Snowflake is a USA originated slang used to define a person or institution that is light airy without much substance.

UBS GROUP EXECUTIVE BOARD

UBS Group Executive Board movie adulating themselves, using shareholder money!

UBS GROUP EXECUTIVE BOARD ALLEGEDLY PLAGIARIZES “RESERVOIR DOGS” MOVIE FOR SELF GLORIFICATION AT EXPENSE OF CLIENTS & SHAREHOLDERS.

Finews.com reports: “UBS executives star in a promotional video released by the Swiss bank on Thursday. The 12-minute production features cinematic tricks to tug at the heartstrings as much as a bank can including swelling music, slow-motion imagery, and personal remembrances. It is meant to extol UBS’ principles and virtues: a slickly-produced promotional video to tell the bank’s story and to humanize its executives.” VA-1 In a UBS gasp of desperation the top UBS decision makers decided to copy the successful “Reservoir Dogs” Quentin Tarantino movie. It is unknown if UBS secretive Group Executive Board paid movie rights or just plagiarized it. This worrisome UBS scheme should have put the Swiss Government on notice. It has not. As usual, the Swiss Government has turned a blind eye and deaf ear towards UBS questionable activities. These premeditated antics have also enabled prior UBS Group Executive Board member Raoul Weil to escape prison through a scheme starting at a Bologna Hotel with a known strict front desk through another sham trial in USA Federal Judge Cohn’s Ft Lauderdale Court. We were at the dubious Court proceedings. Perhaps UBS Group Executive Board should concentrate upon increasing value to the UBS stock rather than plagiarizing to make funny movies of themselves. The readership could find such individuals in a Hollywood central casting movie line, perhaps a spooky a financial episodic Harvey Weinstein Miramar. This UBS Group Executive Board behavior is beyond belief.

click above to view

________________________________________

UBS AG haloed Chief Sergio Ermotti

UBS AG GROUP EXECUTIVE BOARD SUFFERS WORLD CREDIBILITY.

Bloomberg reports: “UBS Group (Executive Board) AG, the world’s biggest manager of money for rich people, imposed a partial hiring freeze at its wealth-management business to cut costs … Chief Executive Officer Sergio Ermotti, 56, has been seeking ways to reduce expenses … The company has since eliminated jobs at the investment bank and announced plans to consolidate some of its back-office functions. … Ermotti called the ‘most challenging period’ in several years, as the unit reported client outflows of 3.4 billion Swiss francs.” VA-2 UBS is loosing credibility with international clients, be they secretive families, political class or covert criminals. A reliable UBS source has said UBS Group Executive Board wants to start unwarranted shifting or shuffling these secret accounts around so UBS can churn commissions. This will create noticeable exposure jeopardizing the hidden UBS Clients to international publicity.

____________________________________

UBS CONTINUING DOWNWARD SLIDE.

Forbes reports: “A decade ago UBS was neck and neck with Germany’s Deutsche Bank, ranking third among global banks in terms of balance sheet assets, with $850 billion. Citigroup and Japan’s Mizuho ranked first and second, with about $1 trillion in assets each. Today UBS’ $1.2 trillion in bank assets doesn’t even put it in the top 20. Industrial & Commercial Bank of China ranks first with $3 trillion in assets, and Deutsche Bank ranks eighth with $2.4trillion.” VA-3 In an act of desperation UBS Group Executive Board has allegedly schemed to recoup their losses. Among other things but not necessarily all, UBS has targeted USA elderly women for the UBS “perfect experience”. UBS has allegedly turned to the age old banking elderly swindle of target, solicit, recruit, isolate, control, dupe and loot. This allegedly leads to the UBS Client victim loosing the greater part of their estate. Seniorsavior.com issues 4 & 6 give several examples.

________________________________________

UBS GROUP EXECUTIVE BOARD FLUFFY MANIFESTO PROCLAMATIONS ON STAFF HYGIENE TO “SMELL LIKE A WINNER”!

Business Insider comments on UBS AG Group Executive Board World employee mantra directive saying: “A flawless appearance

can bring inner peace and a sense of security.

Adopting impeccable behavior extends to

impeccable presentation.

The garment is a critical form of non-verbal

communication.

Jackets:

Jacket buttons should be closed. When seated, they

must always be open. Only when it is very hot, and

after confirmation of your supervisor, can you wear

the shirt without a jacket. The jacket must completely

cover your posterior.

Shirts:

Do not wash, nor ever iron your shirts

yourself.

Glasses:

Eyewear can only be in a subdued color range. Make sure that your jewelry be matched to the metallic color of your glasses’ frames. Sunglasses cannot be worn on top of the head.

Smell:

A scent should at first be perceptible at a distance – an arm’s length – but should be discreet. Try a new fragrance during your lunch break. The ideal time to apply perfume is directly after you take a hot shower, when your pores are still open.

Jewelry:

Stop wearing bracelets and earrings. Piercings, besides earrings, and tattoos are prohibited. Out of consideration for our foreign customers, avoid conspicuous religious symbols.

Hair:

“Every little hair that grows on the body has a function.

Breath:

Strong breath (garlic, onions, cigarettes) can have a significant impact on communication. It is nevertheless possible to fight bad breath – during the week avoid dishes made with garlic and onions.

Facials:

We recommend protecting skin by applying a skin cream that consists of nourishing and soothing elements.

Underwear:

Your underwear must not be visible through your clothes, or stand out. Your figure should not suffer from the way you wear your underwear.” VA-4 This 42 page UBS AG fluffy hygiene manifesto is said to have caused laughter throughout the World financial community. UBS AG got into very personal staff items like underwear and smell encroachments. This weird banking diversion allegedly caused some to wonder about the genetic structure of the UBS secretive Group Executive Board. We see this group think continues with movies of themselves. How can UBS AG Group Executive Board critique staff smells when they cannot pass international banking regulations smell test in most countries?

___________________________________

UBS AG Chief Sergio Ermotti

UBS AG CHIEF SERGIO P ERMOTTI FAILS TO ABIDE BY UBS AG GROUP EXECUTIVE BOARD HYGIENE & DRESS CODE.

UBS AG reliable sources have sent snippets of an otherwise impressive UBS AG CEO Sergio P Ermotti breaking his own UBS AG hygiene/dress code directive (see internalrevenue.com issue 6). Sergio spoke at a UBS AG initiated news conference in Zurich. A usually canny Sergio was so thrilled at UBS AG profits from questionable sources that he failed to abide by the UBS AG grooming directive. One cannot but help to see Sergio has his loose tie to one side with a sloppy shirt. Sergio’s jacket is open, another definite UBS no no. Other more telling pictures of Sergio are said to be forthcoming but will be scrutinized for authenticity. Sergio is said to have UBS grooming enforcers throughout the World. There is no end to what UBS reliable sources are willing to divulge about UBS irregularities. Disgruntled UBS reliable sources have said photographs of a sloppy Sergio are just other examples of UBS Group Executive Board’s endemic “do as I say and not as I do” fiefdom directives. This is one reason UBS has consistently low marks in company moral. Empires fall on endemic sloppiness.

____________________________________

Andrea Orcel President of UBS Group AG Investment Bank

PRESIDENT OF UBS GROUP AG INVESTMENT BANK ANDREA ORCEL FAILS TO ABIDE BY UBS GROUP EXECUTIVE BOARD DRESS CODE.

President Orcel is considered highly competent at his UBS AG job. All it takes is UBS personnel memories to make both Chief Ermotti and President Orcel to look silly in the eyes of the Financial World. We have been given several items that would make these gentlemen look more ditzy, but better left for another day.

_____________________________________________

UBS Chairman of Americas Bob McCann

DOES UBS CHAIRMAN ROBERT McCANN ADD A BEAUTY MARK TO HIS LEFT EYELID OR IS IT AN UNATTENDED UBS MOLE?

In other Chairman Bob McCann UBS oriented pictures there is no discernible blemishes upon his face. It is sometimes common to insert a beauty mark upon ones face in some World communities. Like with UBS AG Chief Ermotti and President Orcel, the only point is that it does not conform to UBS AG World hygiene, dress. et al code regulations that they helped institute.

_____________________________________________

UBS AG REVISES CREEPY SILLY STAFF DRESS CODES TO WHAT IS IMPORTANT TO UBS AG.

BBC reports: “Swiss bank UBS is revising its dress code after being widely mocked for its style guide, which suggests female employees wear skin-coloured underwear and advises men on how to knot a tie. ‘We’re reviewing what is important to us,’ UBS spokesman Andreas Kern said. The existing 44-page dress code also tells women how to apply make-up, what kind of perfume to wear and advises them to avoid black nail varnish. Men are told to get their hair cut every month and to avoid unruly beards. All staff are advised to avoid garlic or onion breath.

The code only applies to client-facing staff, and UBS has previously said it had been ‘misunderstood’. The guide is thought to have been developed by top executives as part of UBS’s attempts to improve its image. Other pieces of advice in the document include: “You can extend the life of your knee socks and stockings by keeping your toenails trimmed and filed.” Another says: ‘Glasses should always be kept clean. On the one hand this gives you optimal vision, and on the other hand dirty glasses create an appearance of negligence.’ Mr Kern told the BBC the mandatory dress code for men of a dark suit, black shoes, white shirt and red tie would remain, but said the bank was reviewing other things in the guide which were only meant as recommendations. He said the size of the guide would probably be reduced from the current 44 pages, but could not say by how much.” VA4-1 As things change, they remain the same. UBS AG seems to have a very strange UBS AG Executive Group Board.

___________________________________________________

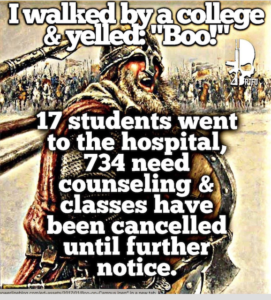

SNOWFLAKES HAS BEEN USED TO REFER TO THE UBS AG GROUP EXECUTIVE BOARD. CROSS OUT COLLEGE, STUDENTS AND CLASSES THEN PUT UBS AG ZURICH HEADQUARTERS AND UBS GROUP EXECUTIVE BOARD.

A reliable USA New York City top banking executive source readership fan has said it is common knowledge UBS AG has been routinely filled with self adulating questionably educated “snowflakes” within it’s top tier of executives. The USA minted term snowflake is defined as being “light, airy, without much substance”. It is common knowledge within World international banking circles that UBS AG top tier executives are light on educational and creative acumen. UBS Group Executive Board would rather spend time mimicking Hollywood films and writing about the color of female personnel panties or men’s breadth smell than pertinent international banking matters. UBS AG would rather make illicit profits by deferred payment bribing the USA Presidential Team UBS triplets and their collaborators than legitimately compete within the USA with other international banks. UBS AG would rather pay for their top executive “to big to jail” status enabling the swindling of UBS elderly USA Clients than allow these senior USA citizens quality of life final years. This UBS AG behavior is an international disgrace that must be curtailed with recompense within the USA and a few other known countries allowing UBS AG to continue degrading their elderly citizens.

________________________________________________

Dave Bruno

UBS CLASH OF USA SUBSTANCE AND CREATIVITY OVER SWISS PSEUDO REGIMENTATION, DEVIOUSNESS ET AL.

Finews reports: “The former head of UBS’ digital efforts in private banking who cut a colorful figure in Zurich’s staid finance circles has resurfaced after leaving the Swiss bank … The American banker cultivated an eclectic personality to go with his role: shorts and colorful t-shirts instead of grey suits, hair tied back into a man-bun, and a «Superdave» avid social media presence often featuring his weightlifting feats, instead of the anonymity many Swiss bankers prefer.” VA-5 This was a clash of substantive casual sponteneity over UBS boss Ermotti mandatory formal business uniforms with underwear matching skin color. UBS had to allow Bruno’s UBS contradictory behavior because UBS desperately needed his creativity. Bruno is now in his element with folks he prefers.

_______________________________

UBS RESHUFFLES SECRETIVE GROUP EXECUTIVE BOARD BUT ROT AT THE TOP CONTINUES!

The Fly reports: “UBS announces changes to group executive board UBS Group announced changes to its Group Executive Board, or GEB, the firm’s most senior management body, and to its board. Robert McCann will take on a new role as Chairman UBS Americas where he will focus on clients and strategic priorities across the region. This follows his decision to step down from his current roles as President Wealth Management Americas and President UBS Americas as well as the GEB. Tom Naratil, currently Group CFO and Group COO, will succeed McCann as President Wealth Management Americas and President UBS Americas on the GEB. UBS has named Axel Lehmann as its new group COO. Lehmann will join the GEB and step down from the role he has held as a member of the UBS Board. Kirt Gardner, currently CFO of Wealth Management, will become Group CFO and a member of the GEB. Following over 30 years with UBS, Group Chief Risk Officer Philip Lofts has decided to step down from his current role and the GEB at the end of the year. He will be succeeded on the GEB by Christian Bluhm who joins UBS from FMS JPMorgan.” VA-6 Reliable UBS sources say McCann and Ermotti were allegedly instrumental in implementing and pulling off the Gardiner’s Island estate looting. Among other things but not necessarily all, this required joining collaborating lawyers, judges. and political operators in New York and Florida. Approximately $147,000,000 Bobby Gardiner estate is unaccounted. Most of the players are known but government authorities in Washington have been told to stand down by the implicated Clinton and Obama Administrations (see internalrevenue.com).

UBS AG Group Executive containing Raoul Weil & Robert J McCann.

_______________________________________

UBS USA FOR SALE!

New York Post reports: “The first casualty of the wealth management wars may be UBS, according to an ex-Swiss banker. One of Wall Street’s most persistent rumors, says Alois Pirker, a widely respected analyst at the Aite Group, is that UBS’ New York-based Americas unit could go on the block this time. And he’s skeptical of his former employer’s commitment to wealth management, despite its recent tech investments, adviser compensation sweetener and a management shake-up. Pirker, who once worked in London and Switzerland for the posh Swiss bank, says UBS has ‘no interest in brokerage.’ UBS Wealth Management Americas (WMA) is really a grand ‘marketing outlet’ beset with moneymaking and profitability challenges, he said.

US clients are, in a sense, more of a ‘liability,’ he told The Post in a veiled reference to past tax-avoidance trouble for UBS. Pirker said a sale of UBS WMA ‘still might happen,’ though it would result in major territorial loss.He also thinks UBS would likely not recover the multimillion-dollar price it paid in its 2000 transaction for the former PaineWebber. ‘The Swiss overpaid back in 2000,’ said industry headhunter Danny Sarch. “But to me, a sale of UBS WMA would be illogical,” he added, citing tax-deferred accounting advantages resulting from the unit’s financial position today. ‘Besides, UBS WMA is earning money.’ But it may not be earning enough. Although UBS WMA employs some of the most productive, multimillion-dollar producers in the business among its ranks of 7,100 brokers, the unit struggles to hit profitability and margin targets.” VA-7 What word can be said other than either widely respected financial analysis Pirker or UBS Chief Ermotti is misrepresenting the truth. A UBS reliable source said UBS Chairman McCann withdrew all invitations to deal “feelers” when there were takers, hence the denial.

______________________________________

UBS AG GROUP EXECUTIVE BOARD CHIEF ERMOTTI DENIES UBS USA FOR SALE, AGAIN.

Investment News reports: “Rumors that the business is up for sale have been popping up since 2010, according to Ron Edde, president and CEO of recruitment firm Millennium Career Advisors. He said it would be a lot less expensive for a firm to pick up its advisers with an acquisition rather than recruit them individually. Mr. Edde also called UBS Wealth Management’s restructuring plans ‘ballsy’. The plan includes cutting recruitment by 40% while boosting compensation for advisers with the largest books of business. … UBS’ CEO Sergio Ermotti also tried to squash the notion that the bank would be willing to give up the unit. ‘It’s not so hard to see why this strong business with its strategic and financial importance looks attractive to our competitors, but it’s worth even more to UBS and its shareholders, and that’s why it’s not for sale’.” VA-8 Ermotti and his buddy McCann have been devious from their inception at UBS. Read internalrevenue.com issue 5 to see continuing outright theft of targeted USA elderly widows’ client accounts. Both the Clintons and Obama have a long history of aiding and abetting UBS in their literally criminal endeavors. In turn, the Clintons have been given donations, speakers fees et al. Prior UBS Chairman Robert Wolf and Obama golf buddy is or will be bagman for Obama (pun intended) picking up loose change from UBS.

________________________________

UBS GROUP EXECUTIVE BOARD ALLEGED CRIME CODE ACRONYMS EXPOSED IN INS WORLD CORRUPTION SCANDAL, AGAIN.

Daily Beast reports: “(Mossak Fonseca Panama Papers criminal activities) politically exposed person, or PEP, in the jargon of corruption investigations. (PEPs are individuals entrusted with prominent public functions that could be abused for money laundering, bribery and the like.” VA-9 UBS implemented popular international criminal banking codes to avoid honest governments. We have been tracking UBS PEPs (Politically Exposed Persons) criminal activity and resulting client victims for almost a decade. UBS Bradley Birkenfeld mentioned UBS secret code used to facilitate UBS international criminal activity noted within seniorsavior.com and internalrevenue.com. UBS Client secret code profiles include but are not necessarily all:

UHNWI = ultra high net worth individual

HNWI = high net worth individual

CEP = criminally exposed person

PEP = politically exposed person

ID = identity donor

IR = identity recipient

UBS secret currency codes used cryptically throughout the world include:

Swan = $1 millionUS transaction

Nut = $250,000US transaction

color orange = euros

color green = dollars

__________________________

WHO TOLD A UBS USA REGIONAL MANAGER FUGITIVE FROM USA JUSTICE TO SURRENDER AND GIVE EVIDENCE AGAINST UBS GROUP EXECUTIVE BOARD MEMBER RAOUL WEIL?

Law360 reports: “Although charged with a crime he (Hansruedi Schumacher) could have remained in his native country for the remainder of his life free from any danger that Swiss government would extradite him.… Schumacher’s counsel previously noted that other individuals prosecuted in the crackdown weren’t responsible for making the laws or culture that allowed Swiss banks to conceal so much U.S. wealth and income from U.S. authorities. … ‘I knew what we were doing. Everyone [at UBS] knew what we were doing … aiding U.S. clients to cheat on their taxes.’ he testified.” VA-10 Despite queries it is still not definitively known why Weil, Schumacher et al were told to participate in the Ft Lauderdale sham trial of Raoul Weil. There was no extradition reason for them to have left cozy Switzerland. The USA Presidential Team UBS cycle potential exposures of past and present deferred payments, offshore Presidential Library secret foreign donation accounts, foreign foundations, foreign speakers/consulting fees ad nausea are thought too explosive to allow World media exposure.

__________________________________________

Hansruedi Schumacher testifying against Raoul Weil in second Ft Lauderdale. Florida Federal Court Judge Cohn questionable trial.

_____________________________________

UBS USA REGIONAL MANAGER FUGITIVE FROM USA JUSTICE AVOIDS USA PRISON BY BECOMING USA FEDERAL WITNESS AGAINST SECRET UBS GROUP EXECUTIVE MEMBER RAOUL WEIL!

swissinfo.ch reports: “Former Swiss UBS banker Hansruedi Schumacher, who pleaded guilty to helping Americans hide their money from US tax authorities, has received a five-year suspended sentence and been fined $150,000 (CHF146,000) by a federal court in Florida, according to his lawyer. … Schumacher was a regional market manager for UBS AG’s North American international business. … Following his 2014 arrest he cooperated as a key witness in the case against Raoul Weil, a former top UBS banker who oversaw an estimated $4 trillion in assets. Weil was found not guilty in November 2014 following a three-week trial.” VA-11 From present information and belief Schumacher was to divulged soft complicated evidence against UBS Group Executive Board member Raoul Weil in the choreographed Weil second Florida trial. Weil was to big to jail so Obama and Holder went along with the Weil Bologna hotel passport divulgence scheme ending with another sham kiss and a wink trial before Ft Lauderdale, Florida USA Federal Judge Cohn. Hansruedi Schumacher and Raoul Weil are back in Switzerland free from their USA crimes. Obama Justice Department has removed all criminal encumbrances from their passports allowing both to continue their banking careers by moving freely throughout the World, for something.!

From information and belief prior UBS Chairman Wolf is to allegedly collect Obama deferred payments through Wolf’s newly minted Washington 32 Advisors LLC. It is said Wolf and Obama want to avoid as much as possible a Foundation or other known continuing Clinton Family schemes to move the cash.

________________________________

UBS AG (Swiss) boxes are for numbered active, dormant, holocaust et al boxes of various sizes. Artworks are inserted into vertical drawers.

UBS AG GROUP EXECUTIVE BOARD DEMANDS CLIENT CONFIDENCE WITHOUT EXPLAINING REPEATED UBS AG SWINDLES AGAINST CLIENTS.

Finews.com reports: “I’m not looking for net new money,» Juerg Zeltner, UBS’s private banking head, said with surprising frankness … The Swiss bank is effectively completely turning its back on growth: Zeltner doesn’t want any part of consolidation in private banking either … He quickly added that of the nine acquisitions that he has overseen as head of wealth management, «eight were mistakes’. … The overall picture of UBS’ wealth management operations is anything but an optimistic one. His strategy of rejecting growth is basically a sort of a battle of attrition with clients. Clients are the only ones who can halt or reverse the downward spiral by investing their cash and generating transaction income for UBS. The cost cuts aren’t aimed at advisors. «I don’t want to weaken the client-facing operations.” VA-12 Reliable UBS sources have translated the UBS Group Executive Board scheme into transparent language. From information and belief, the UBS Group Executive Board is attempting to dislodge the secret offshore billions in their UBS Swiss coffers allegedly stolen by internationally corrupt UBS Client political operatives, criminal organizations et al. The UBS Group Executive Board goal is “investing their cash” to obtain “transaction income” for UBS from these clients. These are the UBS Clients that are most dangerous for they have the means of getting even. Popular internalrevenue.com reported a brief skirmish with the past Gaddafi Family of Libya victims over an attempted swindle. It ended with a reluctant apology from the highest Swiss political operatives. These worried UBS clients should think twice before allowing UBS to invest their assets after UBS swindles are now being routinely exposed. UBS also has a penchant to double cross UBS Clients by divulging offshore asset ownership to World authorities when caught. Under these circumstances, why should UBS secret offshore Clients start causing notice to themselves by allowing UBS to shift their hidden offshore assets? Why would they even keep their secret offshore accounts at volatile UBS?

_____________________________________________

UBS calls in police to control anti-UBS demonstrators.

__________________________________

UBS AG GROUP EXECUTIVE BOARD BEATS FORCASTS BUT OUTLOOK GLOOMY.

Wall Street Journal reports: “Swiss bank cuts expenses while it continues to contend with turbulent markets – UBS Group (Executive Board) AG painted a gloomy picture for the Swiss bank’s future … The business continued to see outflows among European clients, many of whom have been belatedly declaring their Swiss accounts to authorities at home and paying related taxes. In addition, clients in emerging markets also pulled assets out, UBS said, in advance of the expected implementation of agreements to automatically transfer Swiss bank client data to foreign tax authorities. … As UBS has shed assets as part of its effort to trim its investment bank, it has been selling the assets off through a designated portfolio.” VA-13 Our investigations conclude there has never been a time when UBS was not being investigated by some country in the World.

____________________________________

UBS AG CEO Sergio P Ermotti, Chief of the secretive UBS AG (Switzerland) Group Executive Board with risk taker sunburn.

SERGIO P ERMOTTI ROSE TO THE TOP OF UBS AG SECRET GROUP EXECUTIVE BOARD PYRAMID SOLELY BY INITIALLY BEING AN APPRENTICE TO HIS HIGHLY REGARDED FATHER.

Wikipedia reports: “After his apprenticeship as a stockbroker at the Corner Bank, Ermotti was later promoted to trading. Ermotti earned a diploma as a Swiss Federal Banking Certified Expert and a degree in the Advanced Management Program at Oxford University.” VA-14 In Switzerland, business persons obtain guild Swiss certification for almost everything. There are certified fiduciary, electrician, accountant, plumber, banker, mechanic, doctor, realtor, nurse, stockbroker, ad nauseam “diplomas”. This commendable fete allows for dignity to be given to each endeavor. It also allows the Swiss Government to keep tight control over the behavior of the business community players. Harvard Business School started the few summer month Advanced Management Program (AMP) that in turn spread throughout World business schools. These highly profitable programs are for business persons who want to hone their skills through networking with alike others in a prestigious academic setting. Any academic work is predicated upon seminars, group efforts, cocktail parties and fun without tedious individual study/exam routines. There are no individual grades. The program went international because it was highly profitable for the various name business schools as well as being a tax exemption. The corporations or individuals can take a tax write-off for attending the program and receiving a “degree”. These fun & play networking “degrees” are impressive when touted to the unknowing. This is unlike professorial Axel A Weber’s glittering economic degrees earned through the study/exam routines, sometimes. There is an international banking joke saying Axel would gladly accept a traffic ticket if an honorary degree were attached! In any event both Sergio & Axel should be commended for their endeavors.

________________________________

DESPITE CHIEF ERMOTTI’S PROCLAMATIONS, UBS TAKES ANOTHER HUGE DIVE!

Associated Press reports: “Swiss bank UBS saw its shares slide on Tuesday on news that investors had pulled billions out of its division serving wealthy clients … Swiss francs ($3.3 billion) had flowed out of its wealth management arm, which handles money from rich people outside the U.S. Fourth-quarter outflows from clients in emerging markets and in Europe outweighed inflows in the Asia Pacific region and Switzerland. … The U.S. business was helped by money being brought in by newly-recruited financial advisors, the company said … The bank recorded what CEO Sergio Ermotti called “an excellent year” for all of 2015, as net profit rose 79 percent to 6.2 billion francs, boosted by the performance of the wealth management division.” VA-15 How long will it be before UBS stockholders and UBS Clients become concerned about the UBS World reputation? We see many within the financial industry reluctant to work for UBS without large salaries/bonuses to cover the lack of job security.

____________________________________

Member of the secretive UBS AG (Switzerland) Group Executive Board Robert J McCann.

UBS CHAIRMAN ROBERT J McCANN IS A MEMBER OF A CONTROVERSIAL SECRET WALL STREET FRATERNAL SOCIETY.

New York Magazine on Wall Street secret society Kappa Beta Phi reports: “It was a secret fraternity, founded at the beginning of the Great Depression, that functioned as a sort of one-percenter’s Friars Club. Each year, the group’s dinner features comedy skits, musical acts in drag, and off color jokes, and its group’s privacy mantra is ‘What happens at the St. Regis stays at the St. Regis.’ For eight decades, it worked. No outsider in living memory had witnessed the entire proceedings firsthand.” VA-16 UBS Chairman Robert J McCann is a member also of the Group Executive Board of UBS AG based in Switzerland. Controversial UBS CEO Robert Wolf (Obama bundler now bagman) was also a member of this UBS Board (see issue 1). Sergio P Ermotti is presently UBS AG Group Executive Board Chief.

________________________________

UBS GROUP EXECUTIVE BOARD MEMBER McCANN FUZZY RESUME REVELATIONS.

Wikipedia reports: “Robert J. “Bob” McCann … is an US-American and Irish citizen. … He had … served as a member of the UBS Group AG Group Executive Board since October 2009. … McCann is now Chairman of UBS Americas and his duties involve strategic initiatives around clients and business priorities.” VA-17 From information and belief, McCann is alleged to have been in a decision making capacity in the successful documented looting of the Robert L & Eunice Gardiner Florida/New York $147,000,000 estate (see internalrevenue.com issue 5). McCann is a USA citizen who, like many citizens of Irish decent, was allowed to obtain an Irish passport. The writer of this article has both a USA and Irish passport. McCann inexplicably calls himself “an US-American and Irish citizen”. It is unknown what a “an US-American” is suppose to be. A UBS reliable source has said there was a UBS Group Executive Board deliberation on how to make McCann sound less a USA citizen. This is because other foreign nations would complain of having a USA citizen on the secret Group Executive Board, again. A UBS reliable source has said EU, China, Russia and Gulfies are particularly leery of UBS Washington coziness. McCann’s oblique language continues with his perplexing present job description uttering that have never been seen by interviewed top USA financial reliable sources. It allegedly connotes that the UBS lucrative looting of USA elderly estates will continue. Consensus is UBS Group Executive Board has given themselves plausibility of denial in forthcoming McCann operations. If McCann is caught by a potentially President Trump ethical apolitical USA authorities, he will immediately be a “former UBS” with no expensive Group Executive Board support base as was given to Raoul Weil. UBS is blatantly the highest anti-Trump World entity unilaterally giving millions of Client and stockholder assets to the Clintons in various known and unknown forms. These are laundered through speakers/consultant fees, Clinton Foundation donations, secret Presidential library foreign asset donations et al.

__________________________________________

UBS AG Group Executive Board Andrea Orcel division chief.

UBS GROUP EXECUTIVE BOARD MEMBER ORCEL FIRES STAFF, AGAIN.

Bloomberg reports: “UBS Group (Executive Board) AG investment-banking chief Andrea Orcel announced the departure of three senior executives in a sweeping overhaul of his leadership team, citing the need to streamline operations amid ‘dislocation’ from turbulent markets and increased regulation. … The bank’s stock has decreased 35 percent this year, tracking a slide across European financial shares. … ‘Delivering this must start with creating an environment that empowers each of you; an environment that fosters decisiveness, cooperation and accountability,’ Orcel said.” VA-18 A crucial problem at secretive UBS Group Executive Board is that there are many who are called Chief or Chairman. Originating with American Indian parlance, there was only one Chief who was immediately recognizable with his big bonnet of feathers. UBS AG Group Executive Board Chief Sergio Ermotti should properly connote his position as Chief or Chairman, somehow, hence the above noted movie!

Andrea Orcel

_______________________________________________

UBS GROUP EXECUTIVE BOARD ORCEL SAYS THINGS ARE GOING TO “SUCK” FOR A WHILE.

Dealbreaker reports UBS Chief Orcel says: “We are now in a period of dislocation — a perfect storm of challenges and changes from regulation, competitors and markets, … I can’t promise you that it will all be smooth sailing from now on,” VA-19 UBS Investment Banking Chief talks bluntly about the predicaments of UBS but it is of no interest to World finance. A known group of USA based vulture fund UBS AG followers are specifically watching Division Chief Orcel.

________________________________________

IT SEEMS DAVID AUFHAUSER WENT FROM AN HONEST USA FEDERAL TREASURY GENERAL COUNSEL TO A DISHONEST UBS AG GLOBAL GENERAL COUNSEL. DOES UBS AG HAVE A OBLIGATORY CULTURE SUCCESSFULLY PROMOTING EVIL?

American Banker reports: “Mr. Aufhauser, 53, will report to John Costas, the chief executive officer of the investment bank and the deputy CEO of UBS AG, and to Peter Kurer, the group general counsel.

U.S. regulators fined UBS $100 million last month for transferring U.S. currency to Cuba, Iran, and other nations subject to trade sanctions, then trying to hide the transactions. Peter Wuffli, its chief executive, said at the time, ‘UBS recognizes that very serious mistakes were made.’

At the Treasury, Mr. Aufhauser had provided legal advice on banking, international finance, securities, taxation, trade, and enforcement. He has also served on the Department of Justice’s corporate fraud and abuse task force, as counsel to the President’s working group on financial markets, and at the Federal Financing Bank and the Committee on Foreign Investments.” VA-19-1 How can a highly respected Washington nabob be turned into a common thief by adopting UBS AG values? Who in Washington is allowing UBS AG keep their USA Charter?

_______________________________________________________

UBS AG Global General Counsel David Aufhauser smerking!

UBS AG TOP GLOBAL LAWYER GETS CAUGHT IN WALL STREET CRIMINAL INSIDER TRADING CABAL SCANDAL. AUFHAUSER AND UBS COLLABORATORS GET OBAMA/HOLDER UBS GET-OUT-OF-JAIL-FREE-PASS WITH NO PRISON.

Justice Society reports: “While some may have expected attorney David Aufhauser to be seen in the halls of Williams & Connolly as a client but it appears that he has now been embraced as a partner. It appears that involvement in an insider trading scandal is not a barrier to career advancement. The former general counsel and managing director for UBS (Aufhauser) has joined the firm after agreeing not to practice law (in New York) for two years due to the alleged insider trading.” VA-20 UBS AG (Swiss) Global General Counsel Aufhauser never had a New York license to practice law.) A reliable UBS source alleges that many UBS hierarchy supplement their compensation package by insider trading, swindling elderly UBS Clients and other known and unknown misdeeds. This enhances their “meager” UBS compensation. A reliable UBS source has alleged it is an open UBS secret Auphauser and UBS others had been known to be UBS insider trading for a long period of time but had never been investigated by an alerted Obama Administration. UBS AG Global General Counsel David Aufhauser was allegedly UBS Associate General Counsel Craig E Darvin’s boss. Aufhauser’s office was allegedly involved in unilaterally offshore wire transferring (Issue 9 Exhibit L) UBS client account assets. UBS stole 1 million US$ from Eunice Gardner through the commonly used Netherlands Antilles international money laundering scam while she was still alive. This was allegedly implemented with the knowledge and consent of her live-in ex-bartender UBS financial advisor. It is believed Aufhauser was implicated. There is also a question if UBS ever made the unilateral stock transactions to Client Mallard’s account (see above UBS submitted IRS document) by saying they are “NA” not available to the USA IRS.

_______________________________________________

UBS AG (SWISS) GLOBAL GENERAL COUNSEL DAVID AUFHAUSER GETS CAUGHT INSIDER TRADING.

ABC News reports: “The former chief lawyer for UBS’s investment bank has agreed to pay $6.5 million to settle an allegation that he dumped his investments in auction-rate securities after getting a company e-mail warning that the market was in trouble … New York Attorney General Andrew Cuomo said the payment would resolve an insider trading investigation of David Aufhauser, who recently resigned as general counsel at the bank. … Aufhauser will not face criminal charges and he is not required to admit any wrongdoing. … A spokesman for Aufhauser … added that a UBS inquiry had concluded earlier this year that Aufhauser’s transactions were lawful. … Cuomo sued UBS in July, accusing the company of fraudulently promoting the securities as safe, even as it warned internally that trouble was on the horizon. … His investigators said they had identified seven UBS executives who sold $21 million of their personal stakes in the market in the three months leading up to its failure. … Aufhauser, who was general counsel for the U.S. Treasury Department before joining UBS, will also be banned from working in the securities industry or practicing law in New York for two years.” VA20-1 Did Aufhauser become a repetitive criminal upon joining UBS AG or was he a criminal while at Department of Treasury? It is known Aufhauser was part of the UBS criminal cabal, said to number six or more, when UBS General Counsel? A reliable Washington source has maintained after the New York Attorney General Cuomo questionable prosecution Aufhauser paid his nominal fine and had his New York license to practice law revoked for two years. In fact, Aufhauser never had a New York law license to revoke in the first place.

______________________________________

SECRETS WITHIN SECRETS! THE PERPLEXING UBS EVENTS SURROUNDING UBS AG (SWISS) GLOBAL GENERAL COUNSEL DAVID AUFHAUSER’S USA TREASURY DEPARTMENT SECURITY CLEARANCE USE.

UBS AG (Swiss) Global General Counsel Aufhauser had a USA Government top security clearance from his prior USA Treasury General Counsel position. Among other herein mentioned misdeeds UBS AG David Aufhauser did in fact join the UBS AG (Swiss) cabal of UBS Wall Street insider trading theft? The only credible rational for this behavior is Aufhauser knew he was invulnerable because he had the UBS AG (Swiss) Group Executive Board “USA Presidential Team UBS” Obama get-out-of-jail-free card.

It is unknown if Aufhauser’s USA Federal criminal activities were being committed while a Washington Williams & Connolly lawyer lobbyist representing Client UBS AG. It is known UBS chummy Obama took no action against UBS AG (Swiss) Global General Counsel Aufhauser or the other known and unknown perpetrators. For the most part, Aufhausers serious UBS criminal activity and known other un-prosecuted misdemeanors herein mentioned went unpunished. Aufhauser is now back to work as a Williams & Connolly partner “advisor” to UBS AG, among others. Better yet, why was Aufhauser and Shulman allowed to be caught on UBS insider trading theft in the first place? Why did Cuomo and Obama have to suffer a severe credibility hit? Why were the six or more unknown UBS conspirators names and unknown prosecutions never mentioned? Who exactly is the real enemy of USA citizenry? What gives?

_______________________________________

Craig E. Darvin

Executive Director, Associate General Counsel at UBS Inc

Bahnhofstrasse 45, Zurich, Zurich, Switzerland

+41 44 234 11 11

_____________________________________

ANOTHER UBS COMPLIANCE OFFICER AND COLLABORATORS CHARGED WITH INSIDER TRADING!

Dealbreaker reports: “This one is just too good. … A former UBS Group AG compliance officer was charged by U.K. regulators with passing tips on five occasions to a London man who traded on the information, according to court records. … Fabiana Abdel-Malek, 34, and Walid Choucair, 38, were each charged with five counts of insider dealing … Abdel-Malek, who has a law degree, had worked as a compliance officer at UBS”. VA-21 A UBS compliance officer is suppose to oversee UBS staff ethics for any criminal or otherwise behavior!

_____________________________

DOES UBS AG (SWISS) ROT AT TOP HIRE CRIMINALLY INCLINED COMPLIANCE OFFICERS PURPOSEFULLY?

Bloomberg reports: “A former UBS Group AG compliance officer was charged by U.K. regulators with passing tips on five occasions to a London man who traded on the information … charges filed by the Financial Conduct Authority. Abdel-Malek, who has a law degree, had worked as a compliance officer at UBS … A spokeswoman for UBS wasn’t able to immediately provide a statement. … Insider dealing in the U.K. carries a maximum prison term of seven years.” VA-22 From information and belief, UBS AG (Swiss) rot at top intentionally hires unethical compliance officers to cover their own questionable behavior in various countries. This particular UBS scheme has to be UBS top secret for none of our reliable sources knew it exists.

____________________________________

SHADY UBS AG (SWISS) GENERAL COUNSEL WITH USA TOP SECRET CLEARANCE CAUGHT AT UBS INSIDER TRADING CRIMES OF THEFT, AGAIN!

Financial Times reports: ‘A former UBS compliance officer passed takeover tips to a ‘prolific’ day trader who netted £1.4m in profits from insider trading, the UK’s financial watchdog has alleged in court. … Insider trading carries a maximum seven-year sentence in the UK.’ UBS (AG (Swiss) Global) General Counsel David Aufhauser caught committing insider trading theft has never served (jail) time allegedly because of UBS rot at top Obama/Holder deferred payment insider deal.” VA-23 UBS AG always says former immediately after a USA AG officer is caught committing criminal activities. This is meant to distance UBS AG from the usual UBS AG misdeed “incentivization” process. Obama took any action against Aufhauser’s UBS AG criminal activities, ostensibly to collect his own UBS AG deferred payments herein mentioned.

___________________________________

ANOTHER UBS COMPLIANCE OFFICER CAUGHT AT INSIDER TRADING CRIME OF THEFT!

Bloomberg reports: “A former UBS Group AG compliance officer and a day trader charged by U.K. regulators with insider trading appeared in a London court for the first time to face allegations that they made 1.4 million pounds (1.8 million) illegally trading shares of Elizabeth Arden Inc. and four other companies. Fabiana Abdel-Malek, 34, and Walid Choucair, 38, were charged by the U.K. Financial Conduct Authority with five counts of insider dealing. Prosecutors told a London court Friday that in addition to Elizabeth Arden, the pair traded shares of Kabel Deutschland Holding AG and BRE Properties Inc. based on information Abdel-Malek obtained through her work at UBS.” VA-24 A bank compliance officer is top security officer policing ethics of the bank. This position at UBS AG worldwide seems to mean you can steal as much as convenient but if you get caught UBS will immediately tell media you are a UBS former employee. Aufhauser was a partner at Williams & Connolly and an employee at Treasury as well as UBS AG. Aufhauser has a USA Treasury Department top security clearance he has been using at both Williams & Connolly law firm and UBS AG (Switzerland. It is common in USA for top security clearance holders to sell this status as a consultant or as a direct employee. This sweetheart deal allows any domestic or foreign entity to obtain any top secret oral information desired, for the price of engagement. It known that Aufhauser was enabling UBS AG to swindle UBS Clients, especially the elderly (see issue VD & VF-4). As a conduit, it is unknown what USA top secret information he was giving UBS AG (Switzerland). The secret clearance grade enables them to converse with active USA Government employees of lesser or comparable clearance about relevant matters to their work. is it any wonder some of the USA wealthiest towns surround Washington!

_____________________________

UBS CONTINUES LAYOFFS.

Dealbreaker reports: “UBS Group (Executive Board) AG is trimming some positions at the investment bank as part of a plan to reduce costs across the business in response to a revenue slump, according to people with knowledge of the situation. At least a dozen London-based employees in the securities unit lost their jobs this week, said the people, declining to be identified because the matter remains private. Positions were eliminated in equities, debt capital markets, leveraged finance and real estate, they said. A spokesman for the Zurich-based company declined to comment.” VA-25 UBS cutbacks reveal serious rot at the top excuses.

__________________________

UBS HIT WITH DOWNGRADE.

Financial Post reports: “Analyst Fiona Swaffield lowered her rating on UBS to underperform from market perform, telling clients that earnings for the Swiss financial services giant are less resilient that the market perceives. She cited both an increasingly difficult investment banking and wealth management revenue outlook, and relatively limited cost flexibility given higher regulatory costs.” VA-26 We will see more UBS cascading downgrades in the future causing alarm to UBS stockholders and Clients as documented UBS international abuses are revealed.

__________________________________

UBS EXECUTIVE GROUP BOARD CHIEF ERMOTTI CUTS STAFF WHILE PROFITS PLUMIT.

Bloomberg reports: “UBS Group AG Chief Executive Officer Sergio Ermotti pledged to continue cost cuts after profit at the wealth-management business fell and the securities unit was hurt by a slump in equities trading. … Ermotti, 56, has been forced to deepen cost cuts and scrap some profitability goals as negative interest rates, faltering emerging markets and clients’ unwillingness to trade undermined earnings.” VA-27 Daily Beast reports: “Holder was deputy attorney general at the end of the Clinton administration and has been widely reported to be the primary fixer behind the pardon of the same fugitive billionaire whom Comey had been chasing. Holder’s role in the Marc Rich scandal was investigated by the same committee to which Comey sent his letter that the dozens of prosecutors condemned on Sunday. The resulting 2002 report on the pardon depicts Holder as the worst kind of Washington insider and hardly a fitting clarion of piety.

__________________________________

Juerg Zeltner

UBS NEXT CHAIRMAN OF SECRETIVE GROUP EXECUTIVE BOARD! A RELIABLE UBS SOURCE SAYS SOMETHING DIFFERENT. WATCH WHAT HAPPENS!

finews reports: “As boss of UBS’ flagship private bank, the largest in the world, Zelter is almost predestined to take the helm when Ermotti leaves. Like Ulrich Koerner … , the native Bernese made a play for the top job in 2011, which Ermotti eventually won – a past all three top executives have chosen to bury. Zeltner has now waited six years and counting to inherit Ermotti’s job, but his chances of doing so have actually slimmed. Without question, he has made crucial changes to UBS’ private bank in recent years and put his imprint on the world’s largest wealth manager. A UBS veteran, he knows the bank inside and out and is very comfortable in an international setting such as Asia, an increasingly important market for the bank. But Zeltner lacks the power base necessary to lock in the top job. In addition, his star has fallen recently, making a promotion to the top role difficult: he issued an unconventional call for UBS to lower its sights (in German) and voiced frustration over sinking margins – not the best prerequisite to inherit the top job.” VA-28 Jeurg Zelner seems to be a realist in believing UBS is probably acting in a illusionary manner believing in their own controversial staff hygiene proclamations and self important movies, among other things. Throughout our documentation there is an evident pattern of UBS acting over the edge of the law and customary financial propriety. When caught, the UBS group Executive Board attempt to throw expensive lawyers at the problem causing stockholder money drain. We will see UBS World reputation has faltered because of this blatant devious at best activity. Herb Mallard has socially conversed with the very top active financial world players in New York City and in Southampton. Mallard has further talked to many international financial top of the game retirees in Palm Beach who are upset at the UBS documented fraudulent activities against Florida elderly. It is only a matter of time before the small world of financial players react, especially to the Clinton/Bush/Obama/UBS fiasco. Oh yes, the Trump team is well aware of UBS continual “missteps”.

____________________________________________

WORLD BANKS REDUCING UBS STOCKHOLDINGS.

SPI reports: “Wells Fargo & Company MN lowered its position in UBS AG (NYSE:UBS) by 3.5% … Several other hedge funds have also recently modified their holdings of UBS. … A number of brokerages have recently weighed in on UBS. JPMorgan Chase & Co. raised shares of UBS AG from an “underweight” rating to a “neutral” rating in a report” VA-29 UBS international unethical devious behavior is catching up to UBS Group Executive Board. Let us watch their reputation dwindle before our very eyes.

___________________________________________

UBS CONTINUES TO LOOSE WEALTHY CLIENTS.

Bloomberg reports: “UBS Group AG suffered a net 15.2 billion francs ($15.2 billion) in withdrawals during the final three months of last year, in part because investors moved money out of Switzerland before the government shares their data with tax authorities, a trend that’s expected to continue this year. … Chief Executive Officer Sergio Ermotti said in an interview with Bloomberg Television that clients were likely to continue repatriating money this year, before the trend should start to slow in 2018. Now in his sixth year as CEO, Ermotti has stepped up cost-cutting to help offset shrinking profit margins and is using technology to streamline wealth management, UBS’s main business since he scaled back the investment bank four years ago.” VA-30 UBS Chief Ermotti is realistic but UBS cannot see that their World contentious strategy in known by UBS clients throughout the World .

_____________________________________

Andrea Orcel

UBS AG SECURITIES UNIT BOSS ANDREA ORCEL SPEAKS.

Bloomberg reports: “UBS Group AG has put salary increases on hold at its investment bank, including for employees who are promoted … UBS has pulled back from bond trading in recent years to focus on wealth management, meaning the bank missed out when bond trading picked up … Andrea Orcel, who heads the securities unit … said he’s ‘mildly’ optimistic … with regard to client activity, which is the main driver for the investment bank after it shrank trading for its own account. … UBS’s investment bank employed about 4,700 people at the end of last year, down from about 5,200 a year earlier. Orcel said in Davos that the bank is now the right size.” VA-31 Andrea is refreshingly blunt in most of his proclamation utterances we have read for future use. ____________________________________________

UBS AG M & A CEO ANDREA ORCEL NECESSARY UNEXPLAINABLE UP & DOWN YOYO REMARKS.

eFinancialCareers reports: “Separately, UBS’s truly terrible performance in M&A last year doesn’t reflect well on Andrea Orcel. M&A (mergere & acquisitions) revenues at the investment bank fell by 7% in 2015, compared to a 1% increase at Deutsche Bank and a 40% increase at Goldman Sachs. That’s strange, given that Andrea Orcel, CEO of UBS’s investment bank is an M&A man who’s spent the past few years hiring senior M&A bankers in an effort to create an ‘old school investment bank.’ The New York Times says Orcel desperately needs UBS to win more M&A business in the US, but that UBS’s US advisory brand was ‘hammered after the 2008 crisis as rainmakers decamped to boutiques.’” VA-32

_________________________________________

Profitability at UBS wealth management is last. This has prompted the division Chairman Joe Stadler to replace those under him.

UBS UHNW DIVISION LAST WITH WORST EVER PERFORMANCE.

Finews reports: “Profitability at the UHNW (ultra high net worth) unit within UBS wealth management, the business with clients worth more than 50 million Swiss francs, has declined over the past two years. The gross margin dropped below 50 basis points in the fourth quarter of 2016, for the first time ever. It is the lowest among all wealth management units.” VA-33 UBS ULHNW clients are usually those few who have heard something and thus have the versatility to move their secret accounts without a governmental interference.

__________________________________________

IS UBS DANGEROUSLY BETTING ON WORLD FINANCIAL EXTREMES?

UBS will be moving more of its US jobs to Nashville (Tennessee). (Business Insider)

UBS will be moving staff from Switzerland to the eurozone [Poland], where costs are lower. (Financial Times)

“It’s incomprehensible to me why UBS is alternating between perfect and awful.” (Bloomberg)

UBS’s chief financial officer Kirt Gardner said the investment bank had gone into “risk off” mode in a “very complex and treacherous trading market”. (Financial Times)

UBS Asian private banking clients were a big part of the problem: they simply stopped trading. (WSJ)

_______________________

UBS CREATES ANOTHER PUBLIC RELATIONS STUNT AFTER GETTING CAUGHT IMPLEMENTING INTERNATIONAL CRIMINAL ACTIVITIES, AGAIN!

Business Insider reports: “One of the largest financial firms in the world is positioning itself to be the greenest bank on Wall Street. UBS, which manages over 2.7 trillion Swiss francs, has made sustainability the cornerstone of its business. As such, the bank has taken a number of steps to be the go-to firm for sustainable and impact investment offerings.” VA-34 We will continually see that when UBS gets caught in criminal actions it invariably reverts to touchy feely statements about UBS plans to become do-gooders. All the while UBS continues it’s internationally criminal activities destabilizing the World. This UBS statement of making the World green is just one in a litany of such UBS publicity stunts.

_____________________________

Gregor Hirt

UBS CONTINUES LOOSING COMPETENT TOP MANAGERS.

Finews reports: “Vontobel Asset Management … hiring Gregor Hirt as the head of its multi-asset solutions business. … His departure is the third high-ranking departure in short order: veteran Swiss fund distribution head Martin Thommen is leaving for Geneva rival Lombard Odier, and hedge fund star Dawn Fitzpatrick left to run George Soros’ hedge fund.” VA-35 There is an obvious UBS Group Executive Board apparent problem keeping competent staff. When UBS top staff become aware of rot at the top, they leave UBS for more ethical financial companies. The pervading UBS rot at the top continues to noticeably pervade the company. Singapore sovereign fund and other stockholders should be more concerned, especially those sending us requests for further corroborating documentation.

_______________________________________

Martin Thommen

LOMBARD ODIER POACHES UBS VETERAN.

Finews reports: “Lombard Odier has … appointed Martin Thommen as head of third-party distribution for Europe. … The Swiss banker has a long track record with UBS Asset Management where he was head of Wealth Management and Personal Banking in Switzerland. In his 30 years at UBS … he was «the face of UBS» in the Swiss funds business.” VA-36

________________________________________

UBS ORDERED TO FACE ANOTHER WHISTLEBLOWER LAWSUIT IN NEW YORK FEDERAL COURT.

Finews reports: “The case about the alleged unfair dismissal of Trevor Murray … The former bond strategist at Switzerland’s largest lender claims his superiors put pressure on him to publish misleading research reports about mortgage-backed securities. … The managers hoped the publications would support the trading and underwriting business of the bank, Murray said.” VA-37

___________________________________

UBS GROUP EXECUTIVE BOARD PAYS $445 MILLION OVER TOXIC MORTGAGES AND FAILED USA CREDIT UNIONS.

Reuters reports: “UBS Group AG paid $445 million to settle claims that the Swiss bank sold toxic mortgage securities that helped sink two federal credit unions … UBS’ payment is on top of $79.3 million it paid last year to resolve similar NCUA claims involving two other failed credit unions. The bank did not admit wrongdoing … UBS spokeswoman, in an email said: ‘With today’s settlement another legacy matter has been resolved.’ ” VA-38 UBS has a long way to go throughout the World to satisfy it’s “legacy” matters. We are increasingly receiving requests for more documentation from various entities within mentioned scrutinized countries.

________________________

A RUMPLED AND WORN UBS CHAIRMAN ERMOTTI GIVES UBS GROUP EXECUTIVE BOARD AN UNDESERVED COMPLIMENT.

CNBC reports: “We have seen some confidence by clients although it is still uneven, if you look at private clients and wealth management clients have been a little bit more constructive, while if you look at institutional investors they’ve been clearly affected by the global activity in financial markets,” Ermotti said, explaining that “there’s a difference between client confidence and then their willingness to translate confidence into actions.” … According to Ermotti, one of the factors affecting client participation is the uncertainty surrounding the Trump administration. ‘In general, people are waiting to see what the new administration is really going to deliver. They are really positive and willing to consider investment in financial markets and in their own business but they want to see concrete action,’ he said.” VA-39 UBS Chairman Ermotti does not seem to realize the World economy has increased, not just UBS. We believe this will be temporary in the case of UBS. UBS Chairman Ermotti also fails to recognize UBS criminal activities against World clients, domestic banks et al are part of the problem, especially within the USA. We repeatedly see this is endemic in UBS historical World functioning. Fear of loosing a nations Charter to do business only forces UBS to give various forms of payments to top governmental officials at the increasing expense to UBS client victims and domestic banks.

__________________________

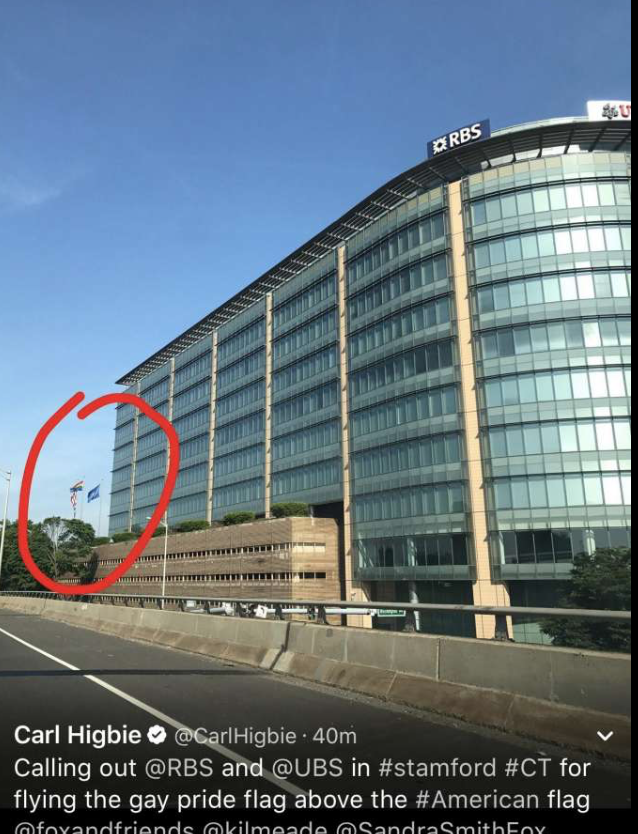

UBS BELITTLES USA FLAG BY SUBORNING IT UNDER GAY PRIDE FLAG, FOR SOME REASON!

Connecticut Post reports: “The colors of the rainbow should never trump the red, white and blue, says a retired Navy SEAL and unflagging defender of the president. … Frequent Fox News guest Carl Higbie … said that’s not proper flag etiquette. ‘Lower that flag below my American flag,’ Higbie told Hearst Connecticut Media. ‘I would never fly a flag above the American flag. I think anybody who does (UBS) is putting whatever that cause is above patriotism.’ ” VA-40 USA flag is always put hire than any other flag within USA. This is to respect all military who sacrificed their lives to defend USA. UBS at best is sloppy and at worse purposefully desecrating USA military called upon to defend them. Let us not forget UBS loves swindling vulnerable USA elderly, some of which were or were married to USA veterans. It could be said UBS is reprehensible without the free passes given UBS rot at the top by Clinton/Bush/Obama to facilitate UBS swindling USA elderly. When will UBS loose it’s USA Charter and leave. A rainbow coalition spokesperson said they had nothing to do with the series of UBS incidents. We believe them.

__________________________

UBS CAUGHT LAUNDERING AFRICAN BRIBES!

Financial Times reports: “Ex-Guinea minister convicted of laundering bribes. Former UBS banker Mahmoud Thiam ‘channelled $8.5m to mansion purchase and school fees’ ”. VA-41 World bank regulators can only wonder the extent to which UBS will go if it will criminally launder insignificant “school fees”. Please note “former UBS banker” is repeatedly not true or correct. We asked a few editors who disclosed this is done to soften the UBS public financial embarrassment but the financial community are very well aware all of these “formers” were committing their UBS crimes as UBS bankers.

____________________________

UBS IS LARGEST WEALTH MANAGEMENT BECAUSE IT INCLUDES UNTOUCHABLE SECRET DORMANT ACCOUNTS.

Finews reports: “As the largest wealth manager in the world, UBS has a leadership role in Swiss banking. … private banking head Juerg Zeltner articulated the uncomfortable truths that is the new reality of private banking. … with interest rates in negative territory and risk-aversion widespread, more assets actually mean higher costs. Zeltner’s surprising admission provoked a wave of agreement from other firms, also suffering from client remaining on the sidelines.” VA-42 UBS suffers because most of it’s dormant customers are afraid of the slightest shifting of assets. In general, UBS existing clients do not want their countries of origin to discover illicit assets in UBS Swiss vaults. UBS looses money if it cannot shift client assets around to create charges, hence a UBS conundrum or paradox.

_________________________________

UBS ERMOTTI REPEATS AGAIN THAT USA BROKERAGE IS NOT FOR SALE!

The Fly reports: “UBS CEO Sergio Ermotti told analysts following the company’s Q2 results that its U.S-based brokerage business, which posted a 6% decline in Q2 profit before tax, is not up for sale, Reuters reports. UBS formed the unit when it bought PaineWebber in 2000, and Ermotti says the unit is “critical” to the bank’s overall private banking strategy. VA-43 We do not know why UBS Group Executive Goard Chief continues repeating his proclamations. Perhaps the World questions his veracity!

_____________________________________________

UBS TOP BANKER POACHED BY VANGUARD.

Vanguard, the U.S. provider of exchange traded funds … has hired Thomas Merz as head of distribution in continental Europe … Merz was head of ETF Europe at UBS asset management. … Vanguard is one of the big three providers of passive investment products. VA-44 UBS looses another effective banker. One has to wonder why UBS continues to train bankers who are then poached by etyhical competitors.

_________________________________

HAS UBS FAILED IN ASIA?

Reuters reports: “Two senior bankers working for UBS Group AG (UBSG.S) in Asia have left to join Citigroup Inc (C.N), adding to other top bankers who have left the Swiss bank in the region in the last few months. … UBS has had a number of senior level departures in Asia in the last six months. … UBS was a powerhouse in Asia equity capital markets and along with Goldman Sachs Group Inc (GS.N), it dominated the league tables from 2002. But … its performance has suffered as Chinese investment banks made inroads.” VA -45

_____________________________

UBS ASIA BANKING CANNOT KEEP STAFF!

Finews reports: “Switzerland’s biggest lender [UBS] has seen a number of bankers exit its investment banking business in Asia over recent months and replaced them swiftly. … Over the past decade, the Swiss bank has built one of the largest China-focused investment-banking businesses and while China remains a key market, UBS wants to pay more attention to other parts of Asia. … Recently, Sam Kendall, head of corporate client solutions Asia Pacific region, said that UBS is committed to strengthen the business across Asia, especially in Southeast Asia, South Korea and India.” Asian banking industry sees otherwise. UBS is loosing excellent staff replaced with amateurs.” VA-46

____________________________

UBS Chairman Sergio Ermotti

UBS CHAIRMAN SERGIO ERMOTTI SAYS HE GETS NO RESPECT!

Finews reports: “CEOs of listed companies take the value of their shares as a judgement of their performance. Sergio Ermotti, UBS’ CEO, is no different. … UBS was not the investment bank with the highest valuation, but the wealth manager with the lowest valuation of the world, he told the newspaper. … Ermotti knows that UBS still carries the stigma of the high-flying investment bank that crashed. Investors see UBS as a risky bet because it has kept the investment bank. And regulators at the same time have come down hard on the bank as well, both in Switzerland and in Europe. Seen this way, UBS very much is part of a European financial industry that struggles to escape the crisis, while the U.S. rivals are prospering.” VA-47 Ermotti only has to look at the trail of UBS World litigation, especially swindling USA elderly UBS Clients allowed to do such by giving Clintons/Bush II.Obama deferred payments .

_________________________

UBS CHIEF SERGIO ERMOTTI USES MEDIA TO TEST SWISS POLITICAL ASPIRATIONS TO GET OUT OF UBS.

Finews reports: “Swiss weekly … suggested that UBS Chief Executive Sergio Ermotti should become a member of the Swiss government. ,,, The Radical Party, the traditional party of business so far has had a rather narrow list of candidates for the post in the seven-member government … In past decades, it wasn’t unusual for prominent representatives of Swiss business (and indeed banks) to respond to the call of duty and to serve as a minister. Ex-Finance Minister Kaspar Villiger, who later became chairman of UBS, was one such businessman.” VA-48 Sergio may see what is coming for UBS and wants to bail out. We know there will be severe weakness in Asia. Asian Governments will talk the talk without any marked UBS contracts. It will be sad to watch.

___________________________

UBS CEO ERMOTTI SAYS NO TO POLITICS AFTER WEAK RESPONSE.

Financial Times reports: “Sergio Ermotti, chief executive of Switzerland UBS bank, has ruled out pursuing a political career, rejecting a suggestion in a Swiss magazine that he should become a top government minister. … Members of the seven person Bundesrat take turns to serve as Switzerland’s president. … Die Weltwoche suggested Mr Ermotti would be suitable because he comes from the Italian speaking part of Switzerland, and so would help correct an imbalance in the Bundesrat. He has been UBSs chief executive since 2011.” VA-49 A Swiss reliable source has said Ermotti may have a better chance later but his often goofy proclimations could destablise the presently insecure Swiss Government. A Swiss Italian could bslance the Bundestrat at some future date.

_________________________________

UBS AG TARGETS ULTRA HIGH NET WORTH (UHNW) WOMEN USING ANNIE LEIBOVITZ AS THE HONEYPOT DRAW!

Forbes reports: “Annie Leibovitz’s exhibition ‘WOMEN: New Portraits’ just completed its 10 city global tour, which included stops in Hong Kong, Mexico, New York and London. The final showcase took place in Zurich, Switzerland, the home of the exhibition’s commissioning partner, UBS. … This diverse group of women includes artists, CEOs, politicians and philanthropists, amongst others. Existing photographs of famous women who are at the top of their fields, such as Meryl Streep, Queen Elisabeth II or Hilary Clinton, were showcased … UBS Unique focuses on globally scaling expertise in better serving female clients with their financial needs, questions and planning. Additionally, UBS aims to launch an education initiative in partnership with leading education organizations to increase the financial confidence of one million women by 2021.” VA-50 UBS contracted Annie Leibowitz for the UBS traveling art show spouting fluffy statements to UHNW women in World. It was considered a joke within both the Financial and Art World. statedepartment.org had people who went to several and interviewed targeted women who were curious as to why they received UBS formal invitations. Most had some first rate food, with bubbly and then left confused. It was later said to have been embarrassing to be seen at the UBS AG honeypot. Reliable sources within the international financial community have said that UBS AG allegedly has used art as a money laundering tool. These UBS AG events are said to have put an international spotlight upon the UHNW women attending.

_________________________________________

UBS AG TARGETS ULTRA HIGH NET WORTH (UHNW) WOMEN USING A FLUFFY ART HONEYPOT FOR “PERFECTION EXPERIENCE”!

Forbes Magazine reports: “UBS created a short film, underlined by Joss Stone’s re-recorded song ‘Free Me’, that pops up some common female life questions, doubts and fears. How is UBS going to guide female clients through these? Dr. Mara Harvey [UBS]: We want the public to understand what ‘Holistic [UBS] Wealth Management’ really means. You don’t just come to a bank like ours [UBS] if you want to know how to invest in stocks and bonds. You rather come to us to have a dialogue on what the purpose of your wealth is. For example, how is that wealth created in a business? Have you inherited or sold your company? Is it within a family context? What do you want to leave behind one day? We [UBS] are not in a position to give clients definitive answers to those questions. However, we [UBS] are there to guide them through possible solutions and similar cases. We [UBS] conduct a conversation in such a way that makes a client (especially female ones) confident and feel that they are not alone with those questions. We show them a spectrum of other people in similar situations. Here is what we’ve done, here is what worked. We play an active role in developing our [UBS] client’s financial life plan and helping them become the architect of their life. What are the essential details that differentiate UBS’ work with female clients from the usual client relationship management?

Dr. Mara Harvey [UBS]: It’s a combination of many details across all departments, which makes the work different. The most important factor is that the aim to support women is deeply rooted in our organization. We have built specific platforms specifically targeting UHNW [ultra high net worth] clients that bring together passion, purpose, legacy and success. A unique quality of these dialogue platforms is that they are tailored to women. We give them an opportunity to network that you won’t find anywhere else. To serve women better, UBS Wealth Management developed a plan that spans across every element of the business. It starts by asking the question: Does this appeal to a woman as much as this appeals to a gentleman? In certain parts of the bank, we have already targeted female clients and see great results. There are various shapes and sizes of projects and cases. It does need to be tailored in every individual case. We do have a certain consistency in what we [UBS] do and we know that the experience needs to be adapted to each customer’s needs. What challenges does UBS face when it comes to female clientele? And what is the plan to overcome those challenges? Dr. Mara Harvey [UBS]: One of our main questions and biggest challenge is: Do they know what we can do for them? There are so many aspects of the organization where we had to create balance in order to connect with clients from a feminine viewpoint. We make efforts outside in and inside out. We have expressed that they need something different from the financial industry. We are responding to it and listen to client’s needs to shape our organization their way. The biggest challenge we [UBS] face is in developing a mindset shift in society. It starts with gender, that’s the most obvious one and then we try to evolve it on every dimension.” VA-51 Remember the UBS mantra of solicit, recruit, isolate, control, dupe and loot. Let us not forget in USA Clinton/Bush II/Obama are on record as successfully receiving deferred payments from UBS for “taking no action” against UBS schemes. Although President Trump has sort of shut the dubious operation down, renditions thereof are still being perpetrated by UBS throughout the World.UBS always follows up with a hard pitch to solicit and recruit UHNW women. ________________________________

UBS CONTEMPORARY ART HUSTLE CONTINUES!

UBS has been peddling contemporary art through the use of renowned Annie Leibovitz World shows for a few years with disappointing results. Many wealthy know contemporary art is used to launder money, thus causing present tax World authority notice. UBS World contemporary art hustle continues long after criminal prosecution for their successful Miami Basel Art Show offshore criminal sales promotions were exposed by UBS officer Bradley Birkenfeld. Thereafter, UBS had to pay deferred payments similar to the successful Bush I/Bandar bakshish (deferred payments) bribes. UBS has been more than willing to overtly pay the often publicized Clinton/Bush II/Obama the deferred payments to continue their lucrative swindle mantra of solicit, recruit, isolate, control, dupe and loot criminal activities against UBS elderly USA clients depicted in issue 4.

______________________________________

UBS new women’s representative Maria Shaparova

UBS IS COMMITTING MORE WOMEN IN SALES TO SOLICIT/RECRUIT ELDERLY WOMEN CLIENTS FOR UBS “PERFECTION EXPERIENCE”!

Finews reports: “The Zurich-based firm has made no secret of its wish to curry favor with women: UBS has two separate programs aimed at hiring and at winning clients. The first is an effort to bolster its management ranks with more women … CEO Sergio Ermotti is taking counsel from Gail Kelly … who sits in on UBS top management’s strategy meetings and provides advice on overall strategy, regulation and risk, is part of an effort to lift representation of women in management … Juerg Zeltner: the private banking head wants to swivel the unit’s admittedly man-centric attention towards women. It is, of course, a bid to win more business off them. … on four core dimensions: business, investments, family and legacy … Along with being thin on self-made women, the absence of the largest wealth market in the world is a stunning oversight by UBS.” VA-52 UBS now is using high achieving female athelets and accomplished business women to attract female elderly for the UBS “perfection experience”. Like the UBS contemporary art scheme, we believe this new effort will also fail because women usually inherit their husband or family assets at an elderly age and are not interested in seeing youthful athletes as a prelude to having UBS separate them from their estates. All World women will have to do is look at UBS elderly USA victims herein displayed in issue 4 to see what happens in USA.

_______________________________

UBS AG UTTERS THEIR ALLEGED STRATEGY ALLUDING TO SOLICIT, RECRUIT, ISOLATE, CONTROL, DUPE AND LOOT UHNW (ULTRA HIGH NET WORTH) WOMEN!

Financial News reports: “UBS is teaching staff at its sprawling wealth management business – the world’s largest – how to talk to rich women about their money. The training for its wealth advisers is part of the Swiss bank’s Unique programme, which aims to generate ‘tens of billions’ of dollars of revenue growth over the next five years by increasing the number of female clients it advises. Managing director Mara Harvey said UBS wanted it to begin conversations with women who ‘have always been present but never really been part of the dialogue’ around looking after family wealth. Harvey said the bank’s wealth advisers were being given ‘very pragmatic talking points’ to improve the quality of conversations they have with female clients. These, she said, centred around goals rather than financial products.” VA-53 The World of finance should be now well aware of what UBS AG is doing regarding UHNW women. We believe this UBS AG strategy started with the successful looting of the Robert L Gardiner estate as mentioned in Issue 4.

_____________________________________

UBS ASSET MANAGEMENT TEETERING!

Finews reports: “UBS asset management boss Ulrich Koerner reveals where he is setting accents instead of taking on the fund industry’s top players and addresses speculation of a unit sale. … By contrast, Koerner puts the kibosh on speculation that part of all of the unit will go, saying «that’s not an issue for us.» Instead, the 54-year-old Koerner is focusing on organic growth in markets like Asia, where he says the Swiss bank is in the top three. … The unit’s profit … (2016) was 552 million francs before tax, a figure Koerner must find a way to double if he wants to meet the targets.” VA-54 If one looks at Issue 7 they will find it is wishful thinking for UBS to think any gains will be made in China, Hong Kong, India and Singapore. Asain market makers will continue to be polite as they slowly move away from UBS. Issue 7 depicts this action.

______________________________

UBS DECLINES, AGAIN!