto Rican UBS AG Puerto Rican UBS swindle (see issue 6, VF4-1 >) of the Puerto Rican investment would never happened with a honest and capable Hong Kong Securities and Futures Commission enforcement.

__________________________________________

UBS DECLINES IN ASIA FROM QUESTIONABLE BANKING PRACTICES.

euromoney.com reports: “Competitors have been quick to delight in the travails of UBS’s Asian investment bank, notably its decline in the league tables and a revolving door at senior management level. A ban imposed by Hong Kong’s regulator is the latest stick with which to beat the Swiss bank. … The bank has had a rough ride in Asia over the last few years, written off on more than one occasion by rivals as a real force in Asian investment banking because of numerous changes in senior management and a slide down the league tables…. Among the threats facing UBS’s business in Asia, the most talked about is regulatory risk. … Asia’s performance is closely watched at the UBS headquarters in Zurich because of the impact on the global numbers. … It would make sense. Investment banking is hyper-competitive, even more so over the last few years as Chinese securities houses have muscled in.” VH5-21

_____________________________

HONG KONG SFC FINANCIAL REGULATORS FOCUS ON UBS WORLD SWINDLES WITH BERNIE MADOFF #3.

Asiamoney reports: “Competitors have been quick to delight in the travails of UBS’s Asian investment bank, notably its decline in the league tables and a revolving door at senior management level. A ban imposed by Hong Kong’s regulator [Securities and Futures Commission {SFC} is the latest stick with which to beat the Swiss bank. … Among the threats facing UBS’s business in Asia, the most talked about is regulatory risk. … In March, just as Asiamoney was preparing to go to press, the Swiss bank revealed that it faced the possibility of being suspended for 18 months from its role as a sponsor on Hong Kong IPOs. … In effect, sponsors provide the first due diligence on a listing, working closely enough with a company that they can spot sins of both omission and commission. … One rival says it will have a “practical, chilling effect on their business” even before the suspension has been confirmed. … [UBS] in its 2017 annual report, published in March this year [2018], and buried on page 383 (as point number seven, out of seven, in the provisions and contingent liabilities section, behind third-placed Bernie Madoff), UBS said the regulator [SFC] had issued a ‘decision notice’ in relation to a HK$119 million fine and an 18-month suspension. It is not yet clear whether the SFC changed its mind about its legal options with regards to China Forestry, or is instead planning to punish UBS for another deal.” VH5-21 The Asian financial group consensus is that UBS will not be able to stand the smell test in any areas of area international banking. UBS has done well hustling new naive off-shore clients from China to the UBS AG mantra of solicit, recruit, isolate, control, dupe and loot. If the Chinese Government decides to clamp down on these tax fugitives UBS AG will turn on them as they did in USA. We have already explained devious tricks if not criminal machinations UBS uses to stifle any ability of any selected Client victims of retrieving their UBS off-shore assets. The clock is ticking on these to be UBS AG newly minted Chinese Client victims.

=================================

TAIWAN

JULIUS BAER POACHES TOP TAIWAN OFFICIAL FROM UBS.

Private bank Julius Baer appointed a new head for the Taiwanese market. He joins the firm from larger Swiss rival UBS. … Chew Mun-Yew joins Julius Baer with immediate effect as the market head Taiwan. He joins from UBS, where he is currently in the same role.” VH6-1

==============================================

INDIA

UBS HELD COMPLICIT IN INDIA STOCK MARKET CRASH.

Wikipedia reports: “The Securities and Exchange Board of India (SEBI) alleged that UBS had played a role in … Black Monday stock market crash … SEBI’s ruling of May 17, 2005 barred UBS from issuing or renewing participatory notes for a period of one year. The ban was later lifted on appeal, as a result of a government tribunal ruling.” VH7-1 It is obvious UBS is breaking nation state laws and religious tenets throughout the world. We only see some countries pursuing UBS while others are curiously ambivalent, especially the authoritarian regimes like Saudi Arabia. It is not known how many Saud family billions are hidden at UBS in Switzerland in secret numbered accounts. We doubt the Saud family government will allow citizens of Arabia under their control to find out. We doubt the Saud family government will allow citizens of Arabia under their control to find out. What the Saud family are doing with UBS is directly against Islamic tenets. How can you have the Islamic “Protector of the two Holy Places” Mecca and Medina with offshore UBS numbered bank accounts collecting interest? Has UBS AG manipulated the accounts to give the Saudi Family members “plausibility of denial”? There is no defense capability on the documented.

____________________________________

EX-UBS MAN FINED AND BARRED IN INDIA.

Financial Times reports: “An ex-UBS investment adviser has been fined £35,000 and banned from holding sensitive finance industry posts in the first of what is expected to be several individual misconduct cases stemming from the bank’s former India private client desk. … for helping to cover up a scam that cost UBS $42m (£25m) in compensation after staff used customer money to hide losses from unauthorized trading. … The bank’s India operations have spawned a separate investigation by the Indian government’s Enforcement Directorate, which has been probing whether what it terms “unspecified parties” violated foreign exchange transactions by misusing accounts in London.” VH7-2 We just do not know what is going on at UBS. This is a definite example of UBS policy of blaming incentivised individual UBS employees for internal UBS policies. Time and time again incentivised UBS employees get caught. They are then on their own.Release: Is UBS USA a threat to national security?

______________________________________

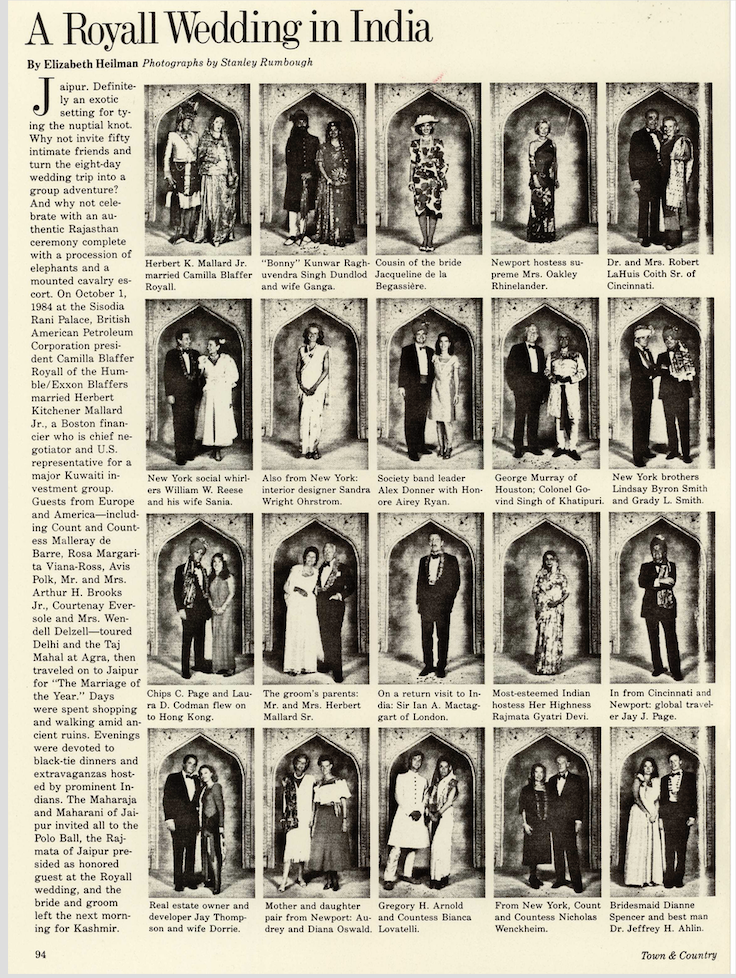

Ghandis as well as the Rajmata & Maharaja of Jaipur gifted Herb Mallard with a marriage in India

UBS TO TARGET INDIA WEALTHY FOR THE UBS “PERFECTION EXPERIENCE”!

Herb Mallard plans to continue entertaining his long standing international friends some now curious of the Palm Beach Winter White House. The USA winter White House is only several streets South. We know for a fact several of Herb’s USA friends have withdrawn their substantial accounts from UBS after reading our newsletter. We also believe the same will continue to occur internationally. UBS is currently pandering to the Indian investment class for the UBS AG “perfection Experience”. The computer game of “Whack a Mole” comes to mind. Every time UBS AG (Swiss) pops up in a country making grandiose or deceptive statements, they are inevitably scrutinized and whacked by honest regulators. We have seen this in Australia, China, Hong Kong, Singapore et al. USA President Trump is starting to turn against UBS and their collaborators rampant corruption during the Clinton/Bush/Obama regimes.

___________________________________

Ghandis with Rajmata & Maharaja of Jaipur bestow a wedding in honor of Herb & Coco Mallard

MALLARD HAS BEEN INSTRUMENTAL IN CONSULTING INDIA BUSINESS SECTORS.

Herb Mallard has had a warm and cordial relationship with the Indian financial community. Herb has has expressed trepidations regarding Swiss banking intent towards India, especially the overt deviousness of UBS expressed herein. It is doubtful the Swiss in general and UBS in particular will be successful in their India banking solicitations. Mallard is an outspoken proponent of keeping assets close to home for security. We only have to read herein of other Asian entities that have not been allowed rightful access to their UBS controlled assets. Mallard has advised Asian entities to pay respect to UBS but keep your hands in your pockets, else questionable losses may be incurred.

_________________________________

UBS CONTINUES TARGETING INDIA BY CREATING ANOTHER SUPPORT CENTER NEAR MUMBAI.

Finews reports: “Asia’s largest wealth manager has initially hired 300 employees to help the group’s technology function primarily and will gradually ramp up the number … This is the second such centre for UBS in the country, after a similar one in Pune. UBS operates similar centres in China, Poland and the U.S.” VH7-3 We have increasing requests from financial regulators, firms and wealthy in India for more information on UBS. We have been completely cooperative.

============================

INDONESIA

UBS SWINDLES INDONESIAN UN AMBASSADOR HEIRS.

Reuters reports: “A lawyer for the estate of former Indonesian diplomat and United Nations president Adam Malik has asked a federal appeals court to revive a lawsuit accusing UBS AG of seizing billions of dollars from inactive accounts over the past 30 years. In a filing on Wednesday, the lawyer said a lower court erred in ruling it did not have jurisdiction over UBS, Switzerland’s largest bank. UBS is so enmeshed with the U.S. banking system that it has a dual nationality in both Switzerland and the United States, lawyer Thomas Easton said in the filing.” VH8-1 We clearly see how UBS AG has operated in many countries by keeping assets of UBS Clients vaulted in Switzerland. . We have reported a growing number of UBS AG incidences within our corroborating documents. Sometimes Client sovereign wealth fund or other assets are in jeopardy. Let us be reminded of the difficulties countries have had clawing back rightfully owned sovereign wealth funds using Swiss Courts. Swiss financial regulators and courts order that all proceedings be translated into French & German. Impediments like these vastly reduce the UBS Client procedurally of ever receiving a favorable judgement or ever seeing any of their Swiss UBS entrusted assets again.

______________________________________

UBS AG SWINDLES INDONESIAN UN AMBASSADOR HEIRS.

Wall Street Journal reports: “The complaint, filed by AM Trust, which says it represents Mr Malik’s heirs and creditors, alleges UBS converted the late political leader’s assets for it’s own use after his death in 1984. … (UBS) used Switzerland’s secrecy laws to lure clients like Malik … Swiss government says a significant amount of money stashed in local banks by foreign political leaders who illegally dipped into state funds.” VH8-2 This form of inside theft is common at UBS and considered one of their best money makers. A reliable UBS source said each numbered account owner’s heirs are profiled for weakness. UBS allegedly used this procedure with Jewish Holocaust, collaborator Bernie Madoff, Gaddafi family and other victims. UBS theft from heirs to drug lords, politicians and white slaver et al clients are particularly easy prey since they have no civil court recourse since the onerous derivation of the assets makes it a challenge against UBS looting particularly difficult. We see UBS operatives sneak in and out of countries using various subtfuge. There are said to be many country and client victims of UBS Swiss bank that would like to recoup their assets stolen by UBS. Is it any wonder why capable Swiss security is so needed to protect UBS chiefs, chairmen and other operatives. Paris Hilton and other notaries now want to move to receive Swiss security given UBS and other dubious entities.

======================================

JAPAN

JAPANESE “INCENTIVIZED” UBS TRADER SPEAKS

Bloomberg interviews UBS conspirator Tom Hayes: “The first thing you think is where’s the edge, where can I make a bit more money, how can I push, push the boundaries, maybe, you know, a bit of a gray area, push the edge of the envelope. But the point is, you are greedy, you want every little bit of money that you can possibly get because, like I say, that is how you are judged, that is your performance metric. – Tom Hayes, UBS trader as leader of the biggest financial conspiracy in history.” VH9-1

===============================

MALAYSIA

MALAYSIAN UBS ET AL WORLD CENTRE FOR MONEY LAUNDERING & CORRUPTION

Reuters reports: “Malaysian companies and banks linked to 1MDB are at the centre of corruption and money laundering probes that have led investigators to look at transactions and financial relationships across the globe – from Malaysia to Singapore and the Seychelles, from Abu Dhabi to offshore companies in the Caribbean, and from the United States to Switzerland. Probes are being conducted by authorities in the United States, Switzerland, Luxembourg, Singapore, and the United Arab Emirates.’’ VH10-1 Presently, there seems to be a noted surge of investigations into opaque UBS. UBS Chief Sergio Ermotti has expressed frustration that Swiss FINMA is becoming resolute by investigating UBS alleged World criminality.

______________________________________________

USA FBI FIND RAZAK/SAUD FAMILY SCAM LOOT