SWITZERLAND

UBS AG dormant vaults may soon be open to safe deposit scrutiny by content family owners.

Holocaust heritage families want to peek inside UBS dormant family deposit boxes!

5:5:18 ubs annual meeting copy

WHY IS ERMOTTI SETTING UP UBS AG FOR A SUSPICIOUS TAKE-OVER BY USA HEDGE FUNDS, VULTURE FUNDS ET AL?

Finews reports: “The deal is striking: Sergio Ermotti, the long-standing CEO of UBS, bought 1 million shares in the Swiss bank for 13.1 million Swiss francs ($13.1 million) after an investor event last week. … The move means the CEO explicitly wanted to be publicly linked to the mega-deal. … For the head of the world’s largest wealth manager to buy such a sizable stake so shortly after an investor event sends a strong signal – likely intended. … Whether Ermotti bankrolled the trade himself is unclear … This will undoubtedly benefit his standing as CEO. … Instead, Ermotti & Co are reliant on the signal that the purchase sends.” VB-1-1

Many of the 2018 USA AG annual meeting attendees were those of “never again” Holocaust Heritage whose family wealth is said to be still UBS AG deniably hidden as “dormant” accounts within the underground UBS AG Swiss vaults. This contentious dispute between the Swiss Government, UBS AG and Holocaust Heritage shareholder query seekers may be finally put to rest with the long sought culmination ending in a UBS AG successful takeover. From information and belief there will be no more delight than for these Holocaust Heritage vocally preeminent shareholders to finally be allowed scrutinization of the UBS AG cavernous vaulted dormant account ownerships and possibly retrieve the Holocaust trove said to be contained within the UBS AG underground vaults. In retrospect, the Swiss Government and UBS AG have been consistently in denial and defensive since the end of WWII. The worrisome series of UBS AG Zurich headquarters et al questionable fires and other known dubious events may conveniently continue to dispose of evidence. It should also be quite apparent a pliable UBS AG Group Executive Board is presently being handsomely rewarded with voted income increases by these ascending Swiss outsider shareholders for no discernible reason! Swiss Government “indelible” credibility may soon be formally challenged, initially from within. Archived documents may deal with this persistence.

A reliable New York source has said a resulting UBS AG takeover will destabilize Swiss banking exposing Swiss financial regulator FINMA as incompetent at best or aiding and abetting endless UBS AG criminal behavior at worst. The ultimate victims will be Swiss citizens who had faith in UBS AG while believing FINMA capable. How come we have archived so much about what UBS AG Group Executive Board is doing while Swiss banking regulator FINMA sleeps?

_____________________________________

Astute USA hedge fund manager David Tepper et al speaks of UBS AG as a target.

SWISS GOVERNMENT HOLOCAUST CREDIBILITY MAY SOON BE CHALLENGED AGAIN. THIS TIME THE INITIATORS ARE THE PROLIFERATING COMPETENT UBS AG HOLOCAUST HERITAGE HEDGE FUND INSTITUTIONAL INVESTORS.

UBS AG shareholders at the 2018 UBS AG annual meeting in apparent numbers were USA institutional hedge, vulture funds et al playing the UBS AG consistently wobbly share price. The UBS AG depreciated yoyo share price has become particularly attractive after the Singapore GIC Sovereign Wealth Fund 2.4 billion US$ sale (see issue 8, VH14). USA vulture funds also became aware after consistently making windfall profits during the USA Presidential Team UBS (Clinton, Bush II, Obama) tenures. In particular; against UBS AG elderly clients in South Florida (see issue 4) and Puerto Rico (see issue 6 VF4), as well as a Bernie Madoff collaborator. Vulture Fund windfalls were accomplished by following UBS elderly USA Client swindles and purchasing the remnants of UBS Client USA victim assets. In the last UBS documented Puerto Rico swindle, a documented paper trail from UBS Chairman McCann’s New York City desk right to Puerto Rico UBS operatives and resulting victims (see issue 6, VF4) was established.

__________________________________

IS UBS AG CHIEF ERMOTTI DELUSIONAL IN “GROPING” FOR TEMPORARY HIGH VALUATION FOR PERSONAL RETIREMENT BENEFIT ENHANCEMENTS AT THE EXPENSE OF UBS AG AND SWISS SECRECY?

Finews reports: “Sergio Ermotti regularly expressed frustration about what he perceived as a low valuation of the banking giant. … Apparently the shares lack «fantasy», in stock market jargon. … According to a regulatory publication from the U.S. supervisory authority SEC, U.S. hedge fund manager David Tepper, using his investment vehicle Appaloosa, recently bought UBS shares in a big way. Apparently he sees potential in the stock, buying as he did some seven million shares worth about 112 million francs. Not a huge amount of course considering the total valuation of UBS, but it could be a signal that perceptions of UBS are shifting, which may encourage other investors. And Tepper isn’t just anyone. … In the wake of the financial crisis Tepper offloaded some banking titles, according to the SEC, and is now buying UBS stock. Tepper also has a reputation for slowly increasing his share holdings, so this could herald rosier times for Sergio Ermotti.” VB-1-2

Wikipedia says: “Forbes ranked him as top hedge-fund earner of 2012, elevating his status to the 166th wealthiest person in the world. Carnegie Mellon University’s business school. … Tepper accepted the suggestion but made the contribution a “naming gift” and suggested that the school’s name be changed to the David A. Tepper School of Business. Tepper and wife Marlene have pledged $3.4 million to Rutgers University – Mason Gross School of the Arts, the alma mater of his wife. … Tepper donated … to United Jewish Communities of MetroWest New Jersey toward their Israel Emergency Campaign. … Tepper and his former colleague, Alan Fournier founded a political action group, Better Education For Kids. … Goldman Sachs Group Inc., where he helped run junk-bond trading during the late 1980s and early 1990s. … Tepper keeps a brass replica of a pair of testicles in a prominent spot on his desk, a present from former employees. He rubs the gift for luck during the trading day to get a laugh out of colleagues.” The inside joke going around the financial world is that Tepper has Ermotti body parts symbol on his desk, squeezing at will! It is unknown at this time if Tepper put up money for Ermotti’s stock purchase.

________________________________

USA FUNDS PILING UP UBS AG STOCKHOLDER OWNERSHIP

Finews reports: “California-based fund house Dodge Cox ramped up its investment in UBS to 3.03 percent, according to an obligatory stock market disclosure … Dodge Cox joins other sizable shareholders including Blackrock, which holds 4.99 percent, and U.S.-based fund house MFS Investment at 3.05 percent.” VB-1-3 There are irate California documented UBS Client citizenry who have lost substantial assets to UBS known systematic swindles. We have not been queried at this time upon the particulars by California media. It will only be a matter of time before Dodge Cox and other USA Fund UBS AG investors find UBS AG Client victims picketing, perhaps with vulture symbols! We have known UBS victim names as well as true and correct documentation available for responsible parties.

___________________________________________

Swiss Government and UBS are both the same. — Bradley Birkenfeld UBS whistleblower

UBS International Banker Bradley Birkenfeld is now in Malta.

UBS AG HEREIN KNOWN WORLD DEVIOUS BANKING SYSTEM WAS SUCCESSFUL UNTIL EXPOSED BY UBS AG SENIOR BANKER BRADLEY BIRKENFELD.

Let it be known that World secret offshoring of assets in Swiss Banks was never a crime in Switzerland. The Swiss banking system went well within the USA until UBS AG senior official Bradley Birkenfeld exposed to international media how deviously aggressive UBS AG was in the World banking forum. The USA citizenry learned the scheme went far beyond an overt USA offshore tax avoidance system to covert criminal perpetrations within the USA against UBS Clients, especially elderly. It could no longer be hidden by the “USA Presidential Team UBS” (Clinton/Bush II/Obama) and other Washington political operatives. Washington terms like damage control, collateral damage, plausibility of denial et al were bandied about by arrogant “swamp” and “deep state” operatives. It was decided to figuratively “kill the messenger” Birkenfeld by imprisoning him. USA President Obama’s Attorney General Eric Holder continued to allow other UBS rot at the top senior officials no jail time for their continuing criminal activity within the USA, for something. Among other things but not necessarily all, this included blatant insider trading with UBS AG (Swiss) Global General Counsel Aufhauser’s internal UBS Wall Street six or so collaborators. None received jail time. Remarkably, UBS AG Global General Counsel (World lawyer) David Aufhauser was not allowed to be properly criminally prosecuted by the Obama/Holder USA Justice Department’s dutifully ethical careerists. The corroborating documents can be easily used by ethical attorneys and USA Government officials to aid UBS victims both criminally and civilly, Remarkably, UBS AG Global General Counsel (World lawyer) David Aufhauser was not allowed to be properly criminally prosecuted by the Obama/Holder USA Justice Department’s dutifully ethical careerists.

___________________________________________

WHY DOES WASHINGTON ALLOW FOREIGN ENTITIES TO SECRETLY OFFSHORE CASH IN USA WITHOUT HAVING TO REPORT IT TO THE ORIGINAL FOREIGN SOURCE COUNTRY? IS THIS A USA UNSCRUTINIZED SECRET LOOPHOLE? WHAT GIVES?

Let it be known that the above mentioned USA offshore tax avoidance system was legal in Switzerland, until the Birkenfeld revelations. An embarrassed Washington then forced the Swiss Government and UBS AG to report USA citizens’ names with secret Swiss offshore accounts. Reliable Washington sources have said an embarrassing number of Washington power players had secret Swiss offshore accounts. USA Congress only sought the few usually elderly token USA citizens profiled for their lack of influence. Washington political operatives, their clients and/or patrons just shifted their secret accounts to primarily Far East tax havens. Hypocritically, Washington allows Foreign bank USA branches to accept offshore accounts from foreign entities without having to report such to the countries of origin. In fact, offshore tax avoiding individuals are now offered USA real estate developers’ packages of secret offshore accounts and USA green card admission if foreigners purchase domiciles. This was attempted by Jared Kushner’s family. It is readily apparent the victims are clearly other countries not demanding Washington give these foreign countries the names of their citizens with USA secret offshore accounts, for some reason!

__________________________________________

Valentin Zellweger

SWISS LEGAL OFFICIAL SPEAKS OF JAMES BOND MOVIES CONTAINING SLEAZY SWISS BANKERS!

qz.com reports: “It irritates Valentin Zellweger (director general of public international law and legal Advisor of the Swiss foreign ministry) that ‘no longer than six minutes into any James Bond movie, a sleazy Swiss banker still appears.’ He’s probably referring especially to Mr Lachaise, the nasty Swiss banker and financier of terrorists and crooks in The World is Not Enough. At one point Lachaise says to Bond, ‘I’m just trying to return the money to its rightful owner’. To which Bond replies: ‘And we know how hard that is for a Swiss banker’. Such stock characters (like Mendel from Casino Royale), only serve to reinforce the stereotype of Switzerland as a safe haven for stolen money and other ill-gotten gains, Zellweger complains.” VB-2 It is well known James Bond films are theme based with character behaviors occurring in reality. However, the extreme plots are created to attract paying viewers.

_____________________________

ARE SWISS BORING CROOKED BANKERS?

Financial Times reports: “Switzerland is a model for the rest of the world – its wealth, economic competitiveness, living standards, transport infrastructure and mountain landscapes. But recent history has exposed its dark side. Swiss banks have been fined more than $5 billion by US authorities for enabling tax evasion. The country was condemned in the 1990s for its treatment of Holocaust victims’ dormant bank accounts. More recently, it allowed rampant corruption at Fifa, world football’s Zurich-based governing body. … Swiss adults top Credit Suisse’s wealth report with average riches of almost $600,000 in 2015. What is less clear is whether the wealth is the fruit of honest toil, or of Switzerland’s status as a haven for buccaneers and their hidden assets. … pressure to clean up the country’s image has encouraged Swiss prosecutors to join international counterparts pursuing corruption in countries such as Malaysia and Brazil. … Meanwhile, scandals over tax evasion make it harder to dismiss as a myth the claim that “the Swiss are crooked bankers,” or at least were in the past too willing to allow illicit financing.” VB-2-1 We only ask our readership to read the repetitive UBS documented World “missteps”presented herein.

_________________________________________

IS TRADITIONAL SWISS BANKING OVER?

finews.ch reports: “Swiss banking in the past lived well with its tax-dodging and therefore undemanding clientele from Europe and customers from big overseas markets in Latin America and the U.S. – the classic offshore banking as it is known in the business jargon. Today it is more the Asian, Middle East, or Russian billionaires, who – in their own language – want to be advised according to the latest banking standards. … Tech-savvy millennials are those who will deal the deathblow to Swiss banking as we know it. … they will get the advice wherever they like and wherever they will find the best private bankers. … millennials will do all their financial transactions for which they don’t need expert advice outside of the traditional banking system … the client of tomorrow has nothing to do with Swiss banking as such – but expects powerful companies that are able to provide the best and obviously most secure financial services anywhere in the world for any specific purpose. … Swiss watches cannot be copied – Swiss banking can.” VB-3 The Swiss Government has the most to gain in the herein mentioned disclosures. They cannot continue their “only need to know basis”, “neither can confirm nor deny” et al to gain plausibility of denial. International banking players are much wiser today.

______________________________________

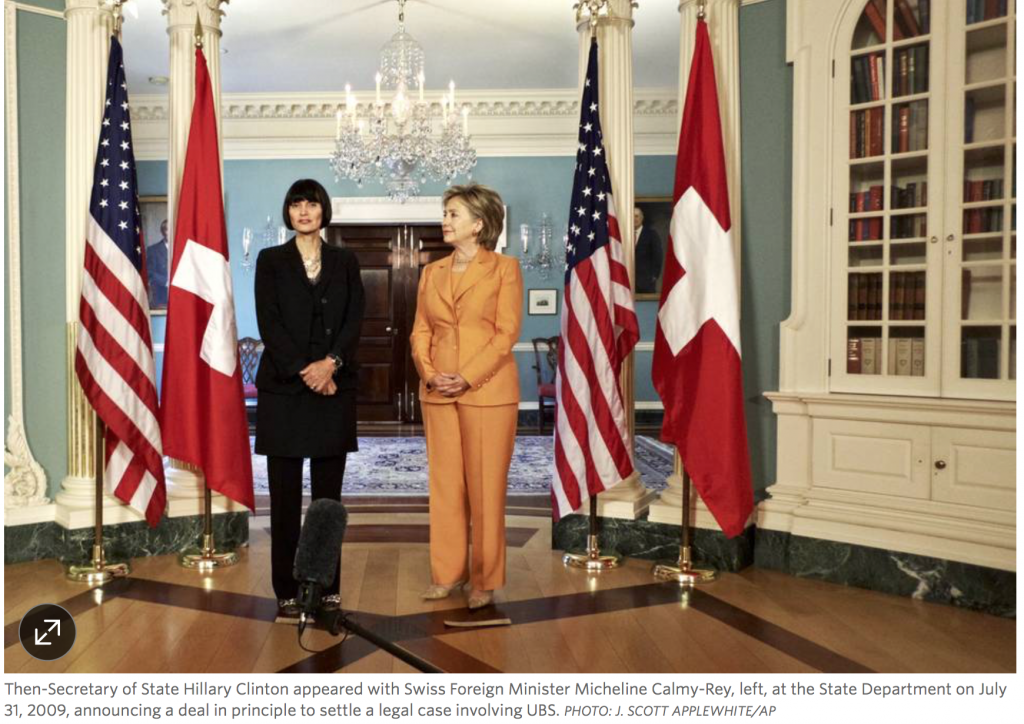

SWISS FOREIGN MINISTER SUMMONED A NEWLY OBAMA APPOINTED USA SECRETARY OF STATE HILLARY CLINTON FOR TALKS TO FREE USA FUGITIVE UBS AG CHAIRMAN RAOUL WEIL. IN CONSIDERATION, UBS AG GAVE CASH TO CLINTON FOUNDATION & DEFERRED PAYMENTS TO BILL CLINTON!

Wall Street Journal reports: “A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts. … Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. … From that point on, UBS’s engagement with the Clinton family’s charitable organization increased. … The Clintons have said accepting donations posed no conflicts of interest and broke no rule or law. … ‘Any insinuation that any of our philanthropic or business initiatives stems from support received from any current or former government official is ludicrous and without merit,’ a bank spokeswoman said. UBS said the speeches by Mr. Clinton and the donations were part of a program to respond to the 2008 economic downturn. … A State Department spokesman said that ‘UBS was a topic of serious discussion, among other issues, in our bilateral relations at that time’ with the Swiss government. A spokeswoman in the Swiss embassy in Washington said the government had no comment.” VB-4 A reliable UBS source has said former USA President Bill Clinton speakers & consultant fees, Clinton Family Foundation donations and other material issues were “intimated” causing a UBS inter office frenzy to fabricate alleged proper USA Federal mandatory compliance. From further UBS information and belief, fugitive from USA Justice prior UBS Chairman Raoul Weil’s phony Bologna capture, fake Ft Lauderdale second trial and USA Federal Ft Lauderdale bogus acquital was planned. We were told that the USA Federal prosecutor and accommodating USA Federal Judge Cohn made it highly technical and boring. Jury members were seen sleeping and only deliberated briefly. Approximately 30 observers dwindled to seven or so. Oh yes, Weil’s Defense team so sure they had a confused jury, they did not even call witnesses. The five or so attached Swiss Government males believed to be monitoring the trial left after a few days. Among other things but not necessarily all, during one of their monitored conversations they were overheard conversing about the alluring nearby beach. It is believed they perceived the outcome and decided to skip out for beach time. Who can blame them. It was another deferred payment payday for the Clintons, Obama and their collaborators. It was shameful to see USA Federal Justice manipulated in such a disgraceful manner. Even most of the few media left were muzzled from telling the World what had happened. The short questionable second trial is allegedly still archived at the Ft Lauderdale USA Federal Court. This episode will never be able to pass the smell test.

_____________________________________________

SWISS FOREIGN MINISTER CALMY-REY UBS AGENDA QUID PRO QUO WITH OBAMA USA SECRETARY OF STATE HILLARY CLINTON!

The Guardian reports: “A Reuters analysis of the settlement negotiations published in April 2010 showed that Clinton was involved at several points in the process. According to the report, the US State Department was grateful to the Swiss for their support in places like Cuba and Iran and for “helping to broker a deal that normalized relations between Turkey and Armenia”. As such, then-Swiss foreign minister Micheline Calmy-Rey was able to connect with Clinton over the phone and meet her face to face three times before the deal was struck in August.” VB-5 The UBS criminal activities agenda within the USA had to be resolved by Swiss government in quid pro quo fashion. The Swiss foreign minister acted as intermediary with several countries. Among other things, UBS is on record giving money to the Clinton Family Foundation and Secretary of State Clinton’s husband “Slick Willy” in the form of speakers or consulting fees et al. Any money transactions of this nature were implemented outside customary diplomacy and should be considered bribery.

______________________________________

THE DISTURBING SORDID MONEY RELATIONSHIP BETWEEN CLINTONS & UBS AG CAUSES SWISS GOVERNMENT HAVOC!

The Hill reports: “The story, as originally recounted by James V. Grimaldi and Rebecca Ballhaus of The Wall Street Journal, was, of itself, deeply troubling. In March 2009, after meeting with Swiss Foreign Minister Micheline Calmy-Rey, then Secretary of State Hillary Clinton intervened with the U.S. Internal Revenue Service (IRS) on behalf of Switzerland’s most powerful banking institution, UBS. … Did a bank that still ranks as “the world’s biggest wealth manager” and has at its disposal a bevy of economists and law firms have a legitimate reason for paying Bill Clinton $1.5 million in speaking fees? Or was the $1.5 million and the tenfold increase in Clinton Foundation donations a reward for the former secretary of State’s intervention? If the latter, that reward would have, under federal law (18 U.S.C. § 201(c)(1)(A)), amounted to an illicit bribe. … There can be little doubt that a media firestorm would ensue if a former president were to accept a lucrative speaking fee from the Mafia. Should the reaction be any different when the speaking fee comes from “banksters” who defrauded the U.S. government?” VB-6 It only can infuriate UBS stockholders, UBS clients and Swiss citizens as much as it does USA citizens. USA citizens are supporting Donald Trump because he is willing to put his entire estate on the line to end rampant Washington corruption. There is a reason why the counties around Washington are some of the wealthiest in USA. Why let Obama collect deferred payments from the likes of UBS the same way the Clinton’s continue to do? UBS attempts commit these egregious acts all over the World. Our issues have UBS incident examples.

_______________________________

WILL FORMER USA SECRETARY OF STATE HILLARY CLINTON & SWISS FOREIGN MINISTER CALMY-REY ET AL GO TO PRISON FOR THEIR UBS AG PAY TO PLAY SCHEMES, INCLUDING UBS AG REPEATED UN-CONVICTED USA FEDERAL CRIMES?

Fox News reports: “The House Oversight Sub-Committee examined allegations that the Clinton Foundation engaged in illegal pay-to-play shenanigans while Hillary Clinton was Secretary of State under President Barack Obama.

Whistle-blowers John Moynihan and Lawrence W. Doyle — who are both former expert forensic government investigators — testified that the Clinton Foundation did not operate as a charitable foundation, but as a “foreign agent” that was being paid to lobby on behalf of foreign governments and entities.

Congressman Mark Meadows — the outgoing chairman of the House Oversight Committee — pointed out that donations to the Clinton Foundation plunged after Hillary Clinton lost the 2016 presidential election, presumably because foreign entities couldn’t influence the US government using her as a well-paid puppet.

“Several reports suggest that the decrease in donations could reflect a ‘pay to play’ activity in the years prior to the decline in donations,” Meadows said.” VB-6-1 Herein and archived USA documentation is available that proves beyond any reasonable doubt Hillary Clinton’s sordid pay to play deals with Swiss Government regarding UBS AG, Chairman Raoul Weil , continuing UBS elderly USA Client swindling which includes UBS Presidential Team UBS et al.

_________________________________________

UBS Zurich World headquarters with the usual client, stockholder or other UBS protesters picketing. There will be other similar UBS picketing depictions from all over the World.

SWISS BANKING DIRTY HANDS!

CBS Money Watch Dirty Little Secrets of Swiss Banking reports: “Swiss banking is built on two majors, UBS and Credit Suisse, plus about 400 smaller banks that can handle just a few well-heeled clients. The system is quirky because there are no government guarantees, in part to keep matters secret. The tradition of banking competence dates back to the revocation of the 1685 Edict of Nantes which was a major step in the history of bank de-regulation. Secrecy dates to the Swiss Banking Act of 1934 which was prompted by a French scandal in which prominent Frenchmen were accused of hiding their money in private Swiss accounts. The list included the Peugeots of automobile fame and perfume maven Francoise Coty. About that time, Swiss accounts became popular with wealthy German Jews facing Nazi anti-Semitism and wanting to protect their money. But the secrecy has led to some major controversies. Among them are:

1 American gangster Meyer Lansky, not wanting to get nailed on IRS charges like Al Capone, used Swiss accounts to hide his money in the 1930s.

2 After World War II, members of the Nazi party used Swiss accounts for their funds as they fled war crime prosecution.

3 The Vatican Bank, accused in class action lawsuit of mishandling money in World War II, used Swiss accounts.

4 Trying to return assets of Jews killed in the Holocaust, the World Jewish Congress, plus some American officials, ran into a stone wall of Swiss bank secrecy when they tried to sort things out and win some retribution for concentration camp survivors.

5 The U.S. government believes that Swiss banks helped shield the money of Osama Bin Laden when they investigated his role in the Sept. 11, 2001 terrorist attacks that killed 3,000 Americans.” VB-7 UBS manages the secret accounts of the Saud, Bin Laden and other wealthy Saudi Arabian families.

_________________________________

This happy days picture will later include a willing and pliable Obama ready to cash in on the UBS AG deferred payment “UBS perfection experience”. In international banking jocular parlance, these men are sucking on the same proverbial UBS tit, for something.

UBS PRESIDENTIAL TEAM UBS CANNOT RECRUIT A RELUCTANT TRUMP. HAPPY UBS DEFERRED PAYMENT SCHEME WILL THUS END WITH OBAMA.

These USA Presidential suborned cozy men are happy receiving UBS patronage amounting to millions USA$ deferred payments laundered through exorbitant speaker, consulting et al deferred payment fees. Many informed international bankers define it as UBS money laundering of deferred payments for known and unknown UBS collaborations while a member of the USA Presidential Team UBS is actively controlling through the USA White House Oval office. In any event, these above depicted men are happy. Why do World preponderance of institutional UBS AG shareholders, Swiss citizens and clients allow this exposed UBS Group Executive Board collaborative USA Presidential Team UBS tit sucking behavior? We will see further on UBS World clients also pay dearly, especially USA elderly. Will this ever stop with corresponding criminal punishments meted out to UBS rot at the top and their collaborators? How long does the World have to wait?

_________________________________

Slick Willy Clinton Foundation with Tony Blair Faith Foundation!

Blair & Bush pray for quid pro quo deferred payments!

EX-PRIME MINISTER TONY BLAIR SUCCESSFULLY TOLD BRITISH GOVERNMENT TO KEEP HIS ALLEGED DEFERRED PAYMENTS SCHEME SECRET FROM UK CITIZENS, UNTIL NOW.

Telegraph reports: “Tony Blair personally asked government officials to keep details of lucrative post-Downing Street advisory work hidden from the public, The Telegraph can disclose. In a letter sent the year after he stepped down as prime minister, Mr Blair insisted that any contracts he struck on behalf of his new consultancy firm should be kept “confidential” to protect his new clients, including foreign governments and major international companies. Following his intervention, the official watchdog that vets the jobs ministers take up after leaving office quietly agreed to avoid publishing details about Tony Blair Associates that would “attract unnecessary attention”. It never published the names of its clients”. VB7-1 It was only a matter of time before the inevitable scandal of Blair mimicking the Clinton, Bush, Obama UBS deferred payment scheme was divulged by an honest Parliamentarian. It has not been divulged by USA Federal Government that the USA Presidential Team UBS (Clinton, Bush II, Obama) asked USA Federal Government agencies not to divulge UBS AG et al secret asset transfers into undesclosed UBS AG Swiss accounts, for something!

__________________________________

Ex-Prime Minister Blair praying he will not rightfully suffer prison for divulging state secrets et al to confidential clients in exchange for deferred payments, consulting fees, speakers fees, ad nausea.

UK MP TONY BLAIR PROTECTED BY UK DEEP STATE ACOBA, FOR NOW.

Tony is attempting to use his influence to keep from influence peddling prosecution. USA triplets may be next up for jail time prosecution. Let us watch them all squirm to obtain a “get out of jail free card” [Monopoly game clichet]. Mr Blair had high value contracts which were not fully disclosed via the government’s committee on business appointments [UK Deep State ACOBA]. Mr Blair has always denied any conflict of interest. The UK and it’s citizens have immeasurably suffered as USA citizens at the direction of USA Presidential Team UBS.

______________________________________

WILL USA PRESIDENTIAL TEAM UBS POTENTIALLY FOLLOW UK PRIME MINISTER TONY BLAIR RIGHTFULLY TO PRISON FOR CRIMES AGAINST STATE?

Daily Mail reports: “Former prime minister Tony Blair attempted to keep details of his high paying advisory post secret from the public after he left Downing Street, it has emerged. The ex Labour leader wrote to government officials suggesting they treat contracts involving him and his firm with ‘confidentiality’ a year after leaving Downing Street. Consultancy firm Tony Blair Associates (TBA) had major clients including international companies and foreign officials when it wrote to the government … However, according to the ministerial code the Advisory Committee on Business Appointments (ACOBA) should be informed of all roles for two years after leaving. … ACOBA (UK Swamp) was forced to hand over documents to the newspaper after spending £10,000 resisting a Freedom of Information request. … Mr Blair maintains he always followed advice given by ACOBA. But Mr Blair, the papers show, claimed his being named would ‘attract unnecessary attention’ if contracts were struck between the government and his clients.

In 2008, Mr Blair told the committee he was setting up TBA as an advisory committee and named … Zurich Financial Services among his clients. [In April 2012, Zurich Financial Services Ltd changed its name to Zurich Insurance Group Ltd. CEO Martin Senn committed suicide on May 27, 2016. Most of Swiss banking related expediency “suicides” are said to use “suicided” or “accidented”Swiss for internal parlance.] There has long been interest in Mr Blair’s activities after he left Number 10 (Downing Street) in 2007.

In 2007 he took a role as Middle East peace envoy, to work as the special representative of the Quartet of international powers (US, EU, Russia and the UN) seeking a peace agreement between Israel and the Palestinians. Campaigners have accused Mr Blair of cashing in on deals struck while in office – something the former PM denies. The latest correspondence shows the former leader was granted a degree of privacy, which will likely anger his opponents … TBA requests it was listed as giving ‘strategic advice’ and said it was attempting to avoid press attention. The letters would appear to suggest Mr Blair’s calls for secrecy were heard [by UK Deep State]. Much of his work was revealed through newspaper investigations and not declarations.

In February 2009, ACOBA published a note on its website about the work of TBA but it was not detailed. His work with Mubadala, the sovereign wealth fund of Abu Dhabi, and governments including Kazakhstan and the United Arab Emirates during the two year time frame were not disclosed via ACOBA. ACOBA [UK Swamp] even assured the former PM [Prime Minister Blair] their notification would not ‘attract unnecessary attention’ after even seeking advice on his office’s preference for wording.” VB-7-2

The World is now seeing how easy it can be for other heads-of- state to mimic these Washington Swamp or Deep State influence peddlers who willingly sell their USA security clearance access or vital interest information to foreign governments and questionable clients for something. In the UBS AG Washington scheme, UBS AG honey pot was too tempting not to join the USA Presidential Team UBS with UBS shady secret offshore bank accounts. [It is actually USA legal to have secret USA Presidential Library secret offshore accounts with secret donors, but goes no further.] We have Presidents Mubarak and his sons of Egypt, Lula of Brazil et al in prison for much lesser crimes than USA Presidential Team UBS triplets or Prime Minister Tony Blare. If Blare goes to UK prison it will be difficult indeed for Washington swamp members to justify freedom for the USA Presidential Team UBS triplets.

________________________________

Zurich popular voyeur inclusive open air sex boxes!

RICHEST WORLD CITY ZURICH OPENS DRIVE – IN SEX BOXES, FOR MEN!

The Guardian reports: “The publicly funded facilities – away from the city centre and open all night – include bathrooms, lockers, small cafe tables, a laundry and shower. Men won’t have to worry about video surveillance cameras, but the sex workers – who will need a permit and pay tax – will have a panic button and access to on-site social workers trained to look after them. … the sex boxes will be open daily from 7pm to 5am. The city has painted the outdoor bathrooms in soft pink and blue, strung colourful light bulbs among the trees and posted creative signs encouraging the use of condoms to spruce the place up a little and make it seem more pleasant. … In Switzerland, anyone who works in the sex trade must be at least 16, the legal age of sexual maturity. The income is taxed and subject to social insurance like any other economic activity.” VB-8 UBS & Credit Suisse are the largest Zurich employers and demand bank secrecy. Zurich sex boxes are are transparent to all while UBS banking procedures are opaque to all. Should this not be the other way around? Is this some sort of Swiss humor?

________________________________

Highly Competent Journalist Katherine Bart

ASTUTE KATHERINE BART’S CAREER

Katharine Bart is a senior contributor for finews.ch and finews.com. She also writes for our Asian partner site, finews.asia. She is a dual Swiss-American citizen with 17 years experience as a journalist, most recently as chief correspondent for Thomson Reuters in Zurich. Prior to that, she wrote for Dow Jones Newswires and The Wall Street Journal from 2003 to 2011. She studied communications at Grand Valley State University in Michigan and graduated with a degree in journalism from the University of Fribourg in Switzerland.”

_______________________________________

SINGAPORE OVERDUE DUMPING OF UBS AG STOCK.

This Finews article created by a highly competent Singapore and Asia based journalist Katherine Bart permeates most of the articles herein mentioned. This is an encapsulation an enactment of what UBS AG has actually been doing within the World financial community. It is delightful reading such quality work from a Swiss/American German educated journalist writing truly and correctly about UBS AG of Zurich.

_______________________________________

UBS UNILATERALLY CONVERTS USA ELDERLY CLIENT “DEAD MONEY” ASSETS INTO UBS SWISS CAPITAL, SOMEHOW.

Fidelity reports: “Big banks have long complained about the costs of holding large pools of inactive deposits. … But the problem isn’t only that inactive cash is a drag on profits, this dead money also ties up bank equity capital, too.” VB-9 Under USA Federal law it is a criminal offense for UBS continual unilateral:

- shifting of UBS Client stock assets,

- conversion of UBS Client stocks into cash and

- transfer of more than $10,000 cash offshore.

This documented UBS routine procedure against UBS USA elderly clients has been repeatedly reported to and ignored by the Clinton, Bush and Obama Administrations. Specific incidences are thoroughly documented within internalrevenue.com and herein.

________________________________________

UBS Group Executive Board created picture still containing Robert J McCann & Raoul Weil as Board members.

_________________________________________

SECRETIVE UBS GROUP EXECUTIVE BOARD REVOLVING DOOR PICTURES

UBS Group Executive Board team photos like Stalin’s Politburo depictions tell a lot. We have seen pictures of these UBS men purged while others continue or are added. We see prior fugitive from USA Justice Raoul as well as USA citizen Robert J McCann remain in good standing to the World. Are their no media cartoonists in Zurich to make humor of these UBS Group Executive Board team photos? Opaqueness is still the mantra underlying UBS international chicanery. The main UBS Board object seems to be keeping their “to big to jail” Washington status and other nations will fall into place. The Board is forever opaque in it’s dealings, as seen below. This enables those like prior Raoul Weil to escape prison. We exposed the deferred payments (bribes, baksheesh et al ) paid Washington political operatives by UBS. These UBS Group Executive Board faces are but the most recent in a long chronology who secretly search the World for those needing opaque offshore accounts. There is no better time for exposing these UBS schemes than just before the USA Presidential voting cycle. USA media is known for transparency during the fourth year presidential election cycles. Nothing transfixes World attention as USA presidential contenders fighting it out with startling revelations. International media has only to connect the dots and follow the pattern.

______________________________________

UBS GROUP EXECUTIVE BOARD CHIEF ERMOTTI SAYS “UNACCEPTABLE” THAT SWISS GOVERNMENT COMPLY WITH OTHER NATIONS BY REVEALING DUBIOUS UBS BANK DATA.

SonntagsZeitung reports Ermotti saying: “Switzerland’s politicians have done too little to protect the country’s banks from demands for data from foreign governments, UBS (UBSG.S) Chief Executive Sergio Ermotti said in an interview … ‘This is unacceptable and opens the door for a new offensive against Swiss banks, … On some issues, the train has left the station,’ he said.” VB-10 What right does UBS have to speak for all Swiss banks? Swiss Government rightly has an obligation to protect UBS stockholders and UBS clients from UBS criminal mischief allegedly now being divulged within opaque UBS data.

______________________________________

UBS Chairman signs a dubious UBS document. It then officially sealed by Swiss Government regarding Marcos secret accounts scrutiny.

UBS Chairman signs a dubious UBS document. It then officially sealed by Swiss Government regarding Marcos secret accounts scrutiny.

UBS DRAFTS PHONY DOCUMENTS REGARDING FERDINAND E MARCOS UBS OFFSHORE GOLD.

Investmentwatchblog.com reports: “Strange that it is recognised and approved by UBS when they have no power or authority over any part of the Collateral Accounts. They are just Custodians – with no power or authority.” VB-11 This is considered an international criminal transaction by the Philippine Marcos regime, UBS and USA Government political operatives. We have more corroborating documents evidencing beyond any reasonable doubt this transference of Philippine gold reserves to the UBS secret accounts of Ferdinand E Marcos. This demonstrates the simplicity of such theft shifting from many herein mentioned countries to UBS secret accounts. Herb Mallard and above signatory Chairman Kaspar Villager have a highly respected friend in common.

_________________________________________

SWISS BANKING REGULATOR FINMA DOWNPLAYS UBS CRIMINAL ACTIVITY WHILE UBS AG CHIEF ERMOTTI CALLS UBS POLICY OF SALESMEN CONTINUALLY DEFRAUDING UBS CLIENTS “UNACCEPTABLE”!

Wall Street Journal reports: “A Swiss regulator (FINMA) has temporarily banned six former UBS Group AG employees from the financial industry and reprimanded a handful of others, as global investigations into foreign-exchange rate manipulation move toward a close. … Finma said it found that those responsible at UBS ‘for the management of foreign exchange trading tolerated, and at times encouraged, behavior which was improper and against the interests of clients.’ A UBS spokesman declined to comment. … The (UBS) bank received immunity from the U.S. Justice Department related to foreign exchange, though its conduct was found to have violated a prior agreement related to the manipulation of the London interbank offered rate … UBS Chief Executive Sergio Ermotti said at that time that ‘the conduct of a small number of employees was unacceptable.’ ” VB-12 From information and belief, Swiss financial regulator FINMA suborns Swiss vital interests to UBS racketeering. Herein, FINMA deviously neither defines meaningless “temporary ban” nor “reprimand”. Dirty hands UBS repeatedly cannot pass the World financial smell test. President Bill Clinton coined the word “unacceptable” to understate criminal acts. The word is now repeatedly uttered by Chief Ermotti referring to constant UBS criminal acts. Let us remember Ermotti is the unoriginal self taught Chief of the secret UBS Group Executive Board where the standard practice is to fire staff when allegedly caught obeying criminally “incentivised” orders. This UBS “misstep” plausibility of denial is so commonly used it is considered another UBS farce among those in World Finance.

______________________________________

It is unknown if Clients, stockholders, angry Swiss citizens or all vandalized UBS Zurich Branch.

UBS STREET LEVEL OFFICE ATTACKED AND DESTROYED BY ENRAGED SWISS.

Swiss clearly do not like the UBS culture and are willing to outwardly express their thoughts on this street level UBS branch. UBS World branches are generally located on guarded upper floors of secured buildings to avoid similar occurrences. UBS staff are said to be constantly stressed about personal harm capabilities. We have also reported elderly demonstrating in Florida against UBS upper floor offices.

___________________________________

UBS CONTINUES TO PROVIDE LITTLE TO NO STAFF JOB SECURITY.

finews.com reports: “UBS in Asia for over a decade, has parted ways with the Swiss banking giant. During her tenure with UBS, Enslow played a leading role for marketing the bank throughout the Asian region. … The departure of Enslow is another major setback for UBS, as the bank experiences stiff headwinds in Asia right now. A few months ago it also lost Dagmar Maria Kamber Borens (pictured below); the regional Chief Financial Officer (CFO) of UBS Asia-Pacific in Singapore.” VB-13 UBS does not treat it’s staff with the dignity other financial institutions do. UBS staff tend to join UBS for learning the business and then depart to more ethical firms.

__________________________________________

UBS & CREDIT SUISSE CONSIDER ASIAN STAFF INEXPENSIVE.

EFC reports: ‘UBS and Credit Suisse are both all about Asian private banking right now. They need to hire more relationships managers (RMs) in Asia as they focus on capturing more assets from the region’s millionaires and billionaires. ‘We are able not only to give a good platform to our colleagues, but also they are able to serve their clients with a very comprehensive offering,’ Ermotti said. … ‘UBS and CS are quite stubborn – they are the big guns and they know they can attract good bankers without offering obscene salaries.’ The two Swiss giants have stricter salary bands than their smaller competitors in Asia … UBS and Credit Suisse won’t give you a large bonus percentage either.” VB-14 This UBS arrogance does not allow for much staff dignity within the Asian community. This could be indicative of how UBS actually thinks about all Asians.

______________________________________________

UBS IS SEEN SQUANDERING STOCKHOLDER & CLIENT ASSETS ON ROT AT THE TOP INFLATED BENEFITS.

Swissinfo.ch reports: “UBS wealth management boss Jürg Zeltner … Some of the world’s richest heirs and entrepreneurs have entrusted him and his team with almost CHF1 trillion ($1 trillion) of their money. … the bank’s sponsorship of Formula One, which plays poorly with the general public in an age of austerity and cutbacks. … UBS, and other wealth managers, have also taken a hammering in the court of public opinion after the Panama Papers’ revelations about banks helping the wealthy to use offshore havens to dodge taxes.” VB-15 From information and belief, there more to be divulged regarding Mossack Fonseca or Panama papers.

_______________________________________

UBS “PAY TO PLAY” WITH CLINTON’S!

Fox News reports: “Donations to the Clinton Foundation by Swiss bank UBS increased tenfold after Hillary Clinton intervened to settle a dispute with the IRS early in her tenure as secretary of state, according to a published report.According to the Wall Street Journal, total donations by UBS to the foundation grew from less than $60,000 at the end of 2008 to approximately $600,000 by the end of 2014. The Journal reports that the bank also lent $32 million through entrepreneurship and inner-city loan programs it launched in association with the foundation, while paying former President Bill Clinton $1.5 million to participate in a series of corporate question-and-answer sessions with UBS Chief Executive Bob McCann.” VB-16 It is any wonder why USA citizens want Washington rot at the top eradicated by a Donald Trump outsider. Trump has been willing to put his entire estate on the line to combat theWashington/Wall Street rot. USA citizens can just hope his appointees have the same convictions.

______________________________________

SWISS AUTHORITIES & OBAMA COLLUDE TO DEFY USA FEDERAL LAWS, AGAIN.

The Washington Free Beacon reports: “New disclosures made by the Treasury Department to Rep. Mike Pompeo (R., Kan.), a House Intelligence Committee member, show that an initial $400 million cash payment to Iran was wired to the Federal Reserve Bank of New York (FRBNY) and then converted from U.S. dollars into Swiss francs and moved to an account at the Swiss National Bank, according to a copy of communication obtained exclusively by the Free Beacon. Once the money was transferred to the Swiss Bank, the “FRBNY (New York Federal Reserve) withdrew the funds from its account as Swiss franc banknotes and the U.S. Government physically transported them to Geneva” before personally overseeing the handover to an agent of Iran’s central bank, according to the documents. … The latest information is adding fuel to accusations the Obama administration arranged the payment in this fashion to skirt U.S. sanctions laws and give Iran the money for the release of U.S. hostages, in what many have called a ransom. … Officials from the Treasury and Justice Departments would not respond to Free Beacon requests for comment about the exact type of legal approval given prior to the cash payment.” VB-17 This depicts the procedure of how Obama/Bush/Clinton have defied USA Federal Laws by attaching highly lucrative deferred payments to their questionable Administration quid pro quo agendas for personal gain. The UBS desired agenda is their continuing lucrative capability of swindling USA elderly without fear of USA Federal recourse. Terms such as to big to jail and get out of jail free cards are frequent explanations. Like Bush/Clinton, Obama deferred payments will be in the form of speakers/consulting fees, secret Swiss Presidential Library+ accounts for foreign cash et al. This procedure has already been set up for Obama to be activated upon the day he leaves his White House office by prior UBS Chairman and Obama fund raiser Robert Wolf (see internalrevenue.com issue 1).

______________________________

DO SWISS BANKING AUTHORITIES SPEAK IN FLUFFY OBLIQUE TERMS FOR A REASON?

The Washington Post said: “Dictators, drug dealers and tax evaders can and do use false names or send relatives or friends to do their banking…. Swiss Banking Commission … managing director (said) ‘There is no excuse to take money from someone who is known to be corrupt.” VB-18 The list should include the child sex trade industry as well as political operatives. UBS has allegedly thrived from hiding criminal gains. UBS is out of control and continues its criminal activity, despite Swiss Banking Commission silly proclamations.

________________________________________

UBS CEO ALLEGES UBS CRIMINAL BEHAVIOR A “MISSTEP”.

Investment News reports UBS CEO saying: “Missteps with the funds and securities have put the most valuable — and vulnerable — UBS’ assets at risk: their reputations.” VB-19 UBS CEO continues to understate reality to explain criminal behavior and its severe ramifications.

_____________________________________

COULD THE SWISS GOVERNMENT BE CONDONING UBS AG AS AN INTEGRAL PART OF THE INTERNATIONAL CRIMINAL CARTELS?

ABC News reports: “Senate Hearing Has All the Trappings of Mafia Investigation. Another witness, Martin Liechti, also took the fifth rather than answer questions from the panel on his bank’s practices. Liechti, head of wealth management for North and South American clients for Swiss bank UBS, was briefly detained in May by the U.S. Justice Department as part of its investigation into tax evasion.” VB-20 Some witnesses who are appearing before the Senate hearings are afraid for their lives. One witness appeared as a shadow to protect his identity. The US Federal witness protection program is being provided to witnesses who are afraid of being harmed by UBS.

_____________________________________________

SWISS OFFICIAL MONEY LAUNDERING!

Wall Street Journal reports: “Are Japan and Switzerland havens for terrorists and drug lords? High-denomination bills are in high demand in both places, a trend that some politicians claim is a sign of nefarious behavior. Yet the two countries boast some of the lowest crime rates in the world.” VB-21 UBS Swiss Government condones money laundering by UBS et al, unless caught. Swiss Government then uses it’s plausibility of denial. This has been evident in past scandals as well as the recent Clinton Family, Ghadaffi Family and prior UBS Group Executive Board member Chairman Raul Weil contrived arrest with the USA Federal Court release.

___________________________________

IS UBS TEACHING CLIENT MONEY LAUNDERING THROUGH CONTEMPORARY ART SALES?

BusinessWire reports: “Group Chief Marketing Officer, UBS: “Artsy is a leader in bringing together art and technology in creative ways so that the art world is accessible to anyone with an internet connection. Our ‘Year in Art’ partnership draws upon a shared belief that a data-led approach to the art world can help navigate such a complex landscape. It’s the same approach we bring to working with our clients in the financial markets around the world. … Developed by UBS to provide its clients, seasoned professionals and beginning art enthusiasts alike with a simple tool to navigate the growing and often fragmented landscape of art information … UBS’s long and substantial record of patronage in contemporary art enables clients and audiences to participate in the international conversation about art and the global art world through the firm’s global art platform. In addition to the UBS Art Collection, considered one of the world’s largest and most important corporate collections of contemporary art”. VB-22 Reliable UBS source has intimated UBS is coaxing dormant (dead) account holders to buy contemporary art which UBS has a strong influence. It is alleged UBS Gulfie oligarch clients have fallen for this scheme to dislodge “dead” assets. UBS Gulfie client victim’s hard assets are now owned by UBS while Gulfie UBS clients own some contemporary artists picture which can be secretly exchanged/transported as money laundering device.

_________________________________________

UBS JOINS VICE GROUP TO TARGET ELDERLY WOMEN!

fines reports: “A new journalism venture shows just how far UBS is willing to use unconventional methods in the hunt for elusive millennial clientele. The Swiss bank’s latest effort to paint itself in a warm glow following its near-collapse almost ten years ago. … Zurich-based UBS needed an image makeover after it was bailed out by the Swiss government in 2008 following billions in write-downs on illiquid mortgage securities. … The Scandinavian marketing magician at the center of its campaign to restore its luster, Johan Jervøe, launched a warm and fuzzy campaign to, in effect, make UBS more lovable. … The editorial push is part of a broader attempt by UBS and Jervøe to humanize itself following the financial crisis of 2008/09. … UBS has also put renewed emphasis on women and on sustainable investing.” VB-23 It has been long part of the UBS target, solicit, recruit, dupe and loot strategy to target elderly, especially women. A reliable UBS source said UBS Group Executive Board was so excited seeing themselves in their initial Quentin Tarantino copy-cat movie (see issue 1) has joined VICE to make more to attract especially wealthy elderly women to the “UBS perfect experience”. How long will the Swiss Government aid & abet UBS dubious banking behavior?

____________________________________

UBS trader Kweki Adoboli

UBS LOOSES $2 BILLION USA$ ON SENIOR TRADER FRAUD.

Reuters reports: “(Kweku) Adoboli had falsified ‘an exchange traded fund made or acquired for an accounting purpose’ and falsified ‘an exchange traded fund transaction and other internal records.’ Exchange traded funds are securities that track an index, a commodity or a basket of assets, and trade on an exchange. … UBS was in turmoil as ratings agencies warned lax risk management could prompt downgrades and senior executives canceled engagements to meet financial regulators. … One UBS trader in London said staff were expecting news of more job cuts in the next two weeks as well as zero bonuses. … Reputational damage could force a restructuring many had already thought inevitable … The two biggest political parties, the Swiss People’s Party and the Social Democrats, want UBS to split investment banking from its wealth management arm and pressure for it to take radical action is likely to mount in the wake of the scandal. … Fitch said the incident ‘strengthens the arguments for UBS to down-scale its investment banking unit’ … The bank has had a history of major risk management glitches. … New losses in UBS’s investment bank risk scaring rich clients and prompting a further flight from its huge private bank, the core of its business that used to be the world’s biggest wealth manager but has slipped to third place.” VB-24 What were UBS due diligence Swiss UBS Group Executive Board rot at the top doing during the swindle? Perhaps UBS will have to swindle more elderly UBS clients and sell more UBS parts to competitors!

___________________________________________

USA FEDERAL RESERVE FINES UBS $100 million USA$.

The New York Times reports: “The (USA) Federal Reserve fined Switzerland’s largest bank, UBS, $100 million on Monday, accusing it of violating United States trade sanctions by sending dollars to Cuba, Iran, Libya and Yugoslavia. UBS operated a trading center for dollars in its Zurich headquarters under contract with the Federal Reserve of New York, to help circulate new United States notes and retire old ones. A condition of the arrangement was that UBS not deliver or accept dollar notes to or from banks in countries under trade sanctions. … ‘UBS recognizes that very serious mistakes were made, accepts the sanctions and expresses its regret,’ ’’ VB-25 Why are UBS stockholders so indifferent or docile at UBS fines, Court losses et al?

_______________________________________

USA’S NORTHERN TRUST SNAPS UBS ASSET MANAGEMENT IN SWIZERLAND & LUXEMBOURG.

Funds-Europe.com report: “Northern Trust has agreed to buy UBS Asset Management’s fund administration servicing units in Luxembourg and Switzerland … A joint statement from both companies said that UBS clients would continue to work with their existing relationship management teams. ‘This agreement represents a significant opportunity for Northern Trust and our clients as we broaden our scale, products and market reach across Europe,’ said Northern Trust Corporation chairman and CEO Frederick Waddell. ‘We look forward to expanding our service offering in Switzerland and further deepening our presence in Luxembourg.’ … Goldman Sachs International was Northern Trust’s financial adviser for the deal.” VB-26 This is a clear example of how UBS is continuing to sell itself for needed cash. It also shows ethical Northern Trust hired Goldman Sachs muscle to see UBS acted correctly without it’s customary devious behavior. What chance does a UBS client or stockholder have against UBS dubious behavior when ethical banks hold UBS suspect.

________________________________

Prior Foreign Minister Micheline Calmy-Rey involved with “Libyan Affair”.

Swiss humor cartoon has Moamar Gadaffi have his female body guards observe the crowning of Swiss President Merz in Libyan desert!

Swiss President Merz as a humbling protector of vulnerable children.

UBS DISPUTE OVER GHADAFFI FAMILY ASSETS ESCALATES INTO SCANDAL.

CSS reports: “The Libyan regime proved to be an extremely difficult and unpredictable negotiating partner that operated out- side the rule of law while engaging in pseudo-legal measures. Equally challenging for Swiss diplomacy was the do- mestic front, with both the political leadership and public opinion according high priority to the release of the hostages. … some serious flaws in the handling of the crisis can be identified that are reflected in the ongoing domestic arguments over the “Libyan affair”. In conjunction with the crises over banking secrecy and UBS, the Libyan issue has raised fundamental questions over the Federal Council’s ability to exercise political leadership. Yet, the roles of the parliament, the media, and the Canton of Geneva should be taken into account too when assessing how the Swiss managed the Libyan crisis.” VB-27 Swiss government apologized to Ghadaffi family but did not forget UBS dispute. Moamar Ghadaffi’s life ended after surrendering from a culvert sanctuary. He was then forced to bend over whereupon a dagger knife was shoved into his anus. It is still unknown if UBS had anything to do with the unspeakable death. As with the Marcos family money entrusted to UBS, it is unknown what UBS did with the Qhadaffi family money. There are many known families that have loss their assets entrusted to unscrupulous UBS.

_________________________________________

UBS AG ROT AT TOP GET NO PUNISHMENT FROM SWISS GOVERNMENT WHILE UBS AG HONEST SINGAPORE GIC MEMBER CITIZEN AND OTHER UBS STOCKHOLDER VICTIMS PAY.

Bloomberg reports: “Switzerland and Singapore are bearing down on the banks linked to a corruption scandal at 1Malaysia Development Bhd., with the Swiss financial regulator saying enforcement proceedings are underway against UBS Group AG, one of six banks targeted, and the Asian city-state ordering one institution to cease operations and fining others. … FINMA is targeting the Zurich-based UBS, rather than individuals at the bank, said Vinzenz Mathys, a spokesman for the Bern-based regulator. He added that he couldn’t say when the proceedings might be concluded. The MAS said it had found control lapses at UBS by specific bank officers.” VB-28 We have repetitively seen Swiss financial regulator allow UBS to continue it’s reign of terror throughout the World of finance. Through condescending platitudes we now see FINFA will not prosecute UBS rot at the top Group Executive Board members but slap insignificant fines upon UBS. This means stockholders like Singapores sovereign wealth fund GIC hardworking constituents will pay. We also see the same FINMA verbiage be used by the USA Federally unregulated Utah Industrial Bank UBS collaborators use the exact verbiage, somehow.

_________________________________________

UBS REPEATEDLY AND KNOWINGLY DEFRAUDED USA FEDERAL RESERVE THEN SAID “MISTAKES WERE MADE”.

New York Times Reports: “The Federal Reserve fined Switzerland’s largest bank, UBS, $100 million on Monday, accusing it of violating United States trade sanctions by sending dollars to Cuba, Iran, Libya and Yugoslavia. UBS operated a trading center for dollars in its Zurich headquarters under contract with the Federal Reserve of New York, to help circulate new United States notes and retire old ones. A condition of the arrangement was that UBS not deliver or accept dollar notes to or from banks in countries under trade sanctions. In an announcement, the Federal Reserve said that UBS had violated the agreement and that some former officers and employees of the bank, whom it did not identify, intentionally concealed the transactions by falsifying monthly reports made to the Fed. … ‘UBS recognizes that very serious mistakes were made, accepts the sanctions and expresses its regret,’ the bank said. … Roughly two-thirds of the $669 billion in United States currency circulates abroad.” VB-29 It is interesting to count the various excuses and apologies UBS uses to rationalize their international criminal activity.

__________________________________________

UBS safe logo on some wall.

UBS tacky/shabby/dangerous logo on windy roof. What do people on other side see? Why was this allowed by Hong Kong Government?

UBS LOGO SIGNS QUESTIONABLE WORLD PROLIFERATION!

We will see controversial UBS has a penchant for tacking the UBS logo sign on sides of buildings throughout the World. This gives the false impression that the buildings are completely rented or owned by UBS with offices filled with UBS staff. Usually UBS rents a couple of above floors for security. When UBS is on the ground floor it is vulnerable to angry UBS clients.

_____________________________________

SWISS CENTRAL BANK CONCERNED ABOUT UBS & CREDIT SUISSE CAPITAL RATIOS.

Wall Street Journal reports: “Switzerland’s central bank said … UBS Group AG and Credit Suisse Group AG need to bolster their respective layers of protective capital.… Both banks need to take action.” VB-30 Zurich as the headquarters of both UBS and Credit Suisse is now the wealthiest per capita city in the World, for a reason. From information and belief UBS is now in severe capital stress. Under international pressure it is being summarily told by Swiss authorities to clean up their act. UBS secret clients will not allow UBS to shift client money for fear of international notice, as with USA clients. UBS derogatorily calls these assets “dead money”. The UBS culture has been molded from decades of allegedly dealing with a client base of drug lords, white slavers, political operatives et al. It has recently been so much easier for UBS to target USA elderly by giving “deferred payments” (bribes) in the form of speakers and consulting fees to willing USA Presidents and their collaborators to facilitate UBS lucrative USA elderly client asset theft. This is readily documented within internalrevenue.com and herein.

___________________________________

USA LAW FIRM ADDS UBS SWISS BANK AS ONLY WORLD BANK AMONG CRIMINAL FRAUDSTERS AND SCAMMERS LIST OF INTEREST. USA ENFORCERS AND REGULATORS WHO NOW PROSECUTE THEM UNDER PRESIDENT TRUMP ARE ALSO LISTED UNDER “TOPICS”.

No other bank in the World has been added to the prestigious Shepherd, Smith, Edwards & Kantas USA law firm list of shame. This should be considered internationally alarming since USA Presidents Clinton/Bush/Obama and their collaborators continue to receive millions USA$ from aiding and abetting UBS in it’s USA perpetrations, especially against USA elderly client victims. We commend this ethical law firm for their work. The Swiss Government should be embarrassed at this World disclosure.

Shepherd, Smith, Edwards & Kantas USA law firm legal actions.

TOPICS

Please click on UBS (103) and see the law firm’s successful prosecutions of UBS.

________________________________

UBS SELLS ANOTHER STRATEGIC EUROPEAN PART TO “REORGANIZE”!

Finews reports: “UBS is pulling out of the onshore business with wealthy Dutch clients and has also agreed to a cooperation deal with the buyer of the local unit. UBS, Switzerland’s largest lender, will stop catering for the rich Dutch clients onshore. … The transaction includes clients’ assets worth 2.6 billion euros, the staff and services and products of UBS in Holland, a unit of UBS Europe SE based in Frankfurt. … UBS is currently reorganizing its business in Europe. VB-31 How many “parts” does UBS have left. Those UBS clients with UBS offshore dormant accounts should be worried. UBS clients involved in the UBS offshore alleged art scam manipulations should be very worried.

________________________________

SINGAPORE GIC SOVEREIGN WEALTH FUND QUICKLY SELLS NEARLY 1/2 UBS STOCKS AFTER OUR DELIBERATIONS AND IS TO SELL THE REST WHEN THE UBS STOCK RECOVERS.

Financial Times reports: “Singapore’s GIC offloads nearly half of its UBS stake”.

Financial Times reports: “UBS: faithless GIC bails out … Singapore money manager’s decision to sell nearly half its stake at a loss is bizarre.”

We assisted Singapores sovereign wealth fund GIC, in their thoughtful and conscientious deliberations using our confidential corroborating documentation, however slightly. As a result, Singapores sovereign wealth fund GIC firmly and unequivocably decided to sell nearly 1/2 of their UBS shares at a loss. We commend GIC for their routine due diligence and ethical behavior as custodian of Singapore public wealth.

________________________________

SWISS LOOSE OUT TO LOCAL SINGAPORE/HONG KONG BANKS!

Finews reports: “Singapore and Hong Kong will attract wealth at more than twice the rate of Switzerland, says Boston Consulting Group in an annual private banking study. … By the end of 2017, the level of private wealth in Asia-Pacific is projected to surpass that in Western Europe, and by 2019, the combined level of private wealth in Asia-Pacific and Japan is projected to surpass that in North America. While Switzerland remains the world’s leading offshore wealth management hub with $2.4 trillion in assets, twice as much as Singapore’s, the safety and stability of the city-state is expected to ensure continued asset growth. … Asia’s biggest wealth centers are attracting clients from within the region who are becoming richer in tandem with its rising economic output. Asian clients feel more comfortable knowing their wealth is being managed geographically closer.” VB-32 Bluntly, Hong Kong and Singapore now do not trust their earned money with the far away Swiss and their one sided banking regulations.

_______________________________

UBS GROUP EXECUTIVE BOARD GETS FREE JAIL PASSES FROM SWISS GOVERNMENT & FINMA FOR MALAYSIA SCAM.

Bloomberg reports: “Switzerland and Singapore are bearing down on the banks linked to a corruption scandal at 1Malaysia Development Bhd., with the Swiss financial regulator saying enforcement proceedings are underway against UBS Group AG, one of six banks targeted, and the Asian city-state ordering one institution to cease operations and fining others. … Malaysian state investment company 1MDB is at the center of several international investigations into alleged corruption and money laundering by public officials. … Samuel Brandner, a spokesman for UBS in Zurich, declined to comment on the FINMA proceedings. In response to the Singaporean sanctions, UBS and DBS said in separate statements they will strengthen controls and take actions against employees responsible for the lapses. … FINMA is targeting the Zurich-based UBS, rather than individuals at the bank, said Vinzenz Mathys, a spokesman for the Bern-based regulator. He added that he couldn’t say when the proceedings might be concluded. The MAS said it had found control lapses at UBS by specific bank officers. VB-33 World finance now is seeing Swiss Government complicit in UBS World criminal activities. Swiss banking is slowly dying of a thousand cuts.

__________________________

UBS AG SELLS ANOTHER PART!

Finews reports: “UBS’ asset management arm is struggling to hit its mid-term targets. Now, the Swiss bank is weighing a sale of a business-to-business fund platform … This is the backdrop of UBS’ recent sale of its fund administration unit to U.S. rival Northern Trust.” VB-34 UBS bank parts are dependent upon each other in various fields of financial endeavor. There will be a time when UBS runs out of crucial parts to sell and collapse.

__________________________________

SWISS BANKERS ASSOCIATION ALLOWS UBS TO EXPOSE CONFIDENTIAL CLIENT SINGAPORE ACCOUNT.

Finews reports: “76 private banks in Switzerland to ink settlements to pay fines for past sins in exchange for escaping prosecution. Is it over for Switzerland? … The 76 banks which came clean in the standardized program delivered data to the U.S. on how much in undeclared money they had bled as a result of cleaning house, and to which banks clients had transferred their funds. … Justice and tax officials are zeroing in on Israel, Singapore and Hong Kong after Switzerland … Swiss Bankers Association emphasized that no client data was delivered as part of the standardized U.S. program, and the data exchange was congruent with Swiss secrecy laws. … UBS – which had originally settled in 2009 – agreed to hand over information on an American who moved funds from the bank’s Swiss office to Singapore.” VB-35 UBS disclosures are tainting the Swiss Bankers Association both of which cannot pass the smell test.

_____________________________

WILL NEXT WORLD FINANCIAL CRASH BE INITIATED BY USA UNREGULATED UTAH INDUSTRIAL BANK CARTEL MEMBER UBS WITHOUT LEHMAN?

Telegraph reports: “The global economy is caught in a permanent trap of boom-bust financial cycles. This deformed structure is becoming ever more corrosive and dangerous as debt ratios rise to vertiginous levels, the world’s top monetary watchdog (headquarters in Basel, Switzerland) has warned. The Bank for International Settlements said the rot in the global monetary system has not been cut out since the Lehman crisis in 2008. The current ageing and unstable cycle could finish in much the same explosive way, contrary to the widespread belief that it was a once-in-a-century event caused by speculators. ‘The end may come to resemble more closely a financial boom gone wrong, just as the latest recession showed, with a vengeance,’ said Claudio Borio, the BIS’s chief economist.” VB-36 USA Federally unregulated Utah Industrial Bank cartel members Lehman and UBS AG (Switzerland) were initial initiators of the 2008 crash. Obama is on record promising USA citizens closure of the cartel. Obama lied. From information and belief, Obama was again bribed by UBS deferred payments now being collected. Obama has no plausibility of denial.

________________________________

WILL SWISS EMOTIONAL HOLD ON CHINA RUB OFF ONTO UBS?

Finews reports: “Harvest Global Investments is a unit of Harvest Fund Management, a China-based asset manager. Ties between Switzerland and China have run deep for years: Chinese leader Xi Jinping in January spent four days in Switzerland on a state visit. One of the first countries to recognize the new People’s Republic of China in 1950, Switzerland has since then fostered close trade ties, and the alpine nation has bid to become a renminbi trading hub and to help China liberalize.” VB-37 How long will China politely carry UBS?

________________________________

Wholesome Swiss banker Martin Senn suicide!

Wholesome Swiss banker Martin Senn suicide!

SWISS BANKERS CONTINUE TO COMMIT ALLEGED SUICIDE!

Finews reports: “Martin Senn’s Suicide … was the third suicide of a high-ranking Swiss executive: former Zurich CEO Martin Senn shot himself in his holiday home in Klosters, Switzerland. His death left the Swiss business establishment reeling, after his finance chief, Pierre Wauthier, and Swisscom boss Carsten Schloter took their own lives within several months of each other three years ago.” VB-38 There was a past movie depicting how Swiss bankers were suicided or accidented. This also successfully occurred in Italy regarding alleged UBS intrigue at Monte Pasche as Worlds oldest bank when their top banker was allegedly thrown out a window. The tape of the occurrence and believed perpetrators were yet again ignored by Italian investigators.

_______________________________

UBS AG CONTINUES TO LOOSE KEY SENIOR STAFF.

efinancialcareers.com reports: “Claudia Rola, the former global head of valuation methodologies at UBS in London, has now joined Deutsche Bank as a managing director. Her public profile suggests her job title is global head of valuation models and methodologies. … Model validation and valuation roles have become increasingly prominent in investment banks over the past few years thanks to regulators. After the financial crisis it became apparent that banks were using different methodologies to define their risk exposure. … Regulations like Basel IV have forced consistency in this area by stopping banks using their own risk models for these calculations. The result has been an explosion in demand for quant professionals with model validation skill-sets and movement into this area from technical front office roles like structuring has become more common. … Despite the relative hotness of these skills, UBS has been losing some very senior risk professionals over the course of the past few months. Paul Shotton, deputy head of portfolio risk control and head of group risk methodology at the bank … Nikolai Kukharkin, global head of model risk management and control at UBS in New York, has also departed, according to recruiters with knowledge of the move.” VB-39 USA AG is becoming the teachers to recruits Worldwide who then leave for more ethical World financial entities. Worldwide UBS AG is selling parts to hide incompetent rot at the top. It seems the only thing the UBS AG Group Executive Board efficiently is give each other raiseses/bonuses. When will UBS AG stockholders stop rot at top?

_______________________________

UBS DOWNGRADES IMPORTANCE OF SENIOR RISK MANAGERS THEN LOOSES THEM.

efinancialcareers.com reports: “In theory, senior risk managers who can help banks with model validation are hot property. A surge in regulatory demands has meant that investment banks have been scrambling to hire quantitative risk managers, and front office expertise – particularly structuring – has been seconded across to meet demand. … However, at UBS in New York, some of the most senior risk professionals in this area have been quietly moved on. And, recruitment sources suggest, this is down to juniorisation of the ranks. …Paul Shotton, deputy head of portfolio risk control and head of group risk methodology at UBS, left the bank earlier this year …. Shotton is a big figure in the model risk management space. He was responsible for the oversight of all market and credit risk taken in UBS’s investment bank, wealth management and asset management businesses. … Nikolai Kukharkin, global head of model risk management and control at UBS in New York, has also departed … Specialist risk recruiters suggest that recent senior departures at UBS are down to a ‘delayering’ of senior quantitative risk managers at the bank, with expensive managing directors being displaced in order to both save on costs and provide opportunities for directors in the group. These senior departures at UBS come at a time when demand is picking up for senior risk professionals with an understanding of model validation.” VB-40 UBS AG constantly goes against the banking trends. This is yet to be acknowledged by their shareholders, other than GIC sovereign wealth fund of Singapore.

_____________________________________

USA ELDERLY VICTIM NAIVELY CORRESPONDS TO UBS AG (ZURICH, SWITZERLAND) AND THEIR USA REGULATORS!

Rippoff Report: #226263

Complaint Review: UBS AG (Bank)

UBS AG (Bank)

UBS AG, Barengasse 16, Postfach, 8098

Zurich,

Phone: 011-411-237-2996

UBS Bank & Financial Services – UBS AG (Bank) ripoff vanished with $250,000 broken Trust Inheritance by taking advantage of 91 year old dying man Lester Wilken’s Power of Attorney trust in UBS AG Wealth Management Barengasse 16, 8001 Zurich Suisse.

The large display ads appearing weekly in the Wall Street Journal, by the New York City Office of World Wide UBS Ag Bank, are quite inviting…’At UBS, we know managing wealth means responding to changes in the market, the world and your life…we consider the perfect time to assess where you are headed as an ongoing conversation called, You & Us.’

My 91 year old friend and elderly patient, Lester Wilken, of Laguna Woods, CA, trusted UBS to manage all his wealth in the Zurich Bank for one reason and one reason only. The peace loving ole timer I helped was so blinded with Macular Degeneration he depended on the eyes of UBS executive director, Claude Ulmann, from Zurich, to manage his accumulated wealth so all heirs named, received his inheritance … As the weeks went by without a response or fund, I contacted the UBS Staff in Zurich for the most sickening shock possible, “Ulmann did not establish a trust fund as he told Lester Wilken, no papers were found in his office file with our name or any evidence of the Power of Attorney, which the Bank knew nothing about and Ulmann refused to explain or respond to our requests for transfer of our trust fund.

While this claim was being ignored I was further alarmed by a Pulitizer Prize winning article in the St. Pete [Petersburg] Times Paper which revealed over half of all Florida Senior Citizens were left living in poverty because of broken bank trusts in Florida Banks. The second shock in that award winning series was the revelation, the most dangerous link to the stolen trust funds was each senior signed a Power of Attorney because a POA is a license to steal in the hands of a bank official without ethics.

The UBS Law firm in Zurich then informed me they would not honor my UBS Power of Attorney [POA] even though Claude E. Ulmann was still employed as one of their executive directors in wealth management, because he violated the bank requirement a power of attorney was not valid without the signature and stamp of the wealth manager who drew up the instrument. On [e] the date of the POA signing, Ulmann had informed us the only signature needed was ours … and all he wrote on the block for his signature was the word, Zurich, indicating the trust was held in the Zurich [UBS AG] home office bank.

How would we three trusting American seniors know the rules of law in a Zurich Bank…or suspect a man Wilken trusted with his large fortune so many years was taking advantage of his near death and our bank ignorance to put himself in position of our funds far away from his bank associates knowledge?

The US Bank Comptroller’s Office in Houston, Texas has a copy of the May 22, 1999 Power of Attorney, the hand written letter Lester Wilken wrote us to celebrate the fact Ulmann’s long distance phone call from Zurich assured him our trust fund was in place drawing interest and on the demise of Wilken he would arrange the transfer we wanted to our American Bank Account with Bank of America, in California.